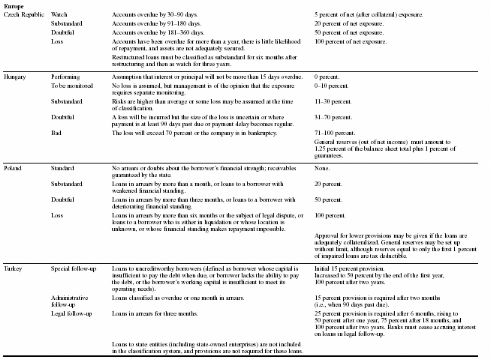

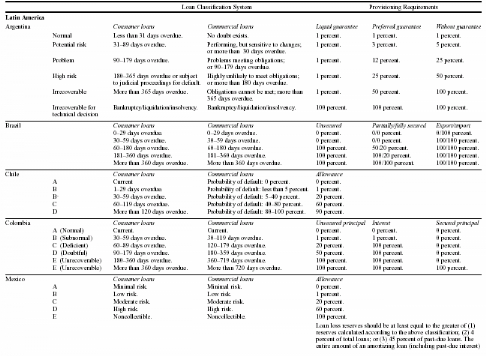

II. Lessons from world banks crises

The issue of problem loans has arisen as one of the

most important sources of the «lost-

decade» in Japan (Fukuda and Koibuchi, 2005). Whereas

more than 60% of total assets of banks are loans to customers, the

safety of those loans becomes very critical and relevant for

the banking system stability. Many authors commented on

the issue of problem loans by considering the measures taken by the

Japanese government to overcome the problem. They also look at the experiences

of other countries.

In his paper on the Japanese banking crisis, Ueda (1998) affirmed

that the definition of bad

loans has changed over time and has been a source of

confusion. Initially, banks were

15 MBA in Banking and Finance

reporting only Non-accrual Loans. Later, they added Past Due

Loans and then Restructured Loans to the list. He underlined inefficient or lax

bank management as a cause of bad loans problems but emphasized the role of the

real estate industry. He found that in 1990s banks with a high exposure to real

estate industry suffered more from bad loans problems.

Nishimura et al (2001), in their critical paper on the Koizumi

Cabinet policies regarding the disposal of Japanese financial institutions' bad

loans, raised the following issues:

- Risk management skills: in their view the existence of bad

loans is not a problem in itself as bad loans are inevitable when banks

provide firms with credit. The financial institutions must practice

adequate risk management.

- Dynamism: the risk management policies must be adjusted to

match the industry structure changes. To evaluate the financial risks they

assume through lending, financial institutions must also have accurate

information on real estate prices when these are used as collateral. According

to the IMF (1999), the slow speed of restructuring in Japan is in part due to

the extensive ownership links among banks, other financial intermediaries, and

corporations.

The role of Asset Management Companies (AMCs) in dealing with

problem loans has been commented on by other authors.

Klingebiel (1999) thinks banks should be better placed to

resolve Non-Performing Loans

(NPLs) than centralized AMCs as they have the loan files and some

institutional knowledge

of the borrower. She adds that leaving the NPLs in

the banks' balance sheets may also provide better incentives for banks

to maximize the recovery value of bad debt and avoid future losses by

improving loan approval and monitoring procedures.

Her cross country experience showed that the countries that

transferred high percentages of their total assets to AMCs, namely Ghana,

Mexico and Philippines (figure 2) are the ones that faced recurrent problems

and did not achieve their narrow objectives. Even the achievement

of their broader objectives was unclear (cases of Ghana

and Philippines) and sometimes a

failure (case of Mexico).

16 MBA in Banking and Finance

Figure 2: Assets transferred to AMCs

Source: Kinglebiel (1999)

Table 1: Evaluating the Country Cases

Source: Kinglebiel (1999)

17 MBA in Banking and Finance

The role and independence of AMCs has also been pointed out in

China. Bartel and Huang (2002) disagreed with China's dealing with State Owned

Banks' (SOB) bad loans problem. For them the establishment of AMCs to

deal with China's bad loans problem was a good foundation upon which a

strong reform of the banking system can be built. Nevertheless, they pointed

out the lack of independent bank governance, and also underlined that creating

AMCs could lead to a moral hazard problem of encouraging banks to new low

quality loans. In their view, identification of bad loans is not trivial

in any banking system. The necessary information to distinguish a

good loan from a bad one is imbedded at the branch level, oftentimes

with the responsible loan officer.

The identification problem is magnified in China because

the standard international loan classification system was adopted only

recently.

Berger and DeYoung (1997) studied problem loans and cost

efficiency in commercial banks. They tested four hypotheses regarding the

relationships among loan quality, cost efficiency, and bank capital. Their data

suggested that: a. problem loans precede reductions in measured cost

efficiency; b. that measured cost efficiency preceded reductions in problem

loans; and c. reductions in capital of undercapitalized banks precede

increases in problem loans. They concluded that cost efficiency might be an

important indicator of future problem.

Cavallo and Majnoni (2001) studied a sample of 1176 large

commercial banks, 372 of which were from non-G10 countries, over the period

1988-1999. They found «robust evidence» that

the relationship between loan loss provisioning and banks'

pre-provision income was positive

for G10 banks and negative for non-G10 banks. They

concluded that non-G10 countries provisioned too little in good times and

were forced to increase provisions in bad times. This view is seconded by

Jiménez and Saurina (2005), who suggest banks to provision in

good times for the additional risk added to the portfolio due to credit growth.

Actually, they found evidence of a positive relation between rapid credit

growth and future non-performing loans

of banks. According to them banks could use the reserves

cumulated in boom periods to cover loan losses in bad times.

Laeven and Majnoni (2002) noted that many banks tended to delay

provisioning for bad loans until too late, when cyclical downturns had already

set in. According to them bankers created

too little provision in good times and then were forced

to increase them in economic downturns. They also found a considerable

difference in patterns followed by banks around

the world.

18 MBA in Banking and Finance

Dahiya, Puri and Saunders (2003) analyzed the effects of loan

sales on both the borrower and

the lender. They found that 42% of the firms whose loans were

sold filed for bankruptcy

within 3 years of the announcement of a loan sale by their bank

lender. On the other hand, the sale of a loan by a bank carries no significant

information and had no impact on its stocks

value; although loan sales appear to be made by generally weaker

banks.

|