|

AFRICAN CENTER FOR ADVANCED STUDIES IN

MANAGEMENT

ECOBANK

Ecobank Ghana Limited

PROBLEM LOANS MANAGEMENT PRACTICES:

ECOBANK GHANA LIMITED AS A CASE STUDY

By

Katoh Hamadou KONE

Being a dissertation submitted in partial fulfilment

of the

requirements for the award of the

MBA in Banking and Finance

April 2006

To my Mother, for her tireless support

May the Almighty God bless and reward You for All.

Hamed

TABLE OF CONTENTS

ACKNOWLEDGEMENT vi

FOREWORD vii

EXECUTIVE SUMMARY 1

RESUME DE L'ETUDE 3

CHAPTER 1: INTRODUCTION 5

|

I.

|

Background of the study

|

5

|

|

II.

|

Purpose of the study

|

7

|

|

III.

|

Research problem

|

7

|

|

IV.

|

Research methodology

|

8

|

|

1.

|

Data collection

|

8

|

|

2.

|

Data analysis and interpretation

|

9

|

|

V.

|

Significance of the study

|

9

|

|

VI.

|

Limitations of the study

|

9

|

|

VII.

|

Structure

|

10

|

CHAPTER 2: LITERATURE REVIEW 11

I. Basic theoretical framework 11

|

1.

|

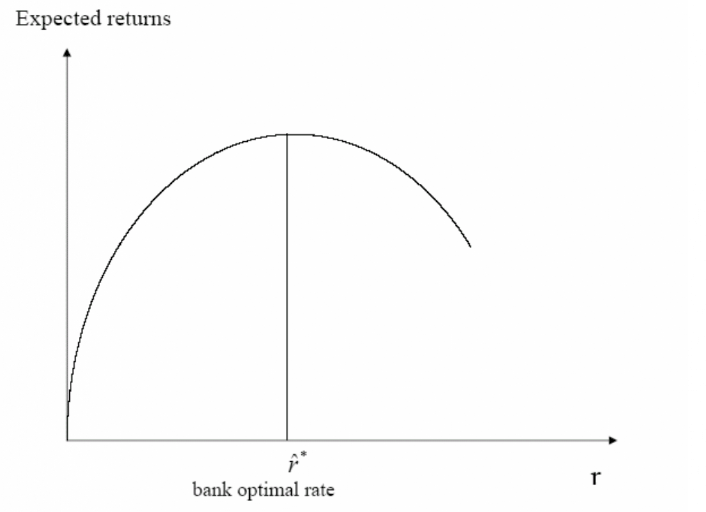

Problem loans and asymmetrical information

|

11

|

|

2.

|

Problem loans, adverse selection and moral hazard

|

12

|

|

3.

|

Problem loans and early warning systems

|

14

|

|

II.

|

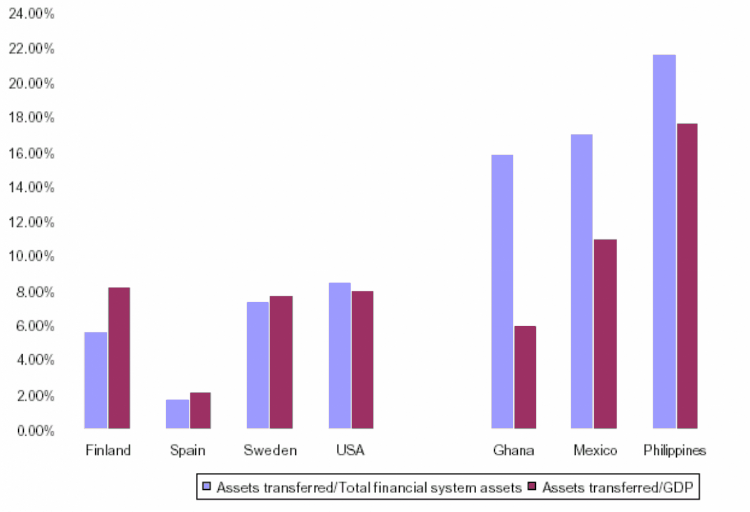

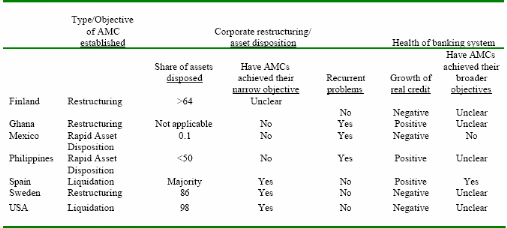

Lessons from world banks crises

|

15

|

|

III.

