|

Dissertation

Programme: MSc. In Financial Mathematics Minor: Banking

and Finance

Name: Agborya-Echi Agbor-Ndakaw

Candidate Number: 59990

Title: Financial Regulations, Risk Management and Value

Creation in Financial Institutions: Evidence from Europe and USA.

Supervisor: Dr Michael Barrow

Date: 02/09/2010 Number of Words: 18,651.

ABSTRACT

The present global financial crises resulted in a near

collapse of the world banking system. Some financial institutions and financial

markets could continue operations only upon reception of public rescue

packages. It also brought to light the inadequacies of the financial model both

at the national and international levels. This study brings out the need for

revising these financial regulations hence. This study also revealed how

behavioural finance greatly contributed to the out break of the present crisis

and therefore suggests the licensing and supervision of financial institutions

at all times.

The principal aim of this study is to investigate how the

relationship between financial regulations, risk management and value creation

alongside other behavioural factors influence the process of investment

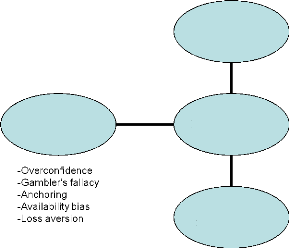

decision-making by investors. Some of the behavioural factors revealed by this

study include overconfidence, gambler's fallacy and availability bias. In

addition to these, this study also revealed that some assets (CDOs and CDSs)

within the financial industry also influence the investment decision-making

process.

This study focuses on the role of risk management within

financial institutions thereby establishing a framework for efficient and

effective risk management. The goal of such an activity is that of achieving

the highest value added from the risk management procedure being undertaken

thereby restoring the trust and confidence that has been lost in financial

institutions and banks as a result of the present crisis.

KEYWORDS: RISK, RETURN, RISK MANAGEMENT, FINANCIAL

REGULATIONS, VALUE CREATION, INVESTMENT DECISION-MAKING, COLLATERIZED DEBT

OBLIGATIONS (CDOs), CREDIT DEFAULT SWAPS (CDSs), BANKS, GLOBAL FINANCIAL CRISIS

AND BEHAVIOURAL FINANCE

ACKNOWLEDGEMENT

The completion of this study would not have been possible

without the help and support of some people. Firstly, I will like to express my

gratitude to my supervisor, Dr Michael Barrow for his professional guidance and

advice. His suggestions and critical remarks to the realisation of this study

have been inspiring.

I will equally wish to acknowledge the support of the rest of

the program instructional team, the entire staff of the University of Sussex in

general and the School of Mathematical and Physical Sciences in particular for

making my stay here memorable. I will also like to thank my classmates for

their help and support.

My sincere gratitude also goes to my family and friends for

their abundant love, support and encouragement throughout the study period.

Success is better when it is a result of teamwork.

Finally and most importantly, I thank God for making it possible

for me to be here.

Contents

ABSTRACT .1

ACKNOWLEDGEMENT 2

CONTENTS 3

CONTENTS .4

List of Figures 5

List of Tables 5

CHAPTER ONE 6

INTRODUCTION 6

1.1 Background 6

1.2 Rationale of Study and Gaps in Existing Research .13

1.3 Research Questions 15

1.4 Aims and Objectives 16

1.5 Hypotheses 17

1.6 Summary of Methodology 18

1.7 Summary of Chapters 18

1.8 Summary of Chapter One .19

CHAPTER TWO ..20

LITERATURE REVIEW ..20

2.1 Introduction 20

2.2 Definition and Meaning of Risk ..20

2.3 Definition and Meaning of Return ...23

2.4 Relationship between Risk and Return .24

2.5 Types of Risks within Financial Institutions 25

2.6 Definition and Meaning of Risk Management ..28

2.7 Reasons for Risk-taking in Financial Institutions 32

2.8 Definition and Meaning of Financial Regulations 33

2.9 Definition and Meaning of Value Creation 38

2.10 The Decision-Making Process 41

2.11 Behavioural Factors Influencing Investment Decision-Making

43

2.12 Assets Influencing Investment Decision-Making 46

2.13 Conclusion 60

CHAPTER THREE ..61

METHODOLOGY 61

|

3.1 Introduction

|

61

|

|

3.2 Research Philosophy

|

61

|

|

3.3 Research Approach

|

.62

|

|

3.4 Choice of Method

|

63

|

|

CHAPTER FOUR

|

.64

|

|

PRESENTATION AND DISCUSSION OF FINDINGS

|

.64

|

|

4.1 Purpose of Chapter

|

64

|

|

4.2 Description of Findings

|

64

|

|

4.3 Discussion of Findings

|

...67

|

|

4.4 Conclusion

|

71

|

|

CHAPTER FIVE

|

72

|

|

CONCLUSIONS AND RECOMMENDATIONS

|

.72

|

|

5.1 Introduction

|

72

|

|

5.2 Overall Assessment of Aims and Objectives Attainment

|

...72

|

|

5.3 Conclusion

|

73

|

|

5.4 Recommendations

|

...75

|

REFERENCES 77

List of Figures

Figure 1: Capital Market Line 7

Figure 2: Security Market Line 7

Figure 3: The UK Bank Rescue Package 11

Figure 4: Risk Management Procedure 31

Figure 5: Estimated Global CDO Market Size 37

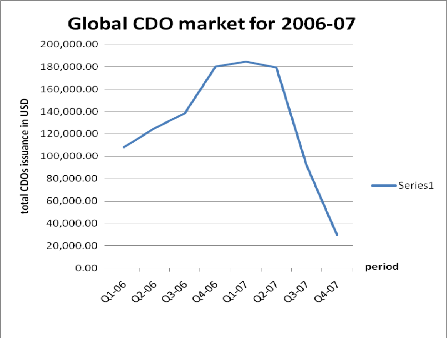

Figure 6: Global CDO Market Data for 2006-2007 48

Figure 7: A Summary on How CDS Works 53

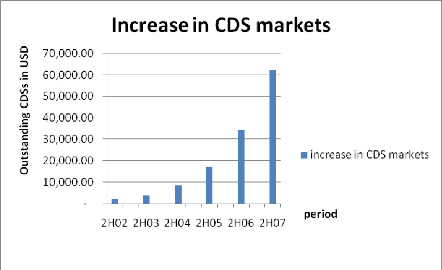

Figure 8: Increase in CDS Markets 57

Figure 9: Factors Influencing Investment Decision-Making 65

Figure 10: Summary 72

List of Tables

Table 1: Estimated Size of the Global CDO Market by the End of

2006 37

Table 2: Global CDO Market for 2006-2007 47

Table 3: The ISDA Market Survey for CDSs 56

CHAPTER ONE INTRODUCTION

1.1 Background

The relationship between financial regulations, risk

management and value creation is the brain behind the investment

decision-making process especially within financial institutions. This

relationship is such that forms the general idea on the understanding of how

financial institutions work with regards to investments and the investment

decision-making process. To successfully establish this relationship between

financial regulations, risk management and value creation, it will be ideal to

pinpoint the fact that financial institutions can stand a better place in

creating value and restoring the trust and confidence that has been lost in

financial institutions and banks as a result of the outbreak of the 2007-2009

financial crises.

