ANNEXE

ANNEXE I

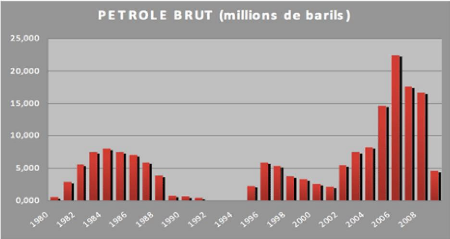

Graphique A-1 : Evolution de la production

pétrolière ivoirienne

Source: Ministère des mines, du pétrole et de

l'énergie.

ANNEXE II

Tableau A-1 : Imposition des carburants (2009),

USD/litre

|

Pays

|

Supercarburant

|

Gasoil

|

Pétrole lampant

|

|

Benin

|

0.41

|

0.29

|

0.19

|

|

Burkina Faso

|

0.71

|

0.63

|

0.01

|

|

Cote d'Ivoire

|

0.84

|

0.72

|

0.23

|

|

Mali

|

0.73

|

0.43

|

0.14

|

|

Niger

|

0.49

|

0.37

|

0.02

|

|

Senegal

|

0.44

|

0.40

|

|

|

Togo

|

0.39

|

0.38

|

0.11

|

|

|

Ghana

|

0.25

|

0.16

|

0.15

|

|

Nigeria

|

0.20

|

0.49

|

0.21

|

Source : calculs du FMI a partir des données

nationales

ANNEXE III

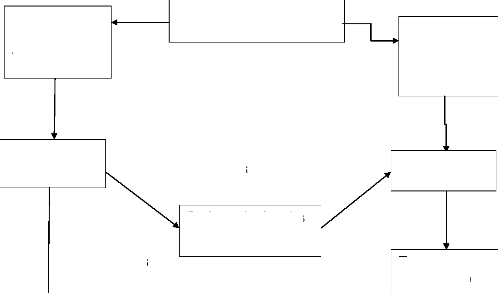

Schema: 3 aRFOdua1- d'1-stimEtiRn du mRd~l1- 9 $ 5 99 (

C

Modèle Vectoriel à Correction d'Erreur

Test de cointégration

Si les variables ne sont pas stationnaires en niveau

Si les variables sont cointégrées

Si les variables ne sont pas cointégrées

Stationnarisation des variables

Test de stationnarito

Estimation VAR

Tests diagnostique

Si toutes les variables sont stationnaires en niveau

Test de causalito

Analyse impulsionnelle

Décomposition de la variance

Source : Auteur

ANNEXE IV

Tableau A-2 : Test de racine unitaire ADF sur les

variables du modèle

|

Modèle(3) avec constante

et tendance (etape1)

|

Modèle(2) avec

constante (etape2)

|

Modèle(1) sans constante

ni tendance (etape3)

|

|

Prix de pétrole (PP)

|

|

Std error

|

0,090908

|

1,267326

|

|

|

T-statistic

|

0,422839

|

-0,826827

|

3,882932

|

|

Probabilité

|

0,6744

|

0,4126

|

0,9999

|

|

Décision

|

La tendance n'est

pas

significative

(prob=0,6744>0,05)

|

La constante n'est

pas

significative

(prob=0,4126>0.05)

|

On accepte H0 de

racine

unitaire

(prob=0.9999>0.05)

|

|

Taux d'inflation (INFL)

|

|

Std error

|

0,063190

|

1,261682

|

|

|

T-statistic

|

-0,707783

|

2,518921

|

-1,908442

|

|

Probabilité

|

0,4830

|

0,1156

|

0,0545

|

|

Décision

|

La tendance n'est

pas

significative

(prob=0,4830>0,05)

|

La constante n'est

pas

significative

(prob=0,1156>0.05)

|

On accepte H0 de

racine

unitaire

(prob=0.0545>0.05)

|

|

Taux de croissance (TXCROISS)

|

|

Std error

|

0,077499

|

0,9443173

|

|

|

T-statistic

|

-1,982496

|

1,127071

|

-1,537939

|

|

Probabilité

|

0,0551

|

0,2670

|

0,1151

|

|

Décision

|

La tendance n'est

pas

significative

(prob=0,0551>0,05)

|

La constante n'est

pas

significative

(prob=0,2670>0.05)

|

On accepte H0 de

racine

unitaire

(prob=0.1151>0.05)

|

|

Exportations (EXPORT)

|

|

Std error

|

12333087

|

1,02E+08

|

|

|

T-statistic

|

0,228138

|

-0,062743

|

4,630168

|

|

Probabilité

|

0,8206

|

0,9502

|

1,0000

|

|

La tendance n'est pas

|

La constante n'est pas

|

On accepte H0 de racine

|

|

Décision

|

significative

|

significative

|

unitaire

|

|

(prob=0,8206>0,05)

|

(prob=0,9502>0.05)

|

(prob=1,0000>0.05)

|

Source, résultat Eviews

Tableau A-3 : Test de racine unitaire ADF en

différence première Test 1 : prix de pétrole

Null Hypothesis: D(PP) has a unit root Exogènes: Constant,

Linear Trend Lag Length: 0 (Fixed)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -4.084597 0.0124

