4 3 .THE RATIONALE FOR BANQUES POPULAIRES TRANSFORMATION FROM

COOPERATIVE TO A COMMERCIAL BANK.

According to the findings from the respondents during this study,

the main reasons for bank populaires transformation from a cooperative to a

commercial bank were:

- Acquiring license to offer a full range of financial services

in urban and rural areas;

- Strengthening the bank capacity to grant loans;

- To foster and strengthen high service quality and customer

care;

- To upgrade its core business from being a cooperative that

offers basic savings and credit services to becoming a fully fledged retail

bank;

A number of respondents stated that«mbere y'uko banki

ihinduka banki y'ubucuruzi ntitwabonaga amafaranga uko tubyifuza, batangaga

amafaranga make cyane kandi ibyo byatumaga abanyamuryango bakeneye amafaranga

menshi bigira mu mabanki y'ubucuruzi meaning that before the bank become

transformed from a cooperative to a commercial bank, it did not granted to us

loans as required, they granted a very little money and this caused the flight

of a good number of customers who needed a good amount of money».

Before the transformation of banques populaires from a

cooperative to a commercial bank each bank was financially and administratively

independent credit union; the fact that each bank was independent, the separate

independence for each credit union limited the capacity for granting loans in

favor of clients and this fact led to the desertion of customers who needed a

reasonable amount of loans.

In terms of loan granting capacity, the transformation of banques

populaires from a cooperative to a commercial bank led to the consolidation of

separate credit unions assets first and second to acquire the bank license

where there is no restriction on the percentage of loan to be granted in favor

of one person or one group of person compared to the total deposits.

According to the interviews the

majority of customers interviewed: «the waiting time for withdrawals or

deposits have relatively reduced compared to the time used before the

transformation of banques popularizes into a commercial bank».

(a) Front office staff has been reinforced,

(b) The time to wait at the counter has been

significantly reduced.

Crucial in this development are the investments in buildings.

Banking offices in all branches are being redesigned to become:

· Modern and professional

· spacious and bright

· customer friendly

Each branch has a VIP (Very Important Person) reception area

while the head office has a new corporate office for this new customer Segment

and the VIP cards are provided; so that VIP customers are served at any branch

and sub branch or outlet without delay and all this to offer quality

services.

According to BPR S.A articles of association, after the

transformation of banques populaires from a cooperative to a commercial bank;

the purpose was both for itself and on behalf of third parties, to carry out

all banking operations, particularly the following:

- Performance of all banking operations relating to discounting,

rediscounting and commission,

- Receipt of deposits,

- Issuance of short-term, medium and long-term loans,

- Effecting the transfer of funds and assets,

- Performance of all stock exchange and currency exchange

transactions,

- Investment and participation in any company that already exists

or is yet to be established, within the limits laid down under the relevant

legislation and regulations,

- Performance of any investment relating to movable or immovable

assets,

- Performance of any operations likely to benefit the development

of any type of company in Rwanda and abroad,

According the views from customers interviewed in this research

at the headquarters: before the bank was transformed from a cooperative to a

commercial bank, there were a good number of services that were not offered by

the bank which are actually now offered. Some of them are:

- Exchange of foreign currency;

- The use of checks as means of payment;

- Issuance of smart cards;

- Deposit and withdrawal anywhere on the computerized

branches,

- International operations, etc

The customers interviewed confirm that after the transformation;

services are upgraded compared to the services offered before the bank was

transformed.

According to one of the interviewed customers in Nyagatare

branch.» ubu igihe twamaraga ku murongo dutegereje kubitsa cyangwa

kubikuza cyaragabanyutse ku buryo bugaragara kandi n'uburyo batwitaho

bigaragaza ko habaye impinduka koko« meaning that «now the time for

waiting to be served depositing or withdrawing is considerably reduced and the

way that we are cared shows that there is a change indeed«.

Although it is difficult to evaluate the impact of this

transformation after only approximately one year and a half of operations in a

new system, according to the findings from this research mainly from the board

of directors interviewed it should be stressed that a positive impact is quite

visible:

- The increase of the number of customers after the

transformation,

- The volume of collected deposits,

- The volume of granted loans,

- The new products introduced after the transformation and some

of which the banks were not allowed to carry on as cooperative banks.

- The impact can also be seen in the promotion of financial

sector in Rwanda.

- Bank management efficiency is high.