Economists have proven that there exist a number of classical

financial theories which support the opinion that risk and return trade-off

play an important role in arriving at investment-making decisions. Some of

these theories include the CAPM, Modern Portfolio Theory (MPT) and the

Efficient Market Hypothesis (EMP). This can be proven using the Capital and

Security Market Lines whereby both portray a positively sloping curve implying

that the higher the risk the higher the expected return.

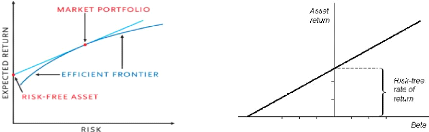

Figure 1: Capital Market Line. Figure 2: Security Market

Line

Looking at the above graphs (indicating that the higher the

risk taken the higher the expected return), and according to Haslem, 2003,

investors should be compensated for taking very high risk in the hope of

expecting higher returns. Never the less, investors are adviced to create a

market portfolio(a portfolio consisting of all securities / assets whereby the

proportion invested in each security corresponds to its market value) which is

located on the efficient frontier (describes the relationship between the

return that can be expected from a portfolio and the riskiness of the

portfolio). The fact that risk and return form the foundation in classical

finance especially when investment decision-making is concerned has led to the

birth of many schools of thought and authors amongst which we have Angelico et

al (2000) and McMenamin (1999) . They are all bring out the point that risk and

return lay the foundation for very important and rational investment decisions

to be taken. There are number of assumptions associated with these classical

financial views. Some of these include:

· The fact that risk is an objective measure which is

quantitative in nature hence can be calculated using historical as well as

statistical data (Beta and Standard Deviation) (Levy and Sarnat, 1972).

· The opinion that investors are generally rational in

their decision-making and are generally risk-averse in their attitude as far as

risk is concern (Pratt and Grabowski, 2008).

· The point that higher risk will always be rewarded with

higher return also known as the risk-return trade-off.

Owing to these assumptions, it is evident that investors when

faced with investment decision and considering risk and return remaining

constant, all investors will definitely choose the investment that will result

to a less risky alternative though at the same level of the expected return

(Friedman and Sevage, 1948). Critically looking at the assumptions of the

classical

finance, it is evident that all investors and everybody in

the financial market think in the same direction. This goes to confirm the

point that whether they are expert professionals, institutions or indidvaidual

investors, there is actually no difference in investors' behaviour.

Contrary to the above, the behavioural finance school of

thought differs from the classical school of thought. This is to say, within

the behavioural financial content, they try in explaining investors' behaviour

in decision making process. They do so by looking at the socio-psychological

factors point of view that influence investors when making their decisions.

Some behavioural finance economists including Statman (1995, 1999), Tversky and

Kahneman (1974), Thaler (1994) stress on the fact that based on these

sociopsychological factors, there exist sufficient evidence in support of the

repeated patterns of irrationality and inconsistence when investment

decision-making is concern especially when there is a choice of choosing from a

situation of uncertainty. Behavioural finance school of thought views risk as

being a subjective measure hence investors are bound not to only exhibit a

risk-averse attitude towards risk but they can as well be risk-seeking or

risk-neutral. This therefore implies investors will not only seek the risk's

highest level of return but will like to as well maximise the risk's expected

return hence wanting to maximise the satisfying strategy (Sortino, 2001).

According to Frankfurter et al (2002), «Behavioural

finance has looked at risk in greater depth and found that attitudes towards

risk are not logical.... Real individuals usually have to address risk in

situations that they have never encountered before and will never encounter

again, for which statistical techniques are largely irrelevant.... There is

clearly much more to risk than finance has begun to consider, and much of it

involves how people form images of the events of which they are expected to

assess the risk»(p. 456).

The human decision-making process as claimed by the

researchers of behavioural finance, is subject to a number of cognitive

illusions which can be grouped into heuristic decision processes

(overconfidence, anchoring, gambler's fallacy and availabilty bias) and the

prospect theory (loss aversion and regret).

Regarding the arguments surrounding how risk and return

greatly influence investment decision, it therefore calls for concern to find

out the extent to which the relationship that exists between risk and return

help in influencing the investment decision-making process.

In the last three years or so, the cry of the day has been

that of the global financial crisis. Most writers and businessmen say this is

the greatest global financial crisis since the Great Depression in the 1930s

which could be traced as a failure in financial regulations to keep pace with

an out of control financial system (Krugman,2008). The causes of today's

financial crisis such as inefficient risk management, inadequacies of the

global model of banking regulations, are not different from the causes of the

Great Depression in the 1930s, no doubt Krugman describes it as the return of

the Depression.

The root cause of the most recent global financial crisis can

be traced back as a result of the failure of the US Treasury allowing Lehman

Brothers- a major Wall Street investment bank, to default sometime around

September 2008. This resulted to a lot of panic with so much consequences felt

in the financial sector as the prices of most financial assets had a massive

turndown. As if that was not enough, there was also the freezing of most

inter-banks' loans thereby resulting to `insecurity' and doubts in the banks

shares as well as the banks' balance sheets. This was a clear evident that the

crisis has brought to light so much focus on the inadequacies in the present

regulations in financial institutions, no doubt, there was the need of

restructuring these financial regulations specifically within financial

institutions. This is because the initial phase of the present financial crisis

almost led to the near collapse of

Northern Rock, a UK medium size mortgage provider. Moreover,

the high and incontrollable risk-taking of some big hedge funds and the

building role they played in this crisis has resulted in it being the centre of

discussion as far as global finance regulations are concerned.

This was done with the US, the UK together with some EU

countries putting together pieces of bank rescue packages together. These

rescue packages were centred on bank recapitalization where by the states had

to purchase most of the bank shares in a bid to reestablish that investors'

confidence in financial institutions. These rescue packages introduced were to

an extent temporary no doubt there was some part-nationalisation of some banks

whereas, in some cases there were out right purchase of these bad loan assets

by the state. For instance, the US at one point in time had to grant state

guarantees of some bank assets so as to stabilise the inter-bank connections

and businesses. The above mentioned points are enough evident for the need for

financial regulations to be implemented for the sake of these financial

institutions to be operated orderly as well as avoiding the outbreak of any

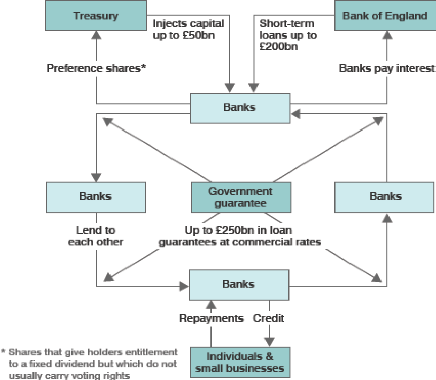

other financial crisis in the nearest future. The diagram below summarises the

UK bank rescue package.

Figure 3: The UK Bank Rescue Package

Source: HM Treasury 2008-9 Near-Cash

Projections

The above UK rescue package is aimed at putting the British

banking system on a better footing. This is because it is hoped that the deal

will get money moving again thereby assuring the future of the banking system

once more. Looking at the diagram above, it is seen that £250billion from

the Treasury and the Bank of England is being injected into the economy through

commercial banks. By implication, there is up to £250billion in the form

of loan guarantees to be available at commercial rates so as to encourage banks

to lend to each other as well as to individuals and small businesses. From

here, banks can easily lend money to other banks, individuals and small

businesses whereby these individuals and small

businesses will repay the borrowed money plus interest to the

banks and the banks to the Bank of England (UK Central Bank). But bear in mind

that, in order to participate in the scheme; banks will need to sign an

agreement on executive pay and dividends.

