Annexe 3

RESUSLTATS DES TESTS ET ESTIMATIONS

Null Hypothesis: _PIBR has a unit root

Exogenous: Constant, Linear Trend

Lag Length: 6 (Automatic - based on AIC, maxlag=7)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -6.354917 0.0001

Test critical values: 1% level -4.374307

5% level -3.603202

10% level -3.238054

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(_PIBR)

Method: Least Squares

Date: 10/31/13 Time: 19:16

Sample (adjusted): 1987 2011

Included observations: 25 after adjustments

|

Variable

|

Coefficient

|

Std. Error t-Statistic

|

Prob.

|

|

_PIBR(-1)

|

-1.169896

|

0.184093 -6.354917

|

0.0000

|

|

D(_PIBR(-1))

|

0.313750

|

0.135071 2.322861

|

0.0337

|

|

D(_PIBR(-2))

|

0.309971

|

0.143036 2.167088

|

0.0457

|

|

D(_PIBR(-3))

|

0.454534

|

0.139543 3.257310

|

0.0049

|

|

D(_PIBR(-4))

|

0.428236

|

0.151001 2.835985

|

0.0119

|

|

D(_PIBR(-5))

|

0.389608

|

0.127214 3.062610

|

0.0074

|

|

D(_PIBR(-6))

|

0.317752

|

0.102968 3.085931

|

0.0071

|

|

C

|

-3.251276

|

1.211732 -2.683165

|

0.0163

|

|

@TREND(1980)

|

0.277674

|

0.065970 4.209123

|

0.0007

|

|

R-squared

|

0.755430

|

Mean dependent var

|

-0.102867

|

|

Adjusted R-squared

|

0.633145

|

S.D. dependent var

|

3.004625

|

|

S.E. of regression

|

1.819859

|

Akaike info criterion

|

4.309108

|

|

Sum squared resid

|

52.99019

|

Schwarz criterion

|

4.747903

|

|

Log likelihood

|

-44.86385

|

Hannan-Quinn criter.

|

4.430811

|

|

F-statistic

|

6.177610

|

Durbin-Watson stat

|

1.679581

|

|

Prob(F-statistic)

|

0.001015

|

|

|

Null Hypothesis: _CCMLT has a unit root Exogenous: Constant,

Linear Trend

Lag Length: 0 (Automatic - based on SIC, maxlag=7)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -0.619743 0.9705

Test critical values: 1% level -4.284580

5% level -3.562882

10% level -3.215267

*MacKinnon (1996) one-sided p-values.

92

Relation Banque-Entreprise et croissance économique

au Cameroun

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(_CCMLT)

Method: Least Squares

Date: 10/31/13 Time: 19:18

Sample (adjusted): 1981 2011

Included observations: 31 after adjustments

|

Variable

|

Coefficient

|

Std. Error t-Statistic

|

Prob.

|

|

_CCMLT(-1)

|

-0.067680

|

0.109206 -0.619743

|

0.5404

|

|

C

|

0.158748

|

3.384819 0.046900

|

0.9629

|

|

@TREND(1980)

|

0.030867

|

0.108469 0.284565

|

0.7781

|

|

R-squared

|

0.081890

|

Mean dependent var

|

-0.434735

|

|

Adjusted R-squared

|

0.016311

|

S.D. dependent var

|

3.003065

|

|

S.E. of regression

|

2.978472

|

Akaike info criterion

|

5.112464

|

|

Sum squared resid

|

248.3963

|

Schwarz criterion

|

5.251237

|

|

Log likelihood

|

-76.24319

|

Hannan-Quinn criter.

|

5.157700

|

|

F-statistic

|

1.248723

|

Durbin-Watson stat

|

1.633159

|

|

Prob(F-statistic)

|

0.302360

|

|

|

Null Hypothesis: D(_CCMLT) has a unit root Exogenous: None

Lag Length: 0 (Automatic - based on SIC, maxlag=7)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -4.291869 0.0001

Test critical values: 1% level -2.644302

5% level -1.952473

10% level -1.610211

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation Dependent Variable:

D(_CCMLT,2) Method: Least Squares

Date: 10/31/13 Time: 19:20 Sample (adjusted): 1982 2011

Included observations: 30 after adjustments

|

Variable

|

Coefficient

|

Std. Error t-Statistic

|

Prob.

