Risk management has today become a virtual issue for

financial institutions because some schools of thought claim that lack of

proper risk management practices has been a key factor in the present financial

crisis. Generally speaking, risk management is referred to the process of

measuring, analysing, controlling and assessing risks as well as developing

strategies to manage these risks. Some of the strategies used in managing these

risks include transferring the risks to other parties, avoiding the risks,

diversifying the risks, etc. Note that financial risk management focuses on

just risks that can be managed using financial instruments. All businesses

whether big or small do have risk management teams. Sometimes these risk

management teams need to use a combination of the risk management strategies to

be able to manage their risks.

There are certain principles that must be identified with

risk management. As a matter of principle, risk management should result in

value creation in any business, be part of any decision making process, be

systematic and well-structured and be very transparent. The processes of risk

management include the identification of the risk, planning what risk

management strategy/strategies to use, mapping out the basis upon which the

risks will be evaluated, a definition of a framework within which the

`job/task' will be carried out, a development of the analysis of the risks

involved in the process and finally implementing the risk management

strategy/strategies to be used.

Once the risk management process has been completed, that is

to say after the risks have been identified and assessed, all risks management

techniques fall into one or more of these categories-avoiding, transferring

(for example insurance companies), reducing and retaining (accepting and

budgeting). These risk management teams are always faced with a number of

risk options including that of designing a new business

process from the start with adequate built-in risk control measures.

In essence, we will like to define the role played by risks

within financial institutions, identify when these risks should be managed and

when they should be transformed (if possible), as well as the procedures that

must be followed for any successful risk management activity of any financial

institution. So far so good, it has been argued that risk is an essential

factor within the financial sector. It therefore implies that active risk

management has a major place in most financial institutions. In the light of

this, what techniques/procedures can be used / implemented in limiting and

managing these risks?

The answers to these questions are straight forward. It is

obvious that if management is to control risk, it has to establish a set of

procedures in order to achieve this goal. Note that for each risk type, a

four-step procedure is established and implemented to define, measure and

manage risk. This will go a long way to assist decision makers to manage risk

in a manner that is consistent with management's goals and objectives. These

steps include:

· Standards and reports-that is, the creation

of a standard setting and financial reporting method. These two activities are

the back bone of any risk management system. Therefore consistent evaluation

and rating is essential for management to understand the true embedded risks in

the portfolio and the extent to which these risks can be reduced if not totally

eliminated.

· Position rules-imposed to cover exposures to

counterparties and credits. This applies to traders, lenders and portfolio

managers. This is so because, in large organizations with thousands of

positions maintained and transactions done (on a daily bases), accurate and

timely reporting is quite difficult though it is perhaps the most essential.

· Investment guidelines (strategies)-these

guidelines and strategies for risk taking in the immediate future are outlined

in terms of commitments to particular areas of the market and the need to hedge

against systematic risk at a particular time. Guidelines offer advice to the

appropriate level of active risk management.

· Incentive contracts and compensation-this

explains the extent to which management can enter into incentive compatible

contracts with line managers and make compensation related to the risks borne

by these individuals, as such, the need for elaborate and costly controls is

lessened. These incentive contracts require accurate cost accounting analysis

together with risk weighting. Notwithstanding this difficulty, well designed

contracts align the goals of managers with other stakeholders.

Risk management need to be an integral part of any

institution's business plan. Decisions to either enter or leave or

concentrate on an existing business activity require careful assessment of both

risks and returns. These risk management procedures must be established so that

risk management begins at the point nearest to the assumption of risk. By

implication, any trade entry procedures, customer documentation as well as

client engagement methods of normal business activities must be adapted to

maintain management control and eliminate needless exposure to risk. As if this

is not enough, data bases and measurement systems must be developed in

accordance with the way the business is conducted. Moreover, for any accurate

daily business reports, trades must be recorded, entered and checked in a

timely fashion. This helps during an overall effective risk management system

put in place by senior management.

There exists three successive levels within any organization

corresponding to the levels at

which risk is considered to have been

typically managed. The senior management system

used in checking and evaluating business as well as individual

performances, need to be sure that these three levels of risks are attained.

Level I aggregates the standalone risks within a single risk

factor such as credit risk in a commercial loan portfolio.

Level II aggregates risks across different risk factors within a

single business line for instance the combination of assets, liabilities and

operating risks in a life insurance.

Level III aggregates risks across different business lines such

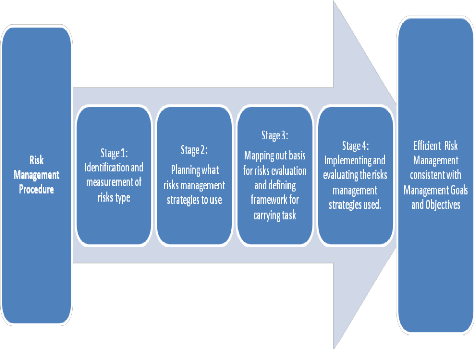

as banking and insurance. The diagram below summarises the risk management

process within financial institutions. Figure 4: Risk Management

Procedure.