In order to put into effect these rescue packages, some banks

especially commercial and investment banks began utilizing the prevailing

atmosphere made up of excessive liquidity and financial innovation in acquiring

huge exposures in the global credit markets. With the use of these of

alternative investment schemes, massive amounts of assets and liabilities were

moved off the balance sheet resulting to the so called shadow-banking (banking

system referring to any unregulated activities carried out by regulated

financial institutions). Although the risks associated with these positions

were unpredictable, yet there were some financial institutions which enjoyed

some reasonable amount of government guarantee and ended up adopting very

casual attitude towards risk controls. To an extent, it is evident that one of

the root causes of the present global crisis is as a result of this attitude

towards risk hence resulting to most rescue packages being directed to

universal banks especially in EU and Switzerland.

Some international investment funds such as the hedge funds

were of the highly leveraged institutions and as such, they were to a larger

extent of regulatory oversight. Thanks to their active participation in the

global credit market, they were constantly increasing in size and number. As

such, some economists have argued that one of the causes of the present global

financial crisis was the unregulated nature of the practice of shadow-banking.

As if that is not enough, the nature in which the shadow-banking sector was

operated coupled with the absence of the global regulation framework especially

for international investment funds, greatly contributed to outbreak of the

present global crisis thereby bringing the global financial system into a near

collapse.

1.2 Rationale of Study and Gaps in Existing

Research

Although there are numerous conceptual evidence on the

validity of classical financial theories such as the CAPM, MPT and EMH, in

trying to provide insights and explanations to the general idea of the

investment decision-making process, there is a need for reviewing the existing

literature revealing that very little attention is being given to the

behavioural aspects influencing the entire process. The classical finance

school of thought seeks in portraying investment decision-making processes as

processes which can be studied and applied properly in real life. With

investors bearing this in mind, they will be allowed to be able to predict as

well as beat the market hence the issue of human error and irrationality will

not arise.

On the other hand, behavioural finance has proven to have

very strong implications especially when seeking to provide cover for the

lacuna done by the classical finance school of thought when trying to stress on

the investment decision-making process. Behavioural finance researchers try in

providing detailed explanations for the existence of irrationality and human

errors as far as investment decision-making are concerned so as to reduce risk

if it cannot be avoided. It is evident that the behavioural finance scholars

always try to stress on the fact that in order not to avoid any investment

mistakes caused by human beings, then the practitioners (financial) should

always try to understand the factors of finance brought out by the behavioural

finance scholars. This is because these scholars try to provide an adequate

understanding of the application of socio-psychological factors in the

investment decision-making processes. This can successfully be done by looking

at the way individual investors are influenced by certain cognitive illusions

especially as they try to arrive at a decision. As these behavioural finance

scholars struggle to provide an adequate understanding into the investment

decision-making processes, they have as well failed to look at the proposed

sociopsychological factors in details alongside with the classical finance

scholars thereby resulting in a gap in the entire investment decision-making

processes which therefore calls for concern.

Nevertheless, it has been argued that the theories of

classical finance such as CAPM are based on many assumptions some of which are

obviously unrealistic?.... «The true test of a

model lies not just in the reasonableness of its underlying assumptions but

also in the validity and usefulness of the model?s prescription. Tolerance of

CAPM?s assumptions, however fanciful, allows the derivation of a concrete,

though idealized, model of the manner in which financial markets measure risk

and transform it into expected return.» (Mullins, 1982).

This then implies that such important classical finance

theories should never be underestimated or disregarded when trying to provide

explanations for other factors influencing investment decision-making

process.

Judging from the above mentioned points, it can be concluded

that the main reason of this research is filling that gap left by the financial

researchers by way of critically analysing the process of investment

decision-making. That is finding out if the different financial scholars'

factors have been assimilated by other different scholars influencing the

decision-making process. This therefore leaves us with the question of

determining the extent to which the behavioural as well as the classical

factors influence the investment decision-making processes thereby giving room

to actually understand the domain of finance and investment and how the

investment process works as a whole.

1.3 Research Questions

From a general point of view, there always exist some

research questions to help in achieving the aims and objectives of any

research. This therefore implies that it is not only important but very

imperative in identifying some key questions for which the answers will be

sought through out the research. It is assumed that when questions are well

defined and precise, it is easier and helps the researcher in determining the

scope of the study thereby remaining focus on this scope (Porter, 2003). It is

evident that these research questions help the researcher in

writing the literature review, tailoring the study framework

as well as setting up what techniques to apply and their analysis. In this

regard, this research aims at answering the following questions:

Question 1: What types of risks affect financial performance

of financial institutions?

Question 2: What financial regulations methods can be used

and how will they be implemented?

Question 3: How financial institutions manage risks and

create value?

Question 4: What are the key factors affecting preferences

for managing risks, financial regulations and value creation?

Question 5: What is the perception of managers regarding risk

management, financial regulations and value creation approaches used?

Question 6: What value creation strategies are to be used

in financial institutions that will fully incorporate risks management and

financial regulations and how successful will these strategies be?

1.4 Aims and Objectives

Specifically, this research aims at critically analysing how

financial institutions deal with financial regulations, risk management and

value creation, hence the research aims at achieving the following

objectives:

. Explaining the meanings of financial regulations, risk

management and value creation.

. Reasons for financial regulations, risk management and

value creation.

. Methods of financial regulations, risk management and

value creation.

? Identifying and determining risks that affect financial

performance of financial institutions.

? Examining financial regulations, managing risks and value

creation approaches of financial institutions.

? Identifying key factors hindering financial regulations,

risk management and value creation strategies

? Examining the perception behind managers behaviour towards

financial regulations, risk management and value creation approaches

. Recommendation of the importance of financial regulations,

risk management and value creation in financial institutions.

1.5 Hypotheses

According to Lind et al, 2005, a hypothesis could be defined

as a statement made with reference to a population parameter which is developed

for testing purposes. Although, Zikmund, 2003, looks at hypothesis from a

different point of view where he sees hypothesis as an unproven proposition

that explains certain facts tentatively and these facts can be tested

empirically. Hypotheses are usually expressed in two forms: the null and the

alternative forms (the exact opposite of the null hypotheses),whereby the null

hypothesis is usually a more naturally conservative and dogmatic statement

about the status quo which is tested using statistical evidence and helps in

rejecting any contrary propositions not tied to it. The null hypothesis is

usually denoted by (Ho) with the alternative denoted by (H1).

Therefore for the purpose of this research, the hypotheses shall

be stated as follows:

Ho: Financial Regulations, Risk Management and

Value Creation are the main factors influencing investment decisions in

financial institutions.

H1: Financial Regulations, Risk Management and Value

Creation, are not the main Behavioural Factors influencing investment decisions

in financial institutions.

Researches in behavioural finance show that the process of

decision-making is subject to a number of cognitive illusions which are grouped

into heuristic (overconfidence, gambler's fallacy as well as

availability bias) decision processes and the prospect theory (regret

and loss aversion). These behavioural factors equally play an important role

when the investment decision-making process is concern.