|

|

D(_CCMLT(-1))

|

-0.810224

|

0.188781 -4.291869

|

0.0002

|

|

R-squared

|

0.388048

|

Mean dependent var

|

0.096797

|

|

Adjusted R-squared

|

0.388048

|

S.D. dependent var

|

3.861256

|

|

S.E. of regression

|

3.020559

|

Akaike info criterion

|

5.081526

|

|

Sum squared resid

|

264.5895

|

Schwarz criterion

|

5.128232

|

|

Log likelihood

|

-75.22289

|

Hannan-Quinn criter.

|

5.096468

|

|

Durbin-Watson stat

|

1.896926

|

|

|

Null Hypothesis: _MM has a unit root

Exogenous: Constant, Linear Trend

Lag Length: 1 (Automatic - based on SIC, maxlag=7)

93

Relation Banque-Entreprise et croissance économique

au Cameroun

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -2.326669 0.4079

Test critical values: 1% level -4.296729

5% level -3.568379

10% level -3.218382

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(_MM)

Method: Least Squares

Date: 10/31/13 Time: 19:21

Sample (adjusted): 1982 2011

Included observations: 30 after adjustments

|

Variable

|

Coefficient

|

Std. Error t-Statistic

|

Prob.

|

|

_MM(-1)

|

-0.213389

|

0.091714 -2.326669

|

0.0280

|

|

D(_MM(-1))

|

0.592584

|

0.226746 2.613428

|

0.0147

|

|

C

|

4.317418

|

1.966798 2.195151

|

0.0373

|

|

@TREND(1980)

|

-0.036268

|

0.033821 -1.072322

|

0.2934

|

|

R-squared

|

0.260043

|

Mean dependent var

|

-0.074262

|

|

Adjusted R-squared

|

0.174663

|

S.D. dependent var

|

1.498692

|

|

S.E. of regression

|

1.361532

|

Akaike info criterion

|

3.578664

|

|

Sum squared resid

|

48.19799

|

Schwarz criterion

|

3.765490

|

|

Log likelihood

|

-49.67996

|

Hannan-Quinn criter.

|

3.638431

|

|

F-statistic

|

3.045726

|

Durbin-Watson stat

|

1.766248

|

|

Prob(F-statistic)

|

0.046538

|

|

|

Null Hypothesis: D(_MM) has a unit root

Exogenous: None

Lag Length: 0 (Automatic - based on SIC, maxlag=7)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -3.030109 0.0037

Test critical values: 1% level -2.644302

5% level -1.952473

10% level -1.610211

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(_MM,2)

Method: Least Squares

Date: 10/31/13 Time: 19:23

Sample (adjusted): 1982 2011

Included observations: 30 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

D(_MM(-1)) -0.622814 0.205542 -3.030109 0.0051

R-squared 0.235520 Mean dependent var -0.128960

94

Relation Banque-Entreprise et croissance économique

au Cameroun

|

Adjusted R-squared

|

0.235520

|

S.D. dependent var

|

1.624517

|

|

S.E. of regression

|

1.420389

|

Akaike info criterion

|

3.572504

|

|

Sum squared resid

|

58.50768

|

Schwarz criterion

|

3.619211

|

|

Log likelihood

|

-52.58756

|

Hannan-Quinn criter.

|

3.587446

|

|

Durbin-Watson stat

|

1.518112

|

|

|

Null Hypothesis: _TIR has a unit root

Exogenous: Constant, Linear Trend

Lag Length: 0 (Automatic - based on SIC, maxlag=7)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -1.418761 0.8351

Test critical values: 1% level -4.284580

5% level -3.562882

10% level -3.215267

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(_TIR)

Method: Least Squares

Date: 10/31/13 Time: 19:24

Sample (adjusted): 1981 2011

Included observations: 31 after adjustments

|

Variable

|

Coefficient

|

Std. Error t-Statistic

|

Prob.

|

|

_TIR(-1)

|

-0.149977

|

0.105710 -1.418761

|

0.1670

|

|

C

|

2.856457

|

1.778415 1.606182

|

0.1195

|

|

@TREND(1980)

|

-0.017234

|

0.031896 -0.540325

|

0.5932

|

|

R-squared

|

0.092861

|

Mean dependent var

|

0.008065

|

|

Adjusted R-squared

|

0.028065

|

S.D. dependent var

|

1.560174

|

|

S.E. of regression

|

1.538125

|

Akaike info criterion

|

3.790771

|

|

Sum squared resid

|

66.24320

|

Schwarz criterion

|

3.929544

|

|

Log likelihood

|

-55.75695

|

Hannan-Quinn criter.

