2.12.2 Credit Default Swaps (CDSs)

CDS is one of the most common credit derivatives and these

credit derivatives are considered as instruments used in moving risk over from

one party to another. This is because they are simple in structure and have

very flexible conditions whereby banks as well as investors can easily use in

hedging their exposure to credit risk. CDS exchanges streams of payments for

agreement in repaying the specified notional amount (face value of an

asset/instrument used in calculating payments made) if there is a default

payment on the loan caused by a `supposed' third party. Bear in mind that, the

protection buying price with a CDS is strictly based on basis point spreads

(the annual amount the protection buyer must pay the protection seller over the

length of the contract expressed as a percentage of the notional amount) with

the basis point being just 0.01% of the contract's notional value of the

supposed deal because 1 basis point=0.01%. Note that the premium is usually

quoted in basis points per year of the contract's notional amount whose payment

is made quarterly. For instance, consider the CDS spreads of the risky

corporation to be 25 basis points, that is, 0.25% remembering that 1 basis

point=0.01%, then an investor wanting to buy a $10million

worth of protection from a triple `A' bank, must be ready to pay the bank

$25,000 per year and these payments continue until the CDS contract expires or

a default occurs.

2.12.2.1 How CDSs Work

CDSs allow the contracting partners to trade or hedge the risk

that an underlying entity defaults. Here, the protection buyer pays a yearly

premium until the contract matures. In return, the protection seller assumes

the financial loss in case the underlying security becomes insolvent. As a

result of this, a CDS contract resembles an insurance policy whereby one side

assumes the risk and the other pays an insurance premium. When signing the

contract, the protection buyer and seller agree upon a premium which will

remain constant until the contract matures and which compensates the protection

seller for bearing the risk.

A typical CDS contract, is bounded with some terms and

conditions usually documented under a confirmation referencing the credit

derivatives definitions as published by the International Swaps and Derivatives

Association (ISDA). In the confirmation, we will have the reference entity

specified, be it a corporation or sovereign body generally being identified

with outstanding debts plus a reference obligation, usually unsubordinated

government bond. Within the confirmation there is a specification of the

calculation agent responsible for making the determinations as to successors

and substitute reference obligations as well as performing the various

calculations and the administrative functions regarding any transaction.

As if that is not enough, in the CDS confirmations, all credit

events giving rise to payment obligations by the protection seller and delivery

obligations by the protection buyer are being specified. Some of these credit

events include bankruptcy with reference to the supposed reference entity and

its failure to pay with respect to its direct loan debt. The contract's

effective date and scheduled termination date is always referred

to the period over which the

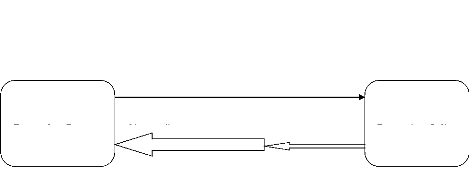

default protection extends. The following diagram illustrates a

summary on how CDS works.

Figure 7: A Summary on How CDS Works

Premium

Protection Buyer No credit event: no payment

Credit event: payment Protection

Protection Seller

Reference entity

From the diagram above, it is clear that there is a

relationship between the protection buyer and seller whereby a premium is paid

to the seller. The seller in return is protected because he has an option of

repaying or not depending on the state of the financial market. All of these

are sealed in the presence of a reference entity which is usually a corporation

or a government. CDS simply put, is a contract of protection between two

counterparties-the protection buyer and the protection seller. Note that the

protection buyer is the one responsible for making the payments to the

protection seller but in case of a default, the seller pays the par value of

the bond in exchange for any physical delivery of the bond.

|