Test critical values: 1% level -4.165756

5% level -3.508508

10% level -3.184230

*MacKinnon (1996) one-sided p-values.

Test 2 : taux d'inflation

Null Hypothesis: D(INFL) has a unit root Exogènes:

Constant, Linear Trend

Lag Length: 1 (Fixed)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -7.162084 0.0000

Test critical values: 1% level -4.175640

5% level -3.513075

10% level -3.186854

Test 3 : Taux de croissance

Null Hypothesis: D(TXCROISS) has a unit root Exogènes:

Constant, Linear Trend

Lag Length: 4 (Fixed)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -3.990599 0.0166

Test critical values: 1% level -4.192337

5% level -3.520787

10% level -3.191277

*MacKinnon (1996) one-sided p-values.

Test 4:exportation

Null Hypothesis: D(EXPORT) has a unit root Exogènes:

Constant, Linear Trend

Lag Length: 0 (Fixed)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -4.987182 0.0010

Test critical values: 1% level -4.165756

5% level -3.508508

10% level -3.184230

*MacKinnon (1996) one-sided p-values.

Source, résultat Eviews

Tableau A-4 : Test de cointégration >

No deterministic trend

Unrestricted Cointegration Rank Test (Trace)

|

Hypothesized

|

|

Trace

|

0.05

|

|

|

No. of CE(s)

|

Eigenvalue

|

Statistic

|

Critical Value

|

Prob.**

|

|

None

|

0.267089

|

29.08752

|

40.17493

|

0.4036

|

|

At most 1

|

0.197880

|

14.79392

|

24.27596

|

0.4720

|

|

At most 2

|

0.071148

|

4.651064

|

12.32090

|

0.6170

|

|

At most 3

|

0.026935

|

1.256011

|

4.129906

|

0.3063

|

> No deterministic trend (restricted

constant)

Unrestricted Cointegration Rank Test (Trace)

|

Hypothesized

|

|

Trace

|

0.05

|

|

|

No. of CE(s)

|

Eigenvalue

|

Statistic

|

Critical Value

|

Prob.**

|

|

None

|

0.359742

|

42.58934

|

54.07904

|

0.3474

|

|

At most 1

|

0.202726

|

22.07868

|

35.19275

|

0.5902

|

|

At most 2

|

0.186600

|

11.65704

|

20.26184

|

0.4800

|

|

At most 3

|

0.045800

|

2.156548

|

9.164546

|

0.7464

|

> Linear deterministic trend

Unrestricted Cointegration Rank Test (Trace)

|

Hypothesized

|

|

Trace

|

0.05

|

|

|

No. of CE(s)

|

Eigenvalue

|

Statistic

|

Critical Value

|

Prob.**

|

|

None

|

0.349360

|

36.90552

|

47.85613

|

0.3520

|

|

At most 1

|

0.201479

|

17.13478

|

29.79707

|

0.6301

|

|

At most 2

|

0.126521

|

6.785050

|

15.49471

|

0.6028

|

|

At most 3

|

0.012156

|

0.562594

|

3.841466

|

0.4532

|

Source, résultats eviews

Tableau A-5 : Résultat de l'estimation du

mod~le

Vector Autoregression Estimates

Date: 03/25/11 Time: 09:35

Sample (adjusted): 1963 2008

Included observations: 46 after adjustments Standard errors in (

) & t-statistics in [ ]

|

DEXPORT

|

DINFL

|

DPP

|

DTXCROISS

|

|

DEXPORT (-1) 0.268517

|

-3.30E-09

|

4.70E-09

|

9.15E-10

|

|

(0.15857)

|

(2.2E-09)

|

(2.1E-09)

|

(2.1E-09)

|

|

[1.69342]

|

[-1.47764]

|

[2.21618]

|

[0.44340]

