|

Dissertation

Programme: MSc. In Financial Mathematics Minor: Banking

and Finance

Name: Agborya-Echi Agbor-Ndakaw

Candidate Number: 59990

Title: Financial Regulations, Risk Management and Value

Creation in Financial Institutions: Evidence from Europe and USA.

Supervisor: Dr Michael Barrow

Date: 02/09/2010 Number of Words: 18,651.

ABSTRACT

The present global financial crises resulted in a near

collapse of the world banking system. Some financial institutions and financial

markets could continue operations only upon reception of public rescue

packages. It also brought to light the inadequacies of the financial model both

at the national and international levels. This study brings out the need for

revising these financial regulations hence. This study also revealed how

behavioural finance greatly contributed to the out break of the present crisis

and therefore suggests the licensing and supervision of financial institutions

at all times.

The principal aim of this study is to investigate how the

relationship between financial regulations, risk management and value creation

alongside other behavioural factors influence the process of investment

decision-making by investors. Some of the behavioural factors revealed by this

study include overconfidence, gambler's fallacy and availability bias. In

addition to these, this study also revealed that some assets (CDOs and CDSs)

within the financial industry also influence the investment decision-making

process.

This study focuses on the role of risk management within

financial institutions thereby establishing a framework for efficient and

effective risk management. The goal of such an activity is that of achieving

the highest value added from the risk management procedure being undertaken

thereby restoring the trust and confidence that has been lost in financial

institutions and banks as a result of the present crisis.

KEYWORDS: RISK, RETURN, RISK MANAGEMENT, FINANCIAL

REGULATIONS, VALUE CREATION, INVESTMENT DECISION-MAKING, COLLATERIZED DEBT

OBLIGATIONS (CDOs), CREDIT DEFAULT SWAPS (CDSs), BANKS, GLOBAL FINANCIAL CRISIS

AND BEHAVIOURAL FINANCE

ACKNOWLEDGEMENT

The completion of this study would not have been possible

without the help and support of some people. Firstly, I will like to express my

gratitude to my supervisor, Dr Michael Barrow for his professional guidance and

advice. His suggestions and critical remarks to the realisation of this study

have been inspiring.

I will equally wish to acknowledge the support of the rest of

the program instructional team, the entire staff of the University of Sussex in

general and the School of Mathematical and Physical Sciences in particular for

making my stay here memorable. I will also like to thank my classmates for

their help and support.

My sincere gratitude also goes to my family and friends for

their abundant love, support and encouragement throughout the study period.

Success is better when it is a result of teamwork.

Finally and most importantly, I thank God for making it possible

for me to be here.