|

3.836008

|

|

F-statistic

|

1.433130

|

Durbin-Watson stat

|

2.181825

|

Null Hypothesis: D(_TIR) has a unit root

Exogenous: None

Lag Length: 0 (Automatic - based on SIC, maxlag=7)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -6.269388 0.0000

Test critical values: 1% level -2.644302

5% level -1.952473

10% level -1.610211

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Relation Banque-Entreprise et croissance économique

au Cameroun

95

Dependent Variable: D(_TIR,2)

Method: Least Squares

Date: 10/31/13 Time: 19:26

Sample (adjusted): 1982 2011

Included observations: 30 after adjustments

|

Variable

|

Coefficient

|

Std. Error t-Statistic

|

Prob.

|

|

D(_TIR(-1))

|

-1.150870

|

0.183570 -6.269388

|

0.0000

|

|

R-squared

|

0.575435

|

Mean dependent var

|

0.000000

|

|

Adjusted R-squared

|

0.575435

|

S.D. dependent var

|

2.407514

|

|

S.E. of regression

|

1.568703

|

Akaike info criterion

|

3.771141

|

|

Sum squared resid

|

71.36409

|

Schwarz criterion

|

3.817848

|

|

Log likelihood

|

-55.56712

|

Hannan-Quinn criter.

|

3.786083

|

|

Durbin-Watson stat

|

1.981959

|

|

|

RESULTAT DU TEST DE COINTEGRATION

Date: 11/03/13 Time: 21:10

Sample (adjusted): 1982 2011

Included observations: 30 after adjustments Trend assumption:

Linear deterministic trend Series: _CCMLT _MM _PIBR _TIR

Lags interval (in first differences): 1 to 1

Unrestricted Cointegration Rank Test (Trace)

|

Hypothesized

|

|

Trace

|

0.05

|

|

|

No. of CE(s)

|

Eigenvalue

|

Statistic

|

Critical Value

|

Prob.**

|

|

None *

|

0.667699

|

63.26660

|

47.85613

|

0.0010

|

|

At most 1

|

0.446524

|

30.21522

|

39.79707

|

0.0647

|

|

At most 2

|

0.256247

|

12.46911

|

15.49471

|

0.1358

|

|

At most 3

|

0.112716

|

3.587703

|

3.841466

|

0.0582

|

Trace test indicates 2 cointegrating eqn(s) at the 0.05 level *

denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Unrestricted Cointegration Rank Test (Maximum Eigenvalue)

|

Hypothesized

|

|

Max-Eigen

|

0.05

|

|

|

No. of CE(s)

|

Eigenvalue

|

Statistic

|

Critical Value

|

Prob.**

|

|

None *

|

0.667699

|

33.05138

|

27.58434

|

0.0089

|

|

At most 1

|

0.446524

|

17.74611

|

21.13162

|

0.1396

|

|

At most 2

|

0.256247

|

8.881406

|

14.26460

|

0.2962

|

|

At most 3

|

0.112716

|

3.587703

|

3.841466

|

0.0582

|

Relation Banque-Entreprise et croissance économique

au Cameroun

Max-eigenvalue test indicates 1 cointegrating eqn(s) at the 0.05

level * denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Unrestricted Cointegrating Coefficients (normalized by

b'*S11*b=I):

-0.099933 0.846217 0.077942 0.701670

-0.132864 -0.046736 0.009932 -0.166215

-0.025725 -0.101732 0.235797 -0.277010

-0.081179 0.180819 -0.045782 -0.318829

Unrestricted Adjustment Coefficients (alpha):

D(_CCMLT) -0.448053 1.253396 0.982958 0.319494

D(_MM) -0.618370 0.006242 0.048803 -0.296349

D(_PIBR) -0.446608 1.131731 -1.065551 -0.070873

D(_TIR) -0.805519 -0.135778 -0.306216 0.334654

1 Cointegrating Equation(s): Log likelihood -231.7593

Normalized cointegrating coefficients (standard error in

parentheses)

