Annexes

56

Annexe 1 : Comparatif des taux d'intérêt

10 ans

OCDE (2016), Taux d'intérêt à long terme

(indicateur). doi: 10.1787/4e01728c-fr

57

Annexe 2 : Questionnaire proposé par Yomoni

58

·

59

Renseignez vos objectifs Durée de votre

p.acement

10 ans

Montant visé

65000€

111 Je vise un montant précis

Définissez vos versements

Versement de départ

20 000C

Versements mensuels

100 €

Définissez votre niveau de risque

a

Plus de risques pour plus de gains potentiels

60

61

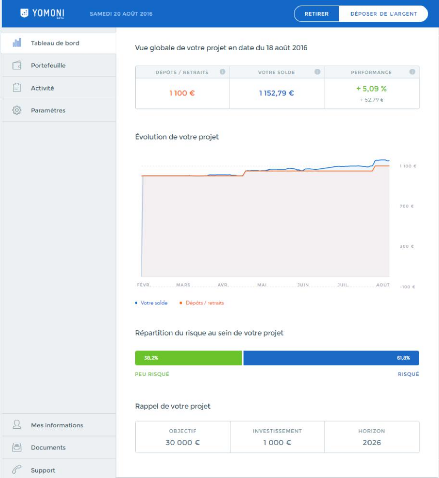

Annexe 3 : le renouvellement de l'expérience

client

62

63

64

65

Annexe 4 : analyse d'Elisabeth Kashner

Wealthfront modifies historic asset-class returns with current

market implied expected returns (Flack-Litterman) as well as with the in-house

views of Chief Investment Officer Burton Malkiels team. In addition,

Wealthfront sets minimum and maximum weights for each asset type. The resulting

portfolio has an unmistakable Malkiel flavor to it, with an emerging market

allocation that reflects his interest in China.

Betterment uses Black-Litterman currently implied market expected

returns, but deliberately includes small-cap and value as separate asset

classes, adding a classic Fama-French factor tilt. It doesn't

constrain the portfolio weights, but they do account for downside risk.

Betterments portfolios wind up quite similar to the global market, at least on

the equities side.

Covestor deliberately veers away from its optimizer to hedge its

portfolios against inflation and to adjust for downside risk. Its wide

constraints allow heavy weights to emerging markets.

Wise Banyan constrains its portfolio weights 'tighter than

most,'2 back toward market-cap weights, according to Herbert Moore,

co-founder and chief investment officer. This might explain why its portfolios

allocate generously to U.S. equities, and away from the rest of the global

equity market.

Invessence includes the largest number of asset types, adding

granularity to the fix ed-income side. It bases asset-class returns

expectations on up to 8o years of historical ETF or index returns, but uses

only nine years of volatility history.

Invessence employs gold as an inflation hedge. It also constrains

all asset weights except for U.S. equity. Sure enough, the U.S. dominates its

equity allocation.

FutureAdvisor doesn't optimize. Instead, its builds its portfolio

in sleeves, creating a glide path much as the target-date mutual funds do. It

builds in astrategic'° allocation to REITs as an inflation hedge, adding

Fama-French type tilts. There not kidding. The firms portfolios emphasize

small- and midcap stocks, and financials (RUTS), with highest-in-class dividend

yields and lowest price/book ratios.

Bibliographie

66

« 10 Disruptive trends in weath management »

Deloitte, 2015

« Europe Year End » SPIVA, 2015

« US Year End » SPIVA, 2015

« How much do fees affect the active versus passive

debate ? » SPIVA, 2016

« Gen Y Investor Insights : Millenial Millionaires in the

Making » TD Ameritrade, janvier 2015

« Fintech Survey Report » CFA Institute, avril

2016

« Relations banques et clients : Fidelité, vous

avez dit fidélité ? » Deloitte, avril 2014

« Relations banques et clients : Banquiers, ne cherchez

plus à vendre, mais aidez vos clients à

acheter » Deloitte, septembre 2015

« Les assurances de personnes - Données

clés 2015 » Fédération française de

l'assurance, 2015

« Active versus passive : a study covering US mutual

funds from 1980 until 2010 » - FundQuest

Advisor

« The rise of robo-advice : changing the concept of

wealth management » Accenture, 2015

« Generation D Europe Investor survey : understanding

expectations of wealth management in the

digital world » Accenture, 2015

« Reinventing Financial Services - What consumers expect

from future banks and insurers » Reggy

de Feniks et Roger Peverelli, edition Pearson Education

Benelux, 6 août 2011

« Les statuts des « robo-advisors » devraient

être très rapidement aménagés »

Décideurs Magazine,

15 mars 2016

« Disruption: Overturning Conventions and Shaking Up the

Marketplace » Jean-Marie Dru, 1996

« World Wealth 2009 » Capgemini et Merrill Lynch,

2009

« Portfolio Selection: Efficient Diversification of

Investments » Harry Markowitz, 1955

|