1.6 Summary of Methodology

The research methods to be used will be the secondary and

tertiary methods. This will entail the reading of textbooks and financial

websites and journals. With the information collected from these methods, the

researcher will be able to know the extent to which the notion of financial

regulations, risk management and value creation influence investment decisions

in financial institutions and whether there exists other factors that influence

these investment decision-making process and how these factors act up with

financial regulation, risks management and value creation as far as investment

decision-making is concern in financial institutions.

1.7 Summary of Chapters

This research will be made up of five chapters with chapter

one being based on providing

justifications for the study and bringing out

the general idea about the entire research, stating

the objectives and the hypotheses of the study ,as well as

the rationale of the study and its implications though from different

perspectives.

Chapter two brings out the theoretical as well as the

empirical literature on financial regulations, risk management and value

creation and the role they play in investment decision-making. In this chapter,

all the key terms will be defined as well as looking into the relationship

existing between the key terms. The last part of this chapter is dedicated to

the investment decision-making process and how behavioural factors as well as

some financial assets influence the investment decision-making process within

the financial sector.

For the purpose of our research, chapter three will be based

on providing arguments on the methods used in carrying out the research as well

bringing out the short comings of the methodology.

Chapter four will be responsible for the analysis and discussion

of the findings.

Chapter five will be dedicated to the conclusion and proposition

of a frame work (recommendations) which can be of help for future research

work.

1.8 Summary of Chapter One

The back bone of this chapter is the provision of a general

background and a justification for the research. This chapter contains the

research questions, hypotheses, aims and objectives of the study. It has as

well as provided a summary of the methodology to be used through out the

research.

CHAPTER TWO

LITERATURE REVIEW

2.1 Introduction

This chapter centres around the existing literature on

aspects relating to financial regulations, risk management and value creation

with regards to investment decision. There exist different scholars with

different theories and arguments in relation to this study. This chapter aims

at examining secondary as well as tertiary data collected from textbooks,

journals, magazines and internet websites/sources.

2.2 Definition and Meaning of Risk

It is evident that everything done in our normal day to day

activity involves some aspect of risk-taking. This is to say from getting out

of bed to going to sleep, driving a car to merely crossing a road or making an

investment decision, all centre on an aspect of risk-taking. Fortunately, the

whole idea on risk is very interesting because while some risks might be out of

control others are not.

Many schools of thought claim that the word risk is thought

to have originated from either the Arabic word `risq? or the Latin

word `riscum?, with `risq? signifying something given by God

from which a profit can be drawn thus having either a fortuitous or favourable

outcome (Merna and Al-Thani, 2008).

Economists claim that the Latin word `riscum? refers

to barrier challenges presented to a soldier. Although it has a fortuitous

connotation, it is more likely linked to unfavourable events. This word was

first ever used in English around the mid-seventeen century with it featuring

in insurance transactions in the eighteen century although it has also been

used in

both French and Greek with both resulting to positive and

negative connotation. Amazingly, throughout the years, the common usage of the

word in English has changed though statistics has proven that every aspect of

our daily life involves some degree of risk-taking. Hence as a result of this,

in today modern day English, there is literally no generally accepted

definition for the term risk.

There is a wide range of descriptions that have developed

over time as different schools of thought and authors including Slovic (1964),

Payne (1973) and Webber (1988) came up with different meanings and

descriptions. It has been revealed that just within the field of accounting and

behavioural finance, there exist more than 150 unique accounting, financial and

investment measurement still under investigation and these have up to date

remain as potential risk indicators, (Ricciardi, 2004).

Owing to the above mentioned points, it is clear that the

definition of risk can be looked at from different perspectives with every

particular discipline coming up with its own definition and meaning of risk.

According to Lane and Quack (1999), risk can be defined as

follows:«...a state in which the number of possible future events

exceeds the number of actually occurring events and some measure of probability

are unknown can be attached to them. Risk is thus seen to differ from

uncertainty where the probabilities are unknown. Such a definition is beholden

to mathematically inspired decision theory and the rational actor?

model, and does not sufficiently consider the complexity of risk in

business.»( p.989).

Owing to the point that the definition of risk is being

looked at from different perspectives, Brehmer, (1987) brought to light the

fact that the different definitions of risk differ significantly regarding the

specific activity, situation and circumstances. This opinion was further

supported by Rohrmann and Renn, 2000 where it was explained that with regards

to disciplines such as engineering, physics and toxicology, a definition of

risk may be based on

the probability as well as the physical measurements of the

negative outcomes. In the social sciences, risk is looked differently again

with attention being paid to the qualitative aspects of risk which are seen as

crucial facets of the concept.

Reading from Kaplan and Garrick (1981) risk is looked upon as

a combination of Uncertainty and Damage. As if that is not

enough, Frank Knight (1921) tries to provide a meaning to the word risk

explaining the notion of risk differentiating it from uncertainty.«...

Uncertainty must be taken in a sense radically distinct from the familiar

notion of Risk, from which it has never been properly separated. The term

«risk,» as loosely used in everyday speech and in economic

discussion, really covers two things which, functionally at least, in their

causal relations to the phenomena of economic organisation, are categorically

different... The essential fact is that «risk» means in some cases a

quantity susceptible of measurement, while at the other times it is something

distinctly not of this character; and there are far-reaching and crucial

differences in the bearings of the phenomenon depending on which of the two is

really present and operating.... It will appear that a measurable uncertainty,

or «risk» proper, as we shall use the term, is so far different from

an unmeasurable one that it is not in effect an uncertainty at all. We ...

accordingly restrict the term «uncertainty» to cases of the

non-quantitative type». (Damodaran, 2008).

According to Knight (1921) risk/certainty can be separated

with reference to two different points of view (a) knowing the future outcome

and (b) knowing the probability that a future outcome will occur is known.

Looking at the various definitions of risk, it can be concluded that the

definition and meaning of risk can be summarised as the potential recognition

of an undesirable consequence that is to happen to anybody. Therefore there

exists a relationship between danger and opportunity whereby

there is a need to strike a balance as to when to expect higher returns/rewards

which comes with the opportunity as well as the risk involved that has to be

born as a consequence of the danger. No doubt, Haslem (2003) attempts in

defining/explaining risk from the financial point of view by

introducing the notion of return to the definition of risk by stating

that:«Risk is the other side of return. Returns comprise of two

elements, the periodic payment of interest or dividends (yield) and change in

asset values over a period of time (capital gains/losses).»

Judging from all the definitions of risk mentioned above, it

is evident that risk is not very simple especially as it is being looked up to

by different schools of thought. This then boils to that fact risk itself is

subjective and will be very difficult in attempting to manage it.

2.3 Definition and Meaning of Return

The definition of risk provided by Haslem, 2003 whereby risk

was defined from a financial perspective point of view leads us to the notion

of return. Return, basically is the reward to risk, even though very little has

been written about return unlike risk. Never the less, from the normal day to

day usage, the word return has so many meanings and definitions provided it is

used within the proper context.

According to the Webster's New English Dictionary and

Thesaurus (2002), return is defined as: «to come or go back; to repay;

to recur. to give or send back; to repay; to yield; to answer; to elect,

something returned; a recurrence; recompense; yield, revenue; a form for

computing (income) tax.»(p502).