Contents

ABSTRACT .1

ACKNOWLEDGEMENT 2

CONTENTS 3

CONTENTS .4

List of Figures 5

List of Tables 5

CHAPTER ONE 6

INTRODUCTION 6

1.1 Background 6

1.2 Rationale of Study and Gaps in Existing Research .13

1.3 Research Questions 15

1.4 Aims and Objectives 16

1.5 Hypotheses 17

1.6 Summary of Methodology 18

1.7 Summary of Chapters 18

1.8 Summary of Chapter One .19

CHAPTER TWO ..20

LITERATURE REVIEW ..20

2.1 Introduction 20

2.2 Definition and Meaning of Risk ..20

2.3 Definition and Meaning of Return ...23

2.4 Relationship between Risk and Return .24

2.5 Types of Risks within Financial Institutions 25

2.6 Definition and Meaning of Risk Management ..28

2.7 Reasons for Risk-taking in Financial Institutions 32

2.8 Definition and Meaning of Financial Regulations 33

2.9 Definition and Meaning of Value Creation 38

2.10 The Decision-Making Process 41

2.11 Behavioural Factors Influencing Investment Decision-Making

43

2.12 Assets Influencing Investment Decision-Making 46

2.13 Conclusion 60

CHAPTER THREE ..61

METHODOLOGY 61

|

3.1 Introduction

|

61

|

|

3.2 Research Philosophy

|

61

|

|

3.3 Research Approach

|

.62

|

|

3.4 Choice of Method

|

63

|

|

CHAPTER FOUR

|

.64

|

|

PRESENTATION AND DISCUSSION OF FINDINGS

|

.64

|

|

4.1 Purpose of Chapter

|

64

|

|

4.2 Description of Findings

|

64

|

|

4.3 Discussion of Findings

|

...67

|

|

4.4 Conclusion

|

71

|

|

CHAPTER FIVE

|

72

|

|

CONCLUSIONS AND RECOMMENDATIONS

|

.72

|

|

5.1 Introduction

|

72

|

|

5.2 Overall Assessment of Aims and Objectives Attainment

|

...72

|

|

5.3 Conclusion

|

73

|

|

5.4 Recommendations

|

...75

|

REFERENCES 77

List of Figures

Figure 1: Capital Market Line 7

Figure 2: Security Market Line 7

Figure 3: The UK Bank Rescue Package 11

Figure 4: Risk Management Procedure 31

Figure 5: Estimated Global CDO Market Size 37

Figure 6: Global CDO Market Data for 2006-2007 48

Figure 7: A Summary on How CDS Works 53

Figure 8: Increase in CDS Markets 57

Figure 9: Factors Influencing Investment Decision-Making 65

Figure 10: Summary 72

List of Tables

Table 1: Estimated Size of the Global CDO Market by the End of

2006 37

Table 2: Global CDO Market for 2006-2007 47

Table 3: The ISDA Market Survey for CDSs 56

CHAPTER ONE INTRODUCTION

1.1 Background

The relationship between financial regulations, risk

management and value creation is the brain behind the investment

decision-making process especially within financial institutions. This

relationship is such that forms the general idea on the understanding of how

financial institutions work with regards to investments and the investment

decision-making process. To successfully establish this relationship between

financial regulations, risk management and value creation, it will be ideal to

pinpoint the fact that financial institutions can stand a better place in

creating value and restoring the trust and confidence that has been lost in

financial institutions and banks as a result of the outbreak of the 2007-2009

financial crises.

Economists have proven that there exist a number of classical

financial theories which support the opinion that risk and return trade-off

play an important role in arriving at investment-making decisions. Some of

these theories include the CAPM, Modern Portfolio Theory (MPT) and the

Efficient Market Hypothesis (EMP). This can be proven using the Capital and

Security Market Lines whereby both portray a positively sloping curve implying

that the higher the risk the higher the expected return.

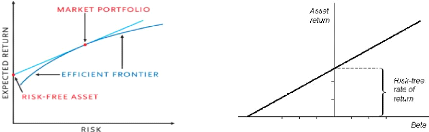

Figure 1: Capital Market Line. Figure 2: Security Market

Line

Looking at the above graphs (indicating that the higher the

risk taken the higher the expected return), and according to Haslem, 2003,

investors should be compensated for taking very high risk in the hope of

expecting higher returns. Never the less, investors are adviced to create a

market portfolio(a portfolio consisting of all securities / assets whereby the

proportion invested in each security corresponds to its market value) which is

located on the efficient frontier (describes the relationship between the

return that can be expected from a portfolio and the riskiness of the

portfolio). The fact that risk and return form the foundation in classical

finance especially when investment decision-making is concerned has led to the

birth of many schools of thought and authors amongst which we have Angelico et

al (2000) and McMenamin (1999) . They are all bring out the point that risk and

return lay the foundation for very important and rational investment decisions

to be taken. There are number of assumptions associated with these classical

financial views. Some of these include:

· The fact that risk is an objective measure which is

quantitative in nature hence can be calculated using historical as well as

statistical data (Beta and Standard Deviation) (Levy and Sarnat, 1972).

· The opinion that investors are generally rational in

their decision-making and are generally risk-averse in their attitude as far as

risk is concern (Pratt and Grabowski, 2008).

· The point that higher risk will always be rewarded with

higher return also known as the risk-return trade-off.

Owing to these assumptions, it is evident that investors when

faced with investment decision and considering risk and return remaining

constant, all investors will definitely choose the investment that will result

to a less risky alternative though at the same level of the expected return

(Friedman and Sevage, 1948). Critically looking at the assumptions of the

classical

finance, it is evident that all investors and everybody in

the financial market think in the same direction. This goes to confirm the

point that whether they are expert professionals, institutions or indidvaidual

investors, there is actually no difference in investors' behaviour.

Contrary to the above, the behavioural finance school of

thought differs from the classical school of thought. This is to say, within

the behavioural financial content, they try in explaining investors' behaviour

in decision making process. They do so by looking at the socio-psychological

factors point of view that influence investors when making their decisions.

Some behavioural finance economists including Statman (1995, 1999), Tversky and

Kahneman (1974), Thaler (1994) stress on the fact that based on these

sociopsychological factors, there exist sufficient evidence in support of the

repeated patterns of irrationality and inconsistence when investment

decision-making is concern especially when there is a choice of choosing from a

situation of uncertainty. Behavioural finance school of thought views risk as

being a subjective measure hence investors are bound not to only exhibit a

risk-averse attitude towards risk but they can as well be risk-seeking or

risk-neutral. This therefore implies investors will not only seek the risk's

highest level of return but will like to as well maximise the risk's expected

return hence wanting to maximise the satisfying strategy (Sortino, 2001).

According to Frankfurter et al (2002), «Behavioural

finance has looked at risk in greater depth and found that attitudes towards

risk are not logical.... Real individuals usually have to address risk in

situations that they have never encountered before and will never encounter

again, for which statistical techniques are largely irrelevant.... There is

clearly much more to risk than finance has begun to consider, and much of it

involves how people form images of the events of which they are expected to

assess the risk»(p. 456).

The human decision-making process as claimed by the

researchers of behavioural finance, is subject to a number of cognitive

illusions which can be grouped into heuristic decision processes

(overconfidence, anchoring, gambler's fallacy and availabilty bias) and the

prospect theory (loss aversion and regret).