1.000000 -8.467879 -0.779946 -7.021431

(1.04609) (0.35329) (1.19861)

Adjustment coefficients (standard error in parentheses) D(_CCMLT)

0.044775

(0.05875)

D(_MM) 0.061795

(0.02018)

D(_PIBR) 0.044631

(0.05565)

D(_TIR) 0.080498

(0.02678)

2 Cointegrating Equation(s): Log likelihood -222.8863

Normalized cointegrating coefficients (standard error in

parentheses)

1.000000 0.000000 -0.102877 0.921085

(0.40279) (0.64187)

0.000000 1.000000 0.079957 0.937958

(0.06216) (0.09905)

96

Adjustment coefficients (standard error in parentheses) D(_CCMLT)

-0.121756 -0.437729

97

|

Relation Banque-Entreprise et croissance économique au

Cameroun

(0.08799) (0.44857)

|

|

D(_MM)

|

0.060966

|

-0.523567

|

|

(0.03357)

|

(0.17115)

|

|

D(_PIBR)

|

-0.105735

|

-0.430819

|

|

(0.08424)

|

(0.42945)

|

|

D(_TIR)

|

0.098538

|

-0.675299

|

|

(0.04432)

|

(0.22591)

|

3 Cointegrating Equation(s): Log likelihood -218.4456

Normalized cointegrating coefficients (standard error in

parentheses)

|

_CCMLT

|

_MM

|

_PIBR

|

_ TIR

|

|

1.000000

|

0.000000

|

0.000000

|

0.853763

|

|

|

|

(0.65330)

|

|

0.000000

|

1.000000

|

0.000000

|

0.990281

|

|

|

|

(0.10196)

|

|

0.000000

|

0.000000

|

1.000000

|

-0.654391

|

|

|

|

(0.57117)

|

Adjustment coefficients (standard error in parentheses)

|

D(_CCMLT)

|

-0.147042

|

-0.537727

|

0.209305

|

|

(0.08240)

|

(0.41807)

|

(0.12173)

|

|

D(_MM)

|

0.059711

|

-0.528532

|

-0.036627

|

|

(0.03393)

|

(0.17217)

|

(0.05013)

|

|

D(_PIBR)

|

-0.078324

|

-0.322418

|

-0.274824

|

|

(0.07699)

|

(0.39066)

|

(0.11375)

|

|

D(_TIR)

|

0.106415

|

-0.644147

|

-0.136337

|

|

(0.04359)

|

(0.22119)

|

(0.06440)

|

ESTIMATION

MODELE 1 : SANS LA DUMMY

Vector autoregression

Sample: 1982 - 2011 No. of obs = 30

Log likelihood = -216.6517 AIC = 16.84345

FPE = 261.9353 HQIC = 17.38135

Det(Sigma_ml) = 22.01977 SBIC = 18.52489

Equation Parms RMSE R-sq chi2 P>chi2

|

pibr

|

9

|

2.67845

|

0.7037

|

71.258

|

0.0000

|

|

mm

|

9

|

1.12668

|

0.9072

|

293.1133

|

0.0000

|

|

ccmlt

|

9

|

2.84231

|

0.9156

|

325.4492

|

0.0000

|

|

tir

|

9

|

1.46362

|

0.7942

|

115.8032

|

0.0000

|

| Coef. Std. Err. z P>|z| [95% Conf.

Interval]

+

pibr |

98

Relation Banque-Entreprise et croissance économique

au Cameroun

|

pibr

|

|

|

|

|

|

|

|

|

|

L1.

|

|

|

.587654

|

.101518

|

5.79

|

0.000

|

.3886824

|

.7866256

|

|

L2. mm

|

|

|

|

.1407672

|

.1029138

|

1.37

|

0.171

|

-.0609401

|

.3424746

|

|

|

L1.

|

|

|

.2716861

|

.3747132

|

0.73

|

0.468

|

-.4627382

|

1.00611

|

|

L2. ccmlt

|

|

|

|

-.6069194

|

.4041899

|

-1.50

|

0.133

|

-1.399117

|

.1852782

|

|

|

L1.

|

|

|

-.3522804

|

.1698362

|

-2.07

|

0.038

|

-.6851533

|

-.0194075

|

|

L2.