Risk and return are mostly referred to as the different sides

of the same coin because in finance and looking at Haslem's definition of risk,

return can be considered as the exact opposite of risk. Most economists refer

to return as the investors' expected outcome for the risk they are taking and

this return is made up of the periodic interest payment (yield) and the change

in assets' values over a given period of time (capital gains/losses).

Return is just as risk because it is a double sided coin

since return does not imply gaining all the time but sometimes losing. A gain

or lost arises from either appreciating or depreciating an asset. As a result

of these, investors always try to implement all forms of investment appraisal

methods so as to try to be sure that the return at the said stage will only be

referred to as the expected return. Note that all projects have a life cycle

and it is at the end of the life of any project that the actual return is known

which can turn out to be either a lost or a gain or just break-even. This

merely lays the foundation for us to know that return must not always be looked

at to imply profits since that will just be misleading because sometimes,

expected return might show some possibility of profit while the actual return

might not thereby taking us back to the idea of danger plus

opportunity.

2.4 The Relationship between Risk and Return

Because risk and return are very important aspects in

finance, it calls for concern to study the relationship that exists between

them. This notwithstanding, it has been brought to our notice that there has

been a debate on whether the relationship existing between risk and return is

positive, negative or curvilinear (Fiegenbaum et al, 1996). Bear this in mind

that as far as issues in finance are concerned, they will always be looked at

from at least two different points of view because of the difference between

the classical school of thought and the behavioural school of thought.

Statistics has proven that most investors are risk averse.

This idea serves as a backbone for looking into the positive relationship

existing between risk and return. This is judging from the point that most low

risks are mostly associated with low return and vice versa (Fisher and Hall,

1969) thereby leaving investors with the problem of choosing the option that

best maximises their abilities (Schoemaker, 1982).

Never the less, this positive relationship of risk and return

has been supported by many classical financial theories including CAPM, MPT and

EMH and this can be supported by the upward sloping curves of the Security and

Capital Market Lines in Figures 1 and 2. Haslem loc also supported the fact

that there is a positive relationship between risk and return, where he stated

that «the Capital Asset Pricing Model (CAPM) posits that return and

risk are positively related, higher return carries higher risk» and

this was as well strongly supported by Vaitilingam et al 2006. Using the

portfolio theory as a guide for investment decisions, it was suggested that the

greater the risk the greater the expected return. This is because, according to

Lumby 1988, the basis of the relationship between risk and return has always

been justified on grounds that investors are generally risk-averse.

According to Bowman (1980 and 1982), and after carrying out

exclusive research and sampling from different industries, Bowman resulted in

suggesting the existence of considerable variance with the classical finance

theories in relation to risk and return in what became known as the Bowman

paradox or the risk and return paradox. It has been evident from his

findings that most of the time, when there happen to be a negative relationship

between risk and return, that implies investors must have swapped from being

risk-averse to risk-seekers and this can be experienced in any institution

whether the institutions are performing well or not. This therefore implies

there really do exist a negative relationship between risk and return.

2.5 Types of Risks within Financial Institutions

The main objective of financial institutions is to maximise

shareholders value by mobilizing deposits and lending to firms and clients

having investment projects. Financial institutions always try to make things

possible for the income to exceed the interest paid on deposits, borrowings as

well as all operating costs. In an attempt to pursuit the aforementioned

objective, financial institutions are faced with a number of

risks of which some include credit risks, liquidity risks, interest rate risks,

foreign currency risks, operational risks (mistakes and fraud committed by

staffs), technological risks (power and equipment failures that lead to data

loss), product innovation risks (new products failing), competitive risks,

regulatory risks (sanctions for violations of regulatory norms), etc.

Note that of all the risks types mentioned above, the two

most important risks however are the interest rate and the credit risks. This

is because problems in these areas often lead to liquidity crisis and bank

failures. As such, if an institution happens to face an increase in the

interest rates on its liabilities and at the same time, fails to increase its

interest rate charged on loans to its clients due to competition, then the said

institution can become compromised.

Similarly, if an institution results in a series of bad loans

that cannot be recovered, its viability can be threatened. Nevertheless, most

of the other risks do not usually pose fatal threats. As a result, many of the

other risks would need to be combined in order to trigger a crisis. Because

risk is considered to involve elements such as feelings of control and

knowledge, it is understood that risk perceptions are influenced by

socio-cultural factors including trust and fairness. Statistics have proven

that the business world (market) is never perfect, that explains the reason of

the introduction of the SWOT(Strength, Weaknesses, Opportunities and Treats)

analysis since any imperfection caused by any individual will merely be used as

an opportunity for some body else (Chromow and Little, 2005).

Some economists claim that one of the causes of the outbreak

of the 2007-2009 global financial crises was as a result of some risks taken by

financial institutions and banks. As such, because of this crisis, banks have

become reluctant to lend to other banks because they are not ready to pay the

price for any risk what so ever within the financial sector. As a result of

this behaviour, it will be ideal to get an in-depth knowledge of the different

risks types existing within financial institutions. Some of the risks faced

within financial institutions include:

· Systematic (undiversifiable)

risk: this risk type is caused by changes associated with systemic

factors. As such, this risk type can only be hedged but cannot be diversified.

This risk type come in many different forms, for example, changes in interest

rates and government policies.

· Credit risk: This risk arises as a

result of the debtor's non-performance. This may arise either from the debtor's

inability or unwillingness to perform in the pre-committed contract manner.

This is because many people will be affected, that is, from the lender who

underwrote the contract to other lenders to the creditors as well as to the

debtor's shareholders. Credit risk is diversifiable but difficult to perfectly

hedge.

· Counterparty risk comes from the

non-performance of a trading partner. This may be as a result of the

counterparty's refusal to perform due to adverse price movement caused by some

political constraint that was not anticipated by the principals.

Diversification is the main tool for controlling counterparty risk.

· Operational risk is the risk

associated with the problems of accurately processing, settling, taking and

making delivery in exchange for cash. It also arises in record keeping,

computing correct payments, processing system failures and complying with

various regulations. As such, individual operating problems are small but can

easily expose an institution to outcomes that may be very costly.

· Legal risks are endemic in financial

institutions. This is in the sense that financial contracting is separate from

legal ramifications of credit risk, counterparty risk as well

as operational risk. New statutes and regulations can put

formerly well established transactions into contention.

2.6 Definition and Meaning of Risk Management

Risk management has today become a virtual issue for

financial institutions because some schools of thought claim that lack of

proper risk management practices has been a key factor in the present financial

crisis. Generally speaking, risk management is referred to the process of

measuring, analysing, controlling and assessing risks as well as developing

strategies to manage these risks. Some of the strategies used in managing these

risks include transferring the risks to other parties, avoiding the risks,

diversifying the risks, etc. Note that financial risk management focuses on

just risks that can be managed using financial instruments. All businesses

whether big or small do have risk management teams. Sometimes these risk

management teams need to use a combination of the risk management strategies to

be able to manage their risks.