|

Role of Supervisors and External auditors in identifying problem

loans

|

19

|

|

1.

|

The role of banking supervision

|

20

|

|

2.

|

The contribution of external auditors

|

21

|

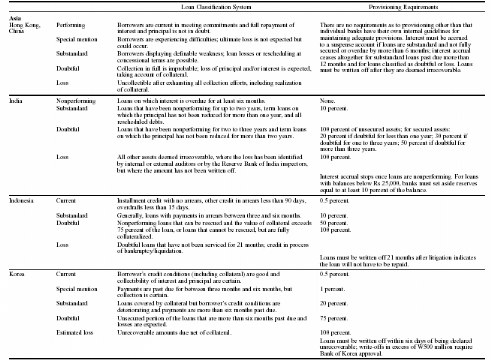

IV. «Problem loans», «Bad loans» and

«Non-performing loans»: definitions and

recommended practices 22

|

1.

|

World Bank

|

22

|

|

2.

|

International Monetary Fund

|

24

|

|

3.

|

West African Monetary Union

|

24

|

|

4.

|

Bank of Ghana

|

25

|

V. Soundness problem loans management criteria 27

|

1.

|

Credit Risk Management

|

27

|

|

2.

|

Loans classification and provisioning

|

28

|

3. Remedial management 28

CHAPTER 3: CREDIT RISK MANAGEMENT PROCESSES 30

I. Credit management process 30

|

1.

|

Credit initiation

|

31

|

|

2.

|

Documentation and disbursement

|

32

|

|

3.

|

Credit administration

|

32

|

II. Problem loans management 32

|

1.

|

Early Warning Systems

|

33

|

|

2.

|

Credit classification and provisioning

|

34

|

|

3.

|

Remedial management

|

35

|

CHAPTER 4: DATA ANALYSIS AND INTERPRETATION 36

I. Data collection 36

|

1.

|

Sample selection

|

36

|

|

2.

|

Variables

|

37

|

|

3.

|

Data collection method

|

38

|

II. Data analysis methodology 39

|

1.

|

Classification

|

39

|

|

2.

|

Provisioning

|

39

|

|

3.

|

Remedial strategy

|

39

|

III. Outcome of data collection 40

|

1.

|

Classification

|

40

|

|

2.

|

Provisioning

|

40

|

|

3.

|

Remedial strategy

|

40

|

IV. Data analysis and interpretation 41

|

1.

|

Dissimilarities in classification

|

41

|

|

2.

|

Dissimilarities in remedial strategies

|

42

|

CHAPTER 5: RECOMMENDATIONS AND CONCLUSION 43

I. Pre-lending recommendations 43

|

1.

|

Industry risks

|

43

|

|

2.

|

Collateral risks

|

43

|

|

3.

|

Information system

|

44

|

|

4.

|

Size and ownership of the companies

|

44

|

|

5.

|

Portfolio growth incentives

|

44

|

6. Companies dealing with governments 45

|

II.

|

Credit monitoring

|

45

|

|

III.

|

Workout strategies

|

45

|

|

1.

|

Effective teamwork

|

45

|

|

2.

|

Incentives

|

45

|

|

3.

|

Additional risks

|

46

|

|

4.

|

External debt collectors

|

46

|

|

5.

|

Enforcement of collateral

|

46

|

IV. Conclusion 47

BIBLIOGRAPHY 48

APPENDIX 51

ACKNOWLEDGEMENT

Before starting with the study, allow me to thank people and

organizations without whom this

study may not be completed.

My first words go to international institutions that created

and are still supporting the MBA in Banking and Finance, especially the African

Capacity Building Foundation that granted me a scholarship to attend the

Program. May you keep strong to continue sustaining African development

through training programs and others.

Special thanks also to the academic staff for providing

us with up to date knowledge in banking and finance and the project

manager and his short and dynamic team.

The Ecobank Group and particularly its subsidiary of Ghana,

Ecobank Ghana Limited, played

a key role in the completion of this study. I thank

the bank for its hospitality during those three months at Trade Finance

and Risk Management Departments and wish you to remain a key role player in the

African financial environment.

I cannot forget Mr. Theophilus Aryee, Director of

my dissertation for his effective commitment to the work. To him I will

say «I learnt a lot from you and expect to do more».

I end by my large family that I would like to thank for their

moral and financial support. I

pray for the time to allow all of you to get the proceeds of your

investment.

vi MBA in Banking and Finance

|