tir

|

|

|

|

.2797095

|

.1755045

|

1.59

|

0.111

|

-.064273

|

.6236919

|

|

|

L1.

|

|

|

.3475441

|

.3157119

|

1.10

|

0.271

|

-.2712399

|

.9663281

|

|

L2.

|

|

|

-.5312605

|

.3371733

|

-1.58

|

0.115

|

-1.192108

|

.1295869

|

|

|

_ cons

|

|

|

10.44826

|

11.21385

|

0.93

|

0.351

|

-11.53048

|

32.427

|

|

mm

|

|

|

|

|

|

|

|

|

|

|

pibr

|

|

|

|

|

|

|

|

|

|

L1.

|

|

|

-.0221558

|

.0427033

|

-0.52

|

0.604

|

-.1058527

|

.0615412

|

|

L2. mm

|

|

|

|

-.0009043

|

.0432905

|

-0.02

|

0.983

|

-.085752

|

.0839435

|

|

|

L1.

|

|

|

.9767054

|

.1576222

|

6.20

|

0.000

|

.6677715

|

1.285639

|

|

L2. ccmlt

|

|

|

|

-.5588232

|

.1700215

|

-3.29

|

0.001

|

-.8920593

|

-.2255871

|

|

|

L1.

|

|

|

.2036317

|

.0714412

|

2.85

|

0.004

|

.0636095

|

.3436539

|

|

L2.

tir

|

|

|

|

-.1198639

|

.0738255

|

-1.62

|

0.104

|

-.2645593

|

.0248315

|

|

|

L1.

|

|

|

-.3098542

|

.1328035

|

-2.33

|

0.020

|

-.5701442

|

-.0495641

|

|

L2.

|

|

|

-.0441096

|

.1418312

|

-0.31

|

0.756

|

-.3220936

|

.2338744

|

|

|

ccmlt

|

_ cons

pibr

|

|

|

|

|

15.25865

|

4.71708

|

3.23

|

0.001

|

6.013345

|

24.50396

|

|

L1.

|

|

|

.1060023

|

.1077287

|

0.98

|

0.325

|

-.105142

|

.3171466

|

|

L2. mm

|

|

|

|

.0886758

|

.1092099

|

0.81

|

0.417

|

-.1253716

|

.3027232

|

|

|

L1.

|

|

|

-.1410324

|

.3976374

|

-0.35

|

0.723

|

-.9203874

|

.6383227

|

|

L2. ccmlt

|

|

|

|

-.3389241

|

.4289174

|

-0.79

|

0.429

|

-1.179587

|

.5017387

|

|

|

L1.

|

|

|

.8095691

|

.1802265

|

4.49

|

0.000

|

.4563316

|

1.162806

|

|

L2.

tir

|

|

|

|

.0174528

|

.1862415

|

0.09

|

0.925

|

-.3475738

|

.3824795

|

|

|

L1.

|

|

|

-.3510041

|

.3350266

|

-1.05

|

0.295

|

-1.007644

|

.3056359

|

|

L2.

|

|

|

-.5458676

|

.3578009

|

-1.53

|

0.127

|

-1.247144

|

.1554093

|

|

|

tir

|

_ cons

pibr

|

|

|

|

|

25.70033

|

11.89989

|

2.16

|

0.031

|

2.376977

|

49.02369

|

|

L1.

|

|

|

-.0576944

|

.0554739

|

-1.04

|

0.298

|

-.1664212

|

.0510323

|

|

L2. mm

|

|

|

|

-.093964

|

.0562366

|

-1.67

|

0.095

|

-.2041857

|

.0162577

|

|

|

L1.

|

|

|

-.2003794

|

.2047596

|

-0.98

|

0.328

|

-.6017009

|

.2009421

|

|

L2.