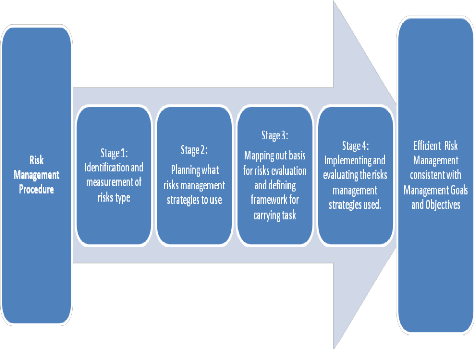

There are certain principles that must be identified with

risk management. As a matter of principle, risk management should result in

value creation in any business, be part of any decision making process, be

systematic and well-structured and be very transparent. The processes of risk

management include the identification of the risk, planning what risk

management strategy/strategies to use, mapping out the basis upon which the

risks will be evaluated, a definition of a framework within which the

`job/task' will be carried out, a development of the analysis of the risks

involved in the process and finally implementing the risk management

strategy/strategies to be used.

Once the risk management process has been completed, that is

to say after the risks have been identified and assessed, all risks management

techniques fall into one or more of these categories-avoiding, transferring

(for example insurance companies), reducing and retaining (accepting and

budgeting). These risk management teams are always faced with a number of

risk options including that of designing a new business

process from the start with adequate built-in risk control measures.

In essence, we will like to define the role played by risks

within financial institutions, identify when these risks should be managed and

when they should be transformed (if possible), as well as the procedures that

must be followed for any successful risk management activity of any financial

institution. So far so good, it has been argued that risk is an essential

factor within the financial sector. It therefore implies that active risk

management has a major place in most financial institutions. In the light of

this, what techniques/procedures can be used / implemented in limiting and

managing these risks?

The answers to these questions are straight forward. It is

obvious that if management is to control risk, it has to establish a set of

procedures in order to achieve this goal. Note that for each risk type, a

four-step procedure is established and implemented to define, measure and

manage risk. This will go a long way to assist decision makers to manage risk

in a manner that is consistent with management's goals and objectives. These

steps include:

· Standards and reports-that is, the creation

of a standard setting and financial reporting method. These two activities are

the back bone of any risk management system. Therefore consistent evaluation

and rating is essential for management to understand the true embedded risks in

the portfolio and the extent to which these risks can be reduced if not totally

eliminated.

· Position rules-imposed to cover exposures to

counterparties and credits. This applies to traders, lenders and portfolio

managers. This is so because, in large organizations with thousands of

positions maintained and transactions done (on a daily bases), accurate and

timely reporting is quite difficult though it is perhaps the most essential.

· Investment guidelines (strategies)-these

guidelines and strategies for risk taking in the immediate future are outlined

in terms of commitments to particular areas of the market and the need to hedge

against systematic risk at a particular time. Guidelines offer advice to the

appropriate level of active risk management.

· Incentive contracts and compensation-this

explains the extent to which management can enter into incentive compatible

contracts with line managers and make compensation related to the risks borne

by these individuals, as such, the need for elaborate and costly controls is

lessened. These incentive contracts require accurate cost accounting analysis

together with risk weighting. Notwithstanding this difficulty, well designed

contracts align the goals of managers with other stakeholders.

Risk management need to be an integral part of any

institution's business plan. Decisions to either enter or leave or

concentrate on an existing business activity require careful assessment of both

risks and returns. These risk management procedures must be established so that

risk management begins at the point nearest to the assumption of risk. By

implication, any trade entry procedures, customer documentation as well as

client engagement methods of normal business activities must be adapted to

maintain management control and eliminate needless exposure to risk. As if this

is not enough, data bases and measurement systems must be developed in

accordance with the way the business is conducted. Moreover, for any accurate

daily business reports, trades must be recorded, entered and checked in a

timely fashion. This helps during an overall effective risk management system

put in place by senior management.

There exists three successive levels within any organization

corresponding to the levels at

which risk is considered to have been

typically managed. The senior management system

used in checking and evaluating business as well as individual

performances, need to be sure that these three levels of risks are attained.

Level I aggregates the standalone risks within a single risk

factor such as credit risk in a commercial loan portfolio.

Level II aggregates risks across different risk factors within a

single business line for instance the combination of assets, liabilities and

operating risks in a life insurance.

Level III aggregates risks across different business lines such

as banking and insurance. The diagram below summarises the risk management

process within financial institutions. Figure 4: Risk Management

Procedure.

2.7 Reasons for Risk-taking in Financial

Institutions

In spite of the dangers associated with risk-taking and the

procedures involved in measuring and managing these risks, some if not all

financial institutions still take on to these risks. The question now wondering

in our minds is why these institutions need to take on those risks. In order to

answer this question, it will be good for us to look into the reasons for

financial institutions taking risks. Because this will help us to better

understand the need for taking such risks.

It will be ideal to begin by discussing the place of risks

and risk management within financial institutions. This can be done by

stressing on why `risk' matters and what approaches can be taken to eliminate

or reduce these risks. Understanding these, will very much help managers and

investors who are faced by these challenges within the financial sector.

The prime goal of every manager is that of profit

maximisation. This implies managers ought to maximize their expected profits

regardless to the variability of the reported earnings. However, today, there

is a growing literature on the reasons for managerial concern over the

volatility of financial performance within financial institutions. This is

justifiable with the following reasons because any one of these reasons is

sufficient enough to motivate management to concern itself with risk and embark

upon careful assessment of both the level of risk associated with any financial

product as well as any potential risk mitigation. Managerial self-interest, tax

effects, the cost of financial distress and capital market imperfections are

all potential risk mitigation techniques.

Note that managers have limited ability when it comes to

diversifying their investment. This fosters risk aversion as well as a

preference for stability. The progressive tax system takes care of the tax

effects. This is because, with this system of taxation, the expected tax burden

is reduced by reduced volatility in reported taxable income. Financial distress

on its own is

costly and the cost of external financing increase rapidly

when the financial institution viability is in question. Accepting the fact

that the volatility of performance has some negative impact on the value of

these financial institutions, leads managers in considering some risks

mitigation strategies. Some of these include:

· Risks being eliminated by simple business

practices- here the practice of risk avoidance involves actions to reduce

the chances of idiosyncratic losses by eliminating such risks that are

superfluous to the institution's business purpose.

· Risks being transferred to other

participants-there are some risks that can be eliminated or reduced

through the technique of risk transfer.

· Risks being actively managed-here there must

be good reasons existing for using further resources to manage risks. This is

because risk management is central to its business purpose.

In each of the above cases, the goal of the institution is to

get rid of the institutions' risks that are not essential to the financial

services provided. Financial institutions take such risks because they know how

to deal with them either through eliminating, transferring or actively managing

the risks. Remember, risks and returns are directly proportionate, the higher

the risk the higher the expected return. All in all, precaution is taken that

the risk is absorbed and the risk management activity monitors the business

activity efficiently as far as risk and return are concerned.

2.8 Definition and Meaning of Financial Regulations

Financial regulation is often reactive with new regulations

sealing up leakages in the financial system usually caused by a crisis. As a

result of this, it is recommended that regulators should focus on the principal

issues that the regulation is intended to address.

Financial regulations are laws and rules governing financial

institutions such as banks and

investment companies. Financial regulations

aim at maintaining orderly markets, enforcing

applicable laws, prosecuting cases of market misconducts,

licensing providers of financial services, protecting clients, promoting

financial stability and maintaining confidence in the financial system.