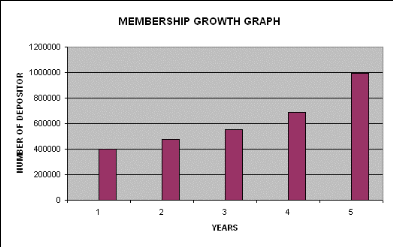

As depicted in the table and graph below, the number of

depositors has increased with 137% in five years; in 2008 the growth was

28.2%

Table 5: Evolution of Depositors In Five

Years

|

Years

|

Number of depositors

|

|

2004

|

398,799

|

|

2005

|

473,547

|

|

2006

|

551,401

|

|

2007

|

687,332

|

|

2008

|

991,919

|

Source : BPR Annual Report 2004 - 2008

Graph 1 : Evolution Of Depositors In Five

Years

After BPR transformation, it has managed to set up the following

new products:

- Gwiza savings account

- Hirwa savings account.

GWIZA SAVINGS ACCOUNT

It is a savings account with the following features:

- Minimum deposit to open the account; 100,000 frw.

- Make monthly deposits to the account of minimum 25,000frw

- Maturity is 6 months renewable.

- No withdrawals are allowed from the account except with a

notice period of 91 days.

Benefits of gwiza savings account

- Interest earnings of up to 7% per annum depending on amount

saved.

- The interests are calculated monthly and paid at the expiry of

the six months;

- This account gives the owner preferential eligibility for a

personal loan in BPR SA

HIRWA SAVINGS ACCOUNT

The new hirwa savings account is designed to enable every Rwandan

to save for a better future.

It is a savings account with the following features:

- No age limits to opening this account

- No minimum opening amount required

- One accumulates his/her savings by freely depositing money in

his/her account

- After 12 months, he/she earns interests on his/her total

savings

- He/she can only earn interest when his/her account balance is

20,000rwf and above

A customer is discouraged from making withdrawals. But he/she is

allowed one emergency withdrawal as follows:

° Before 6 months are up, he/she earns no interest

° After 6 months, she/he earns 50% the normal interest

The more the balance of the hirwa savings account, the higher

the rate of interest to earn.

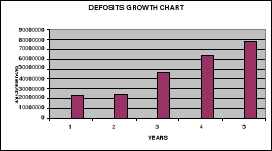

The following table and chart show the five year evolution of

deposits of banques populaires showing the impact of banques populaires

transformation; Most members of board of directors interviewed recognized that

the transformation impacted the growth of deposits.

Table 6: Evolution of Deposits in Five Years

|

Years

|

Amount of deposits frw(000)

|

|

2004

|

23,401,307

|

|

2005

|

23,887,644

|

|

2006

|

46,923,246

|

|

2007

|

63,781,798

|

|

2008

|

77,600,156

|

Source : BPR Annual Report 2004 - 2008

Graph 2 : Evolution of Deposits in Five Years

The total balance has almost tripled in five years; in 2008 the

growth was 22%

THE VOLUME OF GRANTED

LOANS.

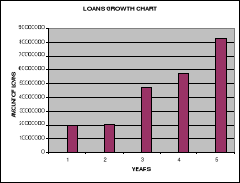

As shown in the table and chart below, the total loans and

advances increased by 45 % in 2008; this increase is in relation with the

increase in deposits and equity whereby the capital has increased with the

investment of rabobank of frw 4,877,581,000, all these are the results of the

transformation of the bank from a cooperative to a commercial bank.

Table 7: Evolution Of Loan In Five Years

|

Years

|

Amount of net loans frw(000)

|

|

2004

|

19,601,034

|

|

2005

|

20,161,934

|

|

2006

|

47,429,246

|

|

2007

|

57,067,076

|

|

2008

|

82,877,982

|

Source : BPR Annual Report 2004 - 2008

GRAPH 3 : EVOLUTION OF LOANS IN FIVE YEARS

Going commercial BPR upgraded its core business from being a

cooperative that offers basic savings and credit services to becoming a fully

fledged retail bank.

The new status acquired by the bank after transformation

conferred upon it the license to offer additional services that it was not

allowed offer. After the transformation the bank set up new departments and

launched new products in line with the new status acquired.

BPR SA set up of a commercial department having under its

portfolio product development, business Development and marketing.

In product development, new products have been launched as part

of the fulfillment of BPR's Mission of offering a wide range of financial

services in both urban and rural areas. These include:

· Domestic money transfer among our branches using BPR

mobile counter

· Account services in foreign currencies (usd and

euro)

· International money transfers via swift

· A new savings account: gwiza savings account

In business development, a corporate unit was set up as a move to

add the corporate segment to a wide retail customer base. This unit has of late

been very active in recruiting;

· Individual corporate clients

· SME's

· Private and public institutions

Western union

Western union that was operated under the license of banque

commerciale du rwanda (BCR) is now operated under BPR's license.

Western union is the world's premier international consumer money

transfer system. It is the best and most reliable way to send and receive

money, person-to-person, country-to-country within a very short time.

Western union money transfers are particularly useful in

emergency situations, when money is needed urgently, because of the speed of

the service. As an important service for its customers, BPR offers this service

at all its branches.

|