Regarding the arguments surrounding how risk and return

greatly influence investment decision, it therefore calls for concern to find

out the extent to which the relationship that exists between risk and return

help in influencing the investment decision-making process.

In the last three years or so, the cry of the day has been

that of the global financial crisis. Most writers and businessmen say this is

the greatest global financial crisis since the Great Depression in the 1930s

which could be traced as a failure in financial regulations to keep pace with

an out of control financial system (Krugman,2008). The causes of today's

financial crisis such as inefficient risk management, inadequacies of the

global model of banking regulations, are not different from the causes of the

Great Depression in the 1930s, no doubt Krugman describes it as the return of

the Depression.

The root cause of the most recent global financial crisis can

be traced back as a result of the failure of the US Treasury allowing Lehman

Brothers- a major Wall Street investment bank, to default sometime around

September 2008. This resulted to a lot of panic with so much consequences felt

in the financial sector as the prices of most financial assets had a massive

turndown. As if that was not enough, there was also the freezing of most

inter-banks' loans thereby resulting to `insecurity' and doubts in the banks

shares as well as the banks' balance sheets. This was a clear evident that the

crisis has brought to light so much focus on the inadequacies in the present

regulations in financial institutions, no doubt, there was the need of

restructuring these financial regulations specifically within financial

institutions. This is because the initial phase of the present financial crisis

almost led to the near collapse of

Northern Rock, a UK medium size mortgage provider. Moreover,

the high and incontrollable risk-taking of some big hedge funds and the

building role they played in this crisis has resulted in it being the centre of

discussion as far as global finance regulations are concerned.

This was done with the US, the UK together with some EU

countries putting together pieces of bank rescue packages together. These

rescue packages were centred on bank recapitalization where by the states had

to purchase most of the bank shares in a bid to reestablish that investors'

confidence in financial institutions. These rescue packages introduced were to

an extent temporary no doubt there was some part-nationalisation of some banks

whereas, in some cases there were out right purchase of these bad loan assets

by the state. For instance, the US at one point in time had to grant state

guarantees of some bank assets so as to stabilise the inter-bank connections

and businesses. The above mentioned points are enough evident for the need for

financial regulations to be implemented for the sake of these financial

institutions to be operated orderly as well as avoiding the outbreak of any

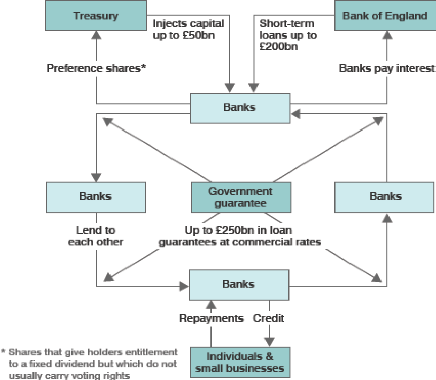

other financial crisis in the nearest future. The diagram below summarises the

UK bank rescue package.

Figure 3: The UK Bank Rescue Package

Source: HM Treasury 2008-9 Near-Cash

Projections

The above UK rescue package is aimed at putting the British

banking system on a better footing. This is because it is hoped that the deal

will get money moving again thereby assuring the future of the banking system

once more. Looking at the diagram above, it is seen that £250billion from

the Treasury and the Bank of England is being injected into the economy through

commercial banks. By implication, there is up to £250billion in the form

of loan guarantees to be available at commercial rates so as to encourage banks

to lend to each other as well as to individuals and small businesses. From

here, banks can easily lend money to other banks, individuals and small

businesses whereby these individuals and small

businesses will repay the borrowed money plus interest to the

banks and the banks to the Bank of England (UK Central Bank). But bear in mind

that, in order to participate in the scheme; banks will need to sign an

agreement on executive pay and dividends.

In order to put into effect these rescue packages, some banks

especially commercial and investment banks began utilizing the prevailing

atmosphere made up of excessive liquidity and financial innovation in acquiring

huge exposures in the global credit markets. With the use of these of

alternative investment schemes, massive amounts of assets and liabilities were

moved off the balance sheet resulting to the so called shadow-banking (banking

system referring to any unregulated activities carried out by regulated

financial institutions). Although the risks associated with these positions

were unpredictable, yet there were some financial institutions which enjoyed

some reasonable amount of government guarantee and ended up adopting very

casual attitude towards risk controls. To an extent, it is evident that one of

the root causes of the present global crisis is as a result of this attitude

towards risk hence resulting to most rescue packages being directed to

universal banks especially in EU and Switzerland.

Some international investment funds such as the hedge funds

were of the highly leveraged institutions and as such, they were to a larger

extent of regulatory oversight. Thanks to their active participation in the

global credit market, they were constantly increasing in size and number. As

such, some economists have argued that one of the causes of the present global

financial crisis was the unregulated nature of the practice of shadow-banking.

As if that is not enough, the nature in which the shadow-banking sector was

operated coupled with the absence of the global regulation framework especially

for international investment funds, greatly contributed to outbreak of the

present global crisis thereby bringing the global financial system into a near

collapse.

|