However, note that the principal aim of financial regulation is to protect

investors who may not be able to protect themselves if left on their own. All

these centre on the fact that the recurrent theme in every regulatory report on

the causes of the global crisis is the role of lax risk management controls

within financial institutions. As such, current financial regulation helps in

policing the amount of risk that can be incurred by a financial institution and

how that institution manages that risk. The regulatory activities range from

setting minimum standards for capital and conduct to making regulatory

inspections to investigating and prosecuting misconduct.

Some prominent key advisers (economists, journalists and

business leaders) including President Barack Obama have succeeded in

introducing a series of regulatory proposals. They also succeeded in mapping

out a number of steps that need to be taken in revamping these regulatory

systems dealing with financial institutions. Some of these regulatory proposals

include consumer protection, expanded regulation of the shadow banking system

and bank financial cushions. These are bent on minimizing the impact of the

current global financial crisis as well as to try to prevent its recurrence in

the nearest future.

The present financial crisis portrayed the inadequacies of

financial regulations both at the national and global levels because they

failed to license and supervise the financial services providers at all times.

A case in point is the boom and collapse of the shadow banking system which

according to Krugman, was the core of what happened to cause the crisis. He

argued that the shadow banking system expanded to rival conventional banking in

importance. As such, politicians, as well as some government officials should

have realized they were recreating the kind of financial vulnerability looked

upon in the 1930s as one of the causes the Great Depression. This implies these

government officials should have responded by

extending some regulations and financial safety so as to

protect the new institutions. Therefore, financial regulations should have at

least been imposed on all banking-like activities. As if that is not enough,

the IMF Managing Director (Dominique Strauss-Kahn) also added that the

financial crisis originated as a result of failure on the part of financial

regulations to guard against excessive risk-taking in the financial system.

Never the less, excessive regulation has also been cited as a possible cause of

the crisis. For instance, the Basel II accord has been criticized for requiring

banks to increase their capital when risks rise which might result in their

decreasing lending when capital becomes scarce. As such, the financial markets

only survived after extensive and costly public rescues from the governments

and some big banks.

2.8.1 Financial Regulations Methods and

Implementations

Basel II financial regulation method is the most commonly used

type of financial regulations. Basel II is the second of the Basel Accords

which are a set of recommendations on banking and regulators issued by the

Basel Committee on Banking Supervision. The purpose of Basel II is to

create an international standard that banking regulators can use when creating

regulations on how much capital banks need to put aside to guard against the

different types of financial and operational risks. Supporters of Basel II

believe that such an international standard can help to protect the

international financial system from the types of problems that might arise if a

major bank or series of banks should collapse. Bear in mind that this Basel II

accord made sure the issues of risk measurement as well as risk management

within financial institutions were tackled.

One of the most difficult aspects of implementing an

international agreement such as Basel II

is the need to accommodate

different cultures, different structural models and the already

existing

regulations. Bear in mind that regulators can't leave capital decisions totally

to the

banks because if they do so they will not be doing their jobs

and the public's interest will not be served as well. The Basel II framework is

intended to promote a more forward-looking approach to capital supervision,

that is, one that encourages banks to identify the risks they may face today

and in the future and to develop their abilities in managing those risks. As

such, Basel II is intended to be more flexible and better able to evolve with

advances in markets and risk management practices.

Following Moody's statistics, it was evident that the CDO

market in the Europe, Middle East and Africa (EMEA) grew up to 78% in 2006.

This growth was driven by banks in a bid in adjusting to the Basel II

regulation. This Basel II regulation forced many banks in 2006 to reexamine

their risk exposure so as to limit the amount of capital they will be holding

against investments, Crompton, 2007. Crompton looked at securitization and CDOs

as means of banks moving some of the risks of their balance sheets into

investors hands. All of these centre on Basel II because it has focused its

attention on economic capital as well as driving the project market into

securitization. This is because securitization is assumed to offer easier

access to mortgage assets for investors thereby making things difficult for

direct holders of home mortgage loans to procure because of the uncertainty

existing in the credit quality of the loans and the problems associated with

servicing them.

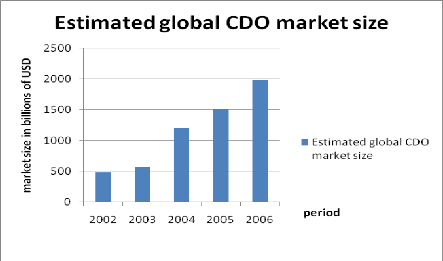

2.8.1.1 The Growth of CDOs

Table 1: Estimated Size of the Global CDO Market by the

end of 2006.

|

Period

|

Estimated amount in billions of USD

|

|

2002

|

480.0

|

|

2003

|

570.0

|

|

2004

|

1200.0

|

|

2005

|

1510.0

|

|

2006

|

1980.0

|

Figure 5: Estimated Global CDO Market Size

Source: Thomson Financial

From the graph above, it is clear that between 2002 and 2006,

the CDO market size experienced a steady growth increase. The issuance of the

CDOs market experienced a significant increase of about 78% in the year 2006.

During this period, most of the CDOs tranches obtained the highest level of

credit rating which is the triple A (AAA) rating considered to be the safest by

the credit rating agencies. The growth in the CDOs market is as a result of

innovation such as the creation and implementation of the Basel II regulation.

Thanks to this innovation, the CDO market became one of the most profitable

markets for investment banking. The CDO market is now moving towards the

direction of on demand credit risk whereby an investor can specify a product's

risk/return ratio and the bank merely originates and then distorts this

risk/return ratio of the portfolio and delivers a new product to its client.

The above mentioned points greatly contributed to the growth of the CDO markets

between the years 2002 and 2006 and thereby creating some value to its

investors, customers as well as the shareholders hence influencing the

investment decision-making process.

2.9 Definition and Meaning of Value Creation

Value creation is the primary objective of any business

entity. It is obvious that most successful organisations understand that the

purpose of any business is to create value for its customers, employees,

investors as well as its shareholders. Because the customers, employees and

investors are linked up together, no sustainable value can be created for one

unless for all of them. The first point of focus should be that of creating the

value for the customer, remember, customers are always right. Value creation

for customers will help in selling the services provided. This can only be

achieved when the right employees are employed, developed and rewarded as well

as when investors keep receiving consistent attractive returns. However, from a

financial point of view, value is said to be created when a business earns

revenue which surpasses expenses.

Value creation simply put occurs when there is an additional

value being added to the bottom line of a business thanks to the creation and

use of new methods to maximize the shareholders wealth. Value creation from the

customer point of view entails the provision of services that customers will

find consistently useful. In today's business world, such value creation is

typically based on constant process innovation as well as constantly

understanding the customers needs with the ever changing business world. This

can be achieved thanks to the commitment, energy and imagination of the

employees. In order for these employees to work effectively and committed, they

need to be motivated and the best way of doing this is by creating values for

the employees as well.

Value creation for employees will include employees to be

treated respectively, the provision of continuous training and development as

well as the employees participating in decision making processes. Bear this in

mind that this only happens when managers decide to define their company's

interests broadly enough to include the interest of everybody-from the

employees to the customers.