|

|

|

-.3832552

|

.220867

|

-1.74

|

0.083

|

-.8161466

|

.0496361

|

|

ccmlt

99

|

|

Relation Banque-Entreprise et croissance économique au

Cameroun

|

|

L1. |

|

-.0603167

|

.0928059

|

-0.65

|

0.516

|

-.2422129

|

.1215796

|

|

L2. |

|

.1395648

|

.0959033

|

1.46

|

0.146

|

-.0484022

|

.3275318

|

|

|

|

tir |

|

|

|

|

|

|

|

|

L1. |

|

.4827631

|

.1725188

|

2.80

|

0.005

|

.1446326

|

.8208937

|

|

L2. |

|

-.0472758

|

.1842462

|

-0.26

|

0.797

|

-.4083917

|

.3138401

|

|

|

|

|

|

|

|

|

|

|

|

_cons |

|

19.2635

|

6.127736

|

3.14

|

0.002

|

7.253354

|

31.27364

|

|

MODELE 2 : AVEC

|

LA DUMMY

|

|

|

|

|

Vector autoregression

|

|

|

|

|

|

|

Sample:

|

1982 - 2011

|

|

|

No.

|

of obs =

|

30

|

|

Log likelihood = -150.9317

|

|

|

AIC

|

=

|

13.72878

|

|

FPE = .7545724

|

|

|

HQIC

|

=

|

14.55058

|

|

Det(Sigma_ml)

|

= .0161269

|

|

|

SBIC

|

=

|

16.29764

|

|

Equation

|

Parms

|

RMSE

|

R-sq

|

chi2

|

P>chi2

|

|

|

pibr

|

|

11

|

1.81466

|

0.8770

|

213.8207

|

0.0000

|

|

|

mm

|

|

11

|

.972291

|

0.9374

|

449.5487

|

0.0000

|

|

|

ccmlt

|

|

11

|

2.72047

|

0.9300

|

398.8428

|

0.0000

|

|

|

tir

|

|

11

|

1.33066

|

0.8461

|

164.9658

|

0.0000

|

|

|

|

|

Coef.

|

Std. Err.

|

z

|

P>|z|

|

[95% Conf.

|

Interval]

|

|

pibr

|

+

|

pibr |

|

|

|

|

|

|

|

|

L1. |

|

.4095291

|

.0716227

|

5.72

|

0.000

|

.2691512

|

.5499071

|

|

L2. |

mm |

|

.104277

|

.0666487

|

1.56

|

0.118

|

-.0263521

|

.2349061

|

|

|

L1. |

|

.0480705

|

.3261238

|

0.15

|

0.883

|

-.5911203

|

.6872614

|

|

L2. |

ccmlt |

|

-.3942414

|

.3907801

|

-1.01

|

0.313

|

-1.160156

|

.3716736

|

|

|

L1. |

|

-.1459539

|

.1161766

|

-1.26

|

0.209

|

-.3736558

|

.081748

|

|

L2. |

tir |

|

1.131323

|

.1741665

|

6.50

|

0.000

|

.7899627

|

1.472683

|

|

|

L1. |

|

.3316325

|

.2037158

|

1.63

|

0.104

|

-.0676432

|

.7309082

|

|

L2. |

dum |

|

-.2332458

|

.2234358

|

-1.04

|

0.297

|

-.6711719

|

.2046802

|

|

|

L1. |

|

13.7116

|

2.937966

|

4.67

|

0.000

|

7.953293

|

19.46991

|

|

L2. |

|

5.041435

|

2.540601

|

1.98

|

0.047

|

.0619475

|

10.02092

|

|

|

mm

|

_ cons |

|

pibr |

|

-21.73062

|

8.993898

|

-2.42

|

0.016

|

-39.35833

|

-4.102903

|

|

L1. |

|

-.0033103

|

.0383752

|

-0.09

|

0.931

|

-.0785244

|

.0719037

|

|

L2. |

mm |

|

.0058781

|

.0357102

|

0.16

|

0.869

|

-.0641125

|

.0758687

|

|

|

L1. |

|

1.416808

|

.1747361

|

8.11

|

0.000

|

1.074331

|

1.759284

|

|

L2. |

ccmlt |

|

-1.148015

|

.2093788

|

-5.48

|

0.000

|

-1.55839

|

-.7376406

|

|

|

L1. |

|

.1591771

|

.062247

|

2.56

|

0.011

|

.0371752

|

.2811791

|

|

L2. |

|

-.07371

|

.0933178

|

-0.79

|

0.430

|

-.2566096

|

.1091896

|

|

100

Relation Banque-Entreprise et croissance économique

au Cameroun

|

tir

|

|

|

|

|

|

|

|

|

|

L1.

|

|

|

-.330377

|

.1091503

|

-3.03

|

0.002

|

-.5443077

|

-.1164464

|

|

L2.