|

|

DINFL (-1) 18153811

|

-0.263418

|

-0.048598

|

0.037765

|

|

(1.0E+07)

|

(0.14122)

|

(0.13395)

|

(0.13027)

|

|

[1.81325]

|

[-1.86528]

|

[-0.36280]

|

[0.28989]

|

|

DPP (-1) 12162971

|

0.028834

|

0.293687

|

-0.143212

|

|

(1.3E+07)

|

(0.18984)

|

(0.18007)

|

(0.17513)

|

|

[0.90373]

|

[2.15188]

|

[1.63095]

|

[-1.81777]

|

|

DTXCROISS (-1) 16049814

|

0.012750

|

0.068751

|

-0.471869

|

|

(1.1E+07)

|

(0.14985)

|

(0.14214)

|

(0.13824)

|

|

[1.51076]

|

[0.08508]

|

[0.48368]

|

[-3.41346]

|

|

C 1.66E+08

|

0.733951

|

0.678665

|

-0.023556

|

|

(7.3E+07)

|

(1.02716)

|

(0.97430)

|

(0.94754)

|

|

[2.28469]

|

[0.71454]

|

[0.69657]

|

[-0.02486]

|

|

R-squared 0.194489

|

0.128120

|

0.209804

|

0.226969

|

|

Adj. R-squared 0.115902

|

0.043059

|

0.132712

|

0.151551

|

|

Sum sq. resids 8.03E+18

|

1597.887

|

1437.650

|

1359.766

|

|

S.E. equation 4.43E+08

|

6.242825

|

5.921540

|

5.758909

|

|

F-statistic 2.474838

|

1.506206

|

2.721473

|

3.009493

|

|

Log likelihood -978.3984

|

-146.8705

|

-144.4400

|

-143.1590

|

|

Akaike AIC 42.75645

|

6.603065

|

6.497392

|

6.441695

|

|

Schwarz SC 42.95522

|

6.801830

|

6.696158

|

6.640460

|

|

Mean dependent 2.32E+08

|

0.166312

|

2.063188

|

0.021452

|

|

S.D. dependent 4.71E+08

|

6.381731

|

6.358477

|

6.252122

|

|

Determinant resid covariance (dof adj.)

|

6.66E+21

|

|

|

|

Determinant resid covariance

|

4.20E+21

|

|

|

|

Log likelihood

|

-1406.264

|

|

|

|

Akaike information criterion

|

62.01150

|

|

|

|

Schwarz criterion

|

62.80656

|

|

|

Source, résultat Eviews

Tableau A-6 : TEST DE LA CAUSALITE

Pairwise Granger Causality Tests

|

Date: 03/26/11 Time: 09:57

Sample: 1960 2008

Lags: 1

|

|

|

|

|

Null Hypothesis:

|

Obs

|

F-Statistic

|

Probability

|

|

INFL does not Granger Cause EXPORT

|

47

|

1.19329

|

0.28061

|

|

EXPORT does not Granger Cause INFL

|

|

0.25442

|

0.61650

|

|

PP does not Granger Cause EXPORT

|

48

|

0.06924

|

0.79364

|

|

EXPORT does not Granger Cause PP

|

|

6.11005

|

0.01729

|

|

TXCROISS does not Granger Cause EXPORT

|

47

|

1.17118

|

0.28506

|

|

EXPORT does not Granger Cause TXCROISS

|

|

5.44061

|

0.02431

|

|

PP does not Granger Cause INFL

|

47

|

0.03916

|

0.84404

|

|

INFL does not Granger Cause PP

|

|

0.09097

|

0.76436

|

|

TXCROISS does not Granger Cause INFL

|

47

|

0.15419

|

0.69646

|

|

INFL does not Granger Cause TXCROISS

|

|

0.33248

|

0.56714

|

|

TXCROISS does not Granger Cause PP

|

47

|

3.88835

|

0.05493

|

|

PP does not Granger Cause TXCROISS

|

|

5.81855

|

0.02010

|

Source, résultat Eviews

GRAPHIQUE A-2 : REPONSE IMPULSIONNELLE

8 8 8

-1.0E+08 10E+08 -1.0E+08

Source, résultat Eviews

TABLEAU A-7 : DECOMPOSITION DE LA VARIANCE

Variance Decomposition of DEXPORT:

|

Period S.E.