Contrary to the above, things go sour when managers decide not

to focus on any value creation strategy but rather make decisions that will in

the long run decrease the value of their businesses. This always happens when

the managers decide to conceive the self-interest conception. This is because

sometimes they decide to ignore employees' satisfaction, learning, research and

development effectiveness. Consequently, when these are ignored, the outcomes

are horrible because it will definitely result to low employees morals and

performances with their associated effects.

2.9.1 Value Creation Strategies

There are different methods leading to value creation in

companies and financial institutions. The real value creation - long term

growth and profitability - occur when financial institutions decide to develop

continuous stream of services that offer unique benefits to their customers.

This implies, in order for an institution to maintain an industry leadership

position, the institution must establish a sustainable process of value

creation. The ability of developing resources and effectively matching them

with opportunities is the brain behind any well established institution's value

to customers, and the basis of its valuation by shareholders. Note that this

value creation process in turn is built on the capabilities and motivation of

the institution's employees. No doubt some experts recommend that value

creation should be treated as a priority for all employees and institutions

decisions. This is because if value creation is put first, managers will know

where and how to grow. Also, understanding what creates value will help

managers to stay focused. For example, if a customer's value is that of

consistent quality and timely delivery then what will be expected of from the

manager will be skills, systems and processes that will produce and deliver

quality services in time.

In today's business world where nearly everybody is faced with

choices, the main challenge for all businesses is to develop and sustain a

uniquely and attractive proposition for both customers as well as employees.

All the same, the most difficult challenge is doing this in such a way that

will result in value creation. This therefore implies managers will

continuously be on their feet because they will need to be constantly asking

themselves what is to be done that will be different from their competitors and

how that will result to value creation? By putting this in place therefore

implies you making for yourselves better managers and creating an environment

that attracts only people who adhere to very high business performance

standards. This more often than not, results with you having more managerial

talents than your competitors thereby enabling you to achieve higher levels

of

profitable as well as sustainable growth. Lloyds TSB is an

example of a financial institution that has made value creation drive to their

growth for over decade because at one point in time, they decided to put value

creation first.

2.10 The Decision-Making Process

Decisions are not arrived at in a vacuum; they rely on

personal resources and some complex models that sometimes do not relate to the

situation. This process most of the time encompasses the specific problem faced

by the individual as well as extending to their environment. The

decision-making process can be defined as the process of choosing a particular

alternative from a number of alternatives. According to Mathews, 2005, it is an

activity that follows after a proper evaluation of all other alternatives.

However, the Normative Theory of Decision-Making tries to

explain the whole idea about the decision-making process and what economists as

well as other finance scholars think of it. This theory aims at explaining the

actual behaviour of an agent focusing on a rational decision-maker whose aim is

that of maximising utility. Applicable to this theory are three economic

conditions of risk, certainty (known possible outcomes) and uncertainty

(unknown probability distributions). Nonetheless, it is highly argued today

that people are highly rational utility maximizers who measure the likely

effect of any action on their wealth before deciding. Thanks to the normative

theory and the implementation of financial models such as rational

decision-making, risk-aversion and uncertainty, the normative theory of

decision-making has come under scrutiny.

Making a proper decision involves a trade-off between the risk

involve in the decision and the

expected return, no doubt there is a

positive shape of both the Security and Capital Market

Lines in Figures 1

and 2 encouraging the fact that investors should be motivated to take

higher risk at least by the promise of a higher expected return

although at the same time, this will greatly be determined by the investors'

behaviour and attitude towards risk.

As already discussed, most finance theories are based on a

number of assumptions of which some include the fact that investors are

rational, objective and risk-averse in their behaviour towards risk, and all

these come into play in the decision-making process. By being rational implies

the reward for an individual's decision is affected by the decisions made by

others. Therefore if everything else should remain equal, then all individuals

faced with the same situation will make the same decision. Therefore, the

optimal choice of the individual is therefore dependent on what they believe

others actions are. Cabral 2000 describes this situation as an interdependent

decision-making process. Here investors turn to view their actions as being

right or wrong depending on the action of others.

The normative decision making theory is of the opinion that

individuals try to maximise their utility. This is because, they make

economically rational decisions, they can assess outcomes and calculate the

alternative paths of these outcomes. This is usually done in a bid of choosing

the action that will yield the most preferred outcome.

However, any decision making process is dependent on the

individual's attitude and behaviour towards risk with regards to gains and

losses. Generally, attitude towards risks when it concerns gains are much more

valuable than attitude towards losses. Therefore, making a proper decision

involves a trade-off between the risks involve in the decision and the expected

return.

Nonetheless, the main assumption of the classical finance

school of thought centres on the fact that investors are risk-averse.

Risk-aversion is important because it helps us to have a clew as to how

investors confront risks and how they behave thereafter. Another assumption of

the classical financial theory is that the utility function remains constant

overtime and

between situations. As such, if faced with a problem,

individual's turn to choose the less risky alternative, at the same level of

expected return (Friedman and Sevage 1948), implying therefore that being a

risk-averse utility maximizer, investors will turn down any investment option

that present a 50/50 lose/gain risk for all initial wealth level (Rabin and

Thaler 2000).

2.11 Behavioural Factors Influencing Investment

Decision-Making

It has been observed that the behaviour of investors is more

dynamic. This behaviour has been a call for concern for numerous researchers in

different backgrounds especially within the behavioural and social sciences.

However, while sociologists try to explain investors' behaviour by looking at

the impact of their social environment, psychologists concentrate on individual

characteristics of the investors and economists focus on the rationality and

irrationality of investors in the investment decision-making process. All these

are geared towards the point that, contrary to the classical finance school of

thought, investors are not economically rational and utility maximising.

Behavioural finance is defined by Lintner (1998) as:

«the study of how humans interpret and act on information to make

informed investment decisions? while Olsen (1998) on his part asserts that

`behavioural finance does not try to define rational? behaviour

or label decision making as biased or faulty; it seeks to understand and

predict systematic financial market implications of psychological decision

processes.»

Behavioural finance challenges most of the assumptions of the

EMH. It shows that human decision- making process is subject to a number of

factors. The behavioural finance scholars use the findings of the so-called

Psychology of Choice and Judgement which is considered by them to be the first

pillar of the Behavioural Decision Theory. The heuristic factors (the

most important findings of the Psychology of Choice and Judgement) claim that

the decision making process is not always strictly rational. Here, when all

relevant information is collected

and objectively evaluated, the decision maker tries to take

shortcuts. Heuristics can therefore be viewed as rules of

thumb where decisions are made in situations involving high degree of risk

and uncertainty. These shortcuts are mostly derived from some past experiences

and they most of the time lead to wrong directions and poor decisions being

arrived at. This is because, in trying to adopt these shortcuts in the

decision-making process, relevant facts which should normally be included are

being ignored. Typical examples of illusions resulted from the use of

heuristics in the decision-making processes include

overconfidence, gambler?s fallacy and availability bias.

Overconfidence can be described as the belief in

oneself and one's abilities with full conviction. This has to do with the way

decision-makers believe in their predictive skills and abilities. In some

cases, it leads investors to overestimating their predictive skills thereby

conceiving the belief that they can `time' the market. The reasons for the

existence of overconfidence within experts in their decision-making

process include the failure to contemplate that human make mistakes, failure to

pay attention to how technology systems perform as a whole, failure to predict