dum

|

|

|

|

-.0920368

|

.1197162

|

-0.77

|

0.442

|

-.3266762

|

.1426026

|

|

|

L1.

|

|

|

4.283414

|

1.574153

|

2.72

|

0.007

|

1.198131

|

7.368697

|

|

L2.

|

|

|

-4.898169

|

1.361246

|

-3.60

|

0.000

|

-7.566163

|

-2.230176

|

|

|

ccmlt

|

_ cons

pibr

|

|

|

|

|

19.16001

|

4.818902

|

3.98

|

0.000

|

9.71513

|

28.60488

|

|

L1.

|

|

|

.2147699

|

.1073741

|

2.00

|

0.045

|

.0043206

|

.4252192

|

|

L2. mm

|

|

|

|

.1128093

|

.0999172

|

1.13

|

0.259

|

-.0830248

|

.3086435

|

|

|

L1.

|

|

|

.2594389

|

.4889125

|

0.53

|

0.596

|

-.6988119

|

1.21769

|

|

L2. ccmlt

|

|

|

|

-.8279374

|

.5858428

|

-1.41

|

0.158

|

-1.976168

|

.3202935

|

|

|

L1.

|

|

|

.6692418

|

.1741675

|

3.84

|

0.000

|

.3278797

|

1.010604

|

|

L2.

tir

|

|

|

|

-.4162115

|

.2611038

|

-1.59

|

0.111

|

-.9279655

|

.0955425

|

|

|

L1.

|

|

|

-.3553616

|

.3054031

|

-1.16

|

0.245

|

-.9539406

|

.2432174

|

|

L2.

dum

|

|

|

|

-.738235

|

.3349665

|

-2.20

|

0.028

|

-1.394757

|

-.0817128

|

|

|

L1.

|

|

|

-4.73861

|

4.404488

|

-1.08

|

0.282

|

-13.37125

|

3.894028

|

|

L2.

|

|

|

-5.844662

|

3.808774

|

-1.53

|

0.125

|

-13.30972

|

1.620397

|

|

|

tir

|

_ cons

pibr

|

|

|

|

|

45.66446

|

13.48331

|

3.39

|

0.001

|

19.23766

|

72.09127

|

|

L1.

|

|

|

-.1126486

|

.0525196

|

-2.14

|

0.032

|

-.215585

|

-.0097121

|

|

L2. mm

|

|

|

|

-.1079887

|

.0488722

|

-2.21

|

0.027

|

-.2037765

|

-.0122009

|

|

|

L1.

|

|

|

-.6637439

|

.2391403

|

-2.78

|

0.006

|

-1.13245

|

-.1950375

|

|

L2. ccmlt

|

|

|

|

.2190201

|

.2865516

|

0.76

|

0.445

|

-.3426107

|

.7806509

|

|

|

L1.

|

|

|

.0247645

|

.08519

|

0.29

|

0.771

|

-.1422049

|

.1917339

|

|

L2.

tir

|

|

|

|

.2732666

|

.1277129

|

2.14

|

0.032

|

.0229539

|

.5235793

|

|

|

L1.

|

|

|

.4988837

|

.1493809

|

3.34

|

0.001

|

.2061025

|

.7916649

|

|

L2.

dum

|

|

|

|

.0601948

|

.1638412

|

0.37

|

0.713

|

-.260928

|

.3813175

|

|

|

L1.

|

|

|

-1.199997

|

2.154354

|

-0.56

|

0.578

|

-5.422454

|

3.02246

|

|

L2.