|

DEXPORT DINFL

|

DPP DTXCROISS

|

|

1

|

4.43E+08

|

100.0000

|

0.000000

|

0.000000

|

0.000000

|

|

2

|

4.97E+08

|

92.23871

|

3.781334

|

0.829794

|

3.150162

|

|

3

|

5.01E+08

|

91.90361

|

3.733572

|

1.196198

|

3.166622

|

|

4

|

5.02E+08

|

91.78874

|

3.724128

|

1.246214

|

3.240922

|

|

5

|

5.02E+08

|

91.77604

|

3.724637

|

1.259564

|

3.239756

|

|

6

|

5.02E+08

|

91.76987

|

3.724112

|

1.262222

|

3.243795

|

|

7

|

5.02E+08

|

91.76921

|

3.724125

|

1.262887

|

3.243779

|

|

8

|

5.02E+08

|

91.76888

|

3.724098

|

1.263017

|

3.244008

|

|

9

|

5.02E+08

|

91.76884

|

3.724099

|

1.263050

|

3.244010

|

|

10

|

5.02E+08

|

91.76882

|

3.724097

|

1.263057

|

3.244023

|

Variance Decomposition of DINFL:

|

Period S.E.

|

DEXPORT DINFL

|

DPP DTXCROISS

|

|

1

|

6.242825

|

4.294497

|

95.70550

|

0.000000

|

0.000000

|

|

2

|

6.680018

|

10.47090

|

89.47337

|

0.044724

|

0.011013

|

|

3

|

6.690946

|

10.44484

|

89.20598

|

0.091553

|

0.257627

|

|

4

|

6.693558

|

10.45610

|

89.13775

|

0.096237

|

0.309909

|

|

5

|

6.694448

|

10.45932

|

89.11409

|

0.096911

|

0.329673

|

|

6

|

6.694597

|

10.45976

|

89.11027

|

0.097186

|

0.332775

|

|

7

|

6.694644

|

10.45988

|

89.10900

|

0.097221

|

0.333892

|

|

8

|

6.694653

|

10.45990

|

89.10878

|

0.097234

|

0.334077

|

|

9

|

6.694656

|

10.45991

|

89.10871

|

0.097236

|

0.334142

|

|

10

|

6.694656

|

10.45991

|

89.10870

|

0.097237

|

0.334153

|

Variance Decomposition of DPP:

|

Period S.E.

|

DEXPORT DINFL

|

DPP DTXCROISS

|

|

1

|

5.921540

|

13.97876

|

0.002029

|

86.01922

|

0.000000

|

|

2

|

6.708486

|

27.22547

|

0.296021

|

72.16098

|

0.317521

|

|

3

|

6.977731

|

31.18841

|

0.728419

|

67.54642

|

0.536748

|

|

4

|

7.024677

|

31.80241

|

0.752490

|

66.87193

|

0.573168

|

|

5

|

7.035287

|

31.94407

|

0.758557

|

66.71851

|

0.578860

|

|

6

|

7.037694

|

31.97566

|

0.759994

|

66.68353

|

0.580818

|

|

7

|

7.038222

|

31.98267

|

0.760316

|

66.67592

|

0.581098

|

|

8

|

7.038341

|

31.98422

|

0.760384

|

66.67420

|

0.581196

|

|

9

|

7.038367

|

31.98457

|

0.760400

|

66.67382

|

0.581209

|

|

10

|

7.038373

|

31.98465

|

0.760404

|

66.67373

|

0.581214

|

Variance Decomposition of DTXCROISS:

|

Period S.E.

|

DEXPORT DINFL

|

DPP DTXCROISS

|

|

1

|

5.758909

|

1.181507

|

2.249269

|

5.414594

|

91.15463

|

|

2

|

6.352756

|

1.033339

|

2.869741

|

4.508524

|

91.58840

|

|

3

|

6.483404

|

1.101843

|

2.874153

|

4.351623

|

91.67238

|

|

4

|

6.518361

|

1.115057

|

2.848024

|

4.306313

|

91.73061

|

|

5

|

6.526055

|

1.114611

|

2.844361

|

4.297983

|

91.74305

|

|

6

|

6.528106

|

1.115342

|

2.842830

|

4.295322

|

91.74651

|

|

7

|

6.528559

|

1.115292

|

2.842618

|

4.294822

|

91.74727

|

|

8

|

6.528679

|

1.115324

|

2.842530

|

4.294666

|

91.74748

|

|

9

|

6.528706

|

1.115319

|

2.842517

|

4.294635

|

91.74753

|

|

10

|

6.528713

|

1.115321

|

2.842512

|

4.294626

|

91.7475

|

Cholesky Ordering: DEXPORT DINFL DPP DTXCROISS

Source, résultat Eviews

|