|

|

|

5.688848

|

1.862974

|

3.05

|

0.002

|

2.037486

|

9.34021

|

|

|

_ cons

|

|

|

8.865309

|

6.595052

|

1.34

|

0.179

|

-4.060756

|

21.79137

|

|

|

+

|

|

|

|

|

|

|

Relation Banque-Entreprise et croissance économique

au Cameroun

101

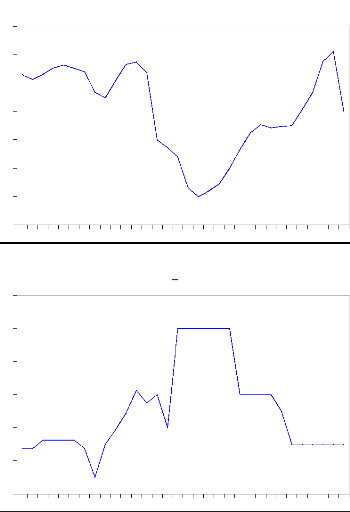

LES GRAPHIQUES DES SERIES

_PIBR

|

20 15 10 5 0 -5

-10

|

|

|

80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10

|

_CCMLT

|

35 30 25 20 15 10

5

|

|

|

80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10

|

24

22

20

18

16

14

12

10

24

22

20

18

16

14

12

_MM

80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10

TIR

80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10

102

Relation Banque-Entreprise et croissance économique

au Cameroun

103

Relation Banque-Entreprise et croissance économique

au Cameroun

Annuaire DGTCFM

Banques agréées au Cameroun en

2013

|

RAISON SOCIALE

|

SIGLE

|

ADRESSE

|

BOITE POSTALE

|

LOCALITE

|

TELEPHONE (+237)

|

FAX (+237)

|

|

|

|

|

|

22.23.30.68

|

22.22.17.85

|

|

Afriland First Bank

|

AFB

|

Place de

l'indépendance

|

11834

|

Yaoundé

|

|

|

|

|

|

|

|

22.22.58.37

|

22.23.91.50

|

|

|

Avenue de

|

|

|

33.43.20.55

|

33.43.20.46

|

|

Banque Atlantique

|

BA

|

Gaulle(place

|

2705

|

Douala

|

|

|

|

|

Joss)

|

|

|

33.43.20.49

|

33.43.20.48

|

|

Banque Internationale

|

|

Avenue du

|

|

|

33.42.84.31

|

|

|

du Cameroun pour

|

BICEC

|

Général de

|

1925

|

Douala

|

|

33.42.12.26

|

|

l'Epargne et le Crédit

|

|

Gaulle

|

|

|

33.42.26.03

|

|

|

Citibank NA

|

|

|

|

|

33.42.42.72

|

|

|

Cameroun

|

|

96 Rue Flatters

|

4571

|

Douala

|

|

33.42.40.74

|

|

|

|

|

|

33.42.40.74

|

|

|

Commercial Bank of

|

|

Rue Joss

|

|

|

|

33.43.38.00

|

|

Cameroon

|

CBC

|

Bonanjo

|

4004

|

Douala

|

33.42.02.02

|

|

|

|

|

|

|

|

33.42.38.02

|

|

Crédit Agricole SCB

|

CA

|

220, Avenue

|

|

|

22.23.40.05

|

22.22.41.32

|

|

Cameroun

|

SCB

|

Mgr Vogt

|

700

|

Yaoundé

|

|

|

|

|

|

|

|

22.22.88.99

|

22.22.88.05

|

|

|

|

|

|

33.43.82.51

|

|

|

Ecobank Cameroun SA

|

EBC

|

Boulevard de la liberté

|

582

|

Douala

|

|

33.42.15.19

|

|

|

|

|

|

33.42.15.08

|

|

|

|

|

|

|

22.22.87.80

|

|

|

National Financial Credit

|

NFC

|

Immeuble Hajal Massad

|

6578

|

Yaoundé

|

|

22.22.87.81

|

|

|

|

|

|

22.22.87.83

|

|

|

Standard Chartered

|

|

|

|

|

33.43.52.00

|

|

|

Bank Cameroun

|

|

Rue Joffre

|

|

Douala

|

|

33.42.27.89

|

|

|

|

|

|

33.42.52.52

|

|

|

Société Générale des

|

|

|

|

|

33.42.70.10

|

33.42.87.72

|

|

Banques du

|

SGBC

|

Rue jOSS

|

4042

|

Douala

|

|

|

|

Cameroun

|

|

|

|

|

33.42.80.75

|

33.42.71.32

|

|

Union Bank of

|

|

Immeuble

|

|

|

33.42.25.08

|

33.42.24.51

|

|

Cameroon

|

UBC

|

Kassap

|

15569

|

Douala

|

|

|

|

|

|

|

|

33.43.64.03

|

33.42.93.75

|

|

United Bank For Africa

|

UBA

|

Boulevard de la Liberté-Akwa

|

2088

|

Douala

|

33.43.36.83

33.43.36.39

|

33.43.37.07

|

Relation Banque-Entreprise et croissance économique

au Cameroun

104

|