AFRICAN CENTER FOR ADVANCED STUDIES IN

MANAGEMENT

ECOBANK

Ecobank Ghana Limited

PROBLEM LOANS MANAGEMENT PRACTICES:

ECOBANK GHANA LIMITED AS A CASE STUDY

By

Katoh Hamadou KONE

Being a dissertation submitted in partial fulfilment

of the

requirements for the award of the

MBA in Banking and Finance

April 2006

To my Mother, for her tireless support

May the Almighty God bless and reward You for All.

Hamed

TABLE OF CONTENTS

ACKNOWLEDGEMENT vi

FOREWORD vii

EXECUTIVE SUMMARY 1

RESUME DE L'ETUDE 3

CHAPTER 1: INTRODUCTION 5

|

I.

|

Background of the study

|

5

|

|

II.

|

Purpose of the study

|

7

|

|

III.

|

Research problem

|

7

|

|

IV.

|

Research methodology

|

8

|

|

1.

|

Data collection

|

8

|

|

2.

|

Data analysis and interpretation

|

9

|

|

V.

|

Significance of the study

|

9

|

|

VI.

|

Limitations of the study

|

9

|

|

VII.

|

Structure

|

10

|

CHAPTER 2: LITERATURE REVIEW 11

I. Basic theoretical framework 11

|

1.

|

Problem loans and asymmetrical information

|

11

|

|

2.

|

Problem loans, adverse selection and moral hazard

|

12

|

|

3.

|

Problem loans and early warning systems

|

14

|

|

II.

|

Lessons from world banks crises

|

15

|

|

III.

|

Role of Supervisors and External auditors in identifying problem

loans

|

19

|

|

1.

|

The role of banking supervision

|

20

|

|

2.

|

The contribution of external auditors

|

21

|

IV. «Problem loans», «Bad loans» and

«Non-performing loans»: definitions and

recommended practices 22

|

1.

|

World Bank

|

22

|

|

2.

|

International Monetary Fund

|

24

|

|

3.

|

West African Monetary Union

|

24

|

|

4.

|

Bank of Ghana

|

25

|

V. Soundness problem loans management criteria 27

|

1.

|

Credit Risk Management

|

27

|

|

2.

|

Loans classification and provisioning

|

28

|

3. Remedial management 28

CHAPTER 3: CREDIT RISK MANAGEMENT PROCESSES 30

I. Credit management process 30

|

1.

|

Credit initiation

|

31

|

|

2.

|

Documentation and disbursement

|

32

|

|

3.

|

Credit administration

|

32

|

II. Problem loans management 32

|

1.

|

Early Warning Systems

|

33

|

|

2.

|

Credit classification and provisioning

|

34

|

|

3.

|

Remedial management

|

35

|

CHAPTER 4: DATA ANALYSIS AND INTERPRETATION 36

I. Data collection 36

|

1.

|

Sample selection

|

36

|

|

2.

|

Variables

|

37

|

|

3.

|

Data collection method

|

38

|

II. Data analysis methodology 39

|

1.

|

Classification

|

39

|

|

2.

|

Provisioning

|

39

|

|

3.

|

Remedial strategy

|

39

|

III. Outcome of data collection 40

|

1.

|

Classification

|

40

|

|

2.

|

Provisioning

|

40

|

|

3.

|

Remedial strategy

|

40

|

IV. Data analysis and interpretation 41

|

1.

|

Dissimilarities in classification

|

41

|

|

2.

|

Dissimilarities in remedial strategies

|

42

|

CHAPTER 5: RECOMMENDATIONS AND CONCLUSION 43

I. Pre-lending recommendations 43

|

1.

|

Industry risks

|

43

|

|

2.

|

Collateral risks

|

43

|

|

3.

|

Information system

|

44

|

|

4.

|

Size and ownership of the companies

|

44

|

|

5.

|

Portfolio growth incentives

|

44

|

6. Companies dealing with governments 45

|

II.

|

Credit monitoring

|

45

|

|

III.

|

Workout strategies

|

45

|

|

1.

|

Effective teamwork

|

45

|

|

2.

|

Incentives

|

45

|

|

3.

|

Additional risks

|

46

|

|

4.

|

External debt collectors

|

46

|

|

5.

|

Enforcement of collateral

|

46

|

IV. Conclusion 47

BIBLIOGRAPHY 48

APPENDIX 51

ACKNOWLEDGEMENT

Before starting with the study, allow me to thank people and

organizations without whom this

study may not be completed.

My first words go to international institutions that created

and are still supporting the MBA in Banking and Finance, especially the African

Capacity Building Foundation that granted me a scholarship to attend the

Program. May you keep strong to continue sustaining African development

through training programs and others.

Special thanks also to the academic staff for providing

us with up to date knowledge in banking and finance and the project

manager and his short and dynamic team.

The Ecobank Group and particularly its subsidiary of Ghana,

Ecobank Ghana Limited, played

a key role in the completion of this study. I thank

the bank for its hospitality during those three months at Trade Finance

and Risk Management Departments and wish you to remain a key role player in the

African financial environment.

I cannot forget Mr. Theophilus Aryee, Director of

my dissertation for his effective commitment to the work. To him I will

say «I learnt a lot from you and expect to do more».

I end by my large family that I would like to thank for their

moral and financial support. I

pray for the time to allow all of you to get the proceeds of your

investment.

vi MBA in Banking and Finance

FOREWORD

Globalization, to be effective, requires the actual involvement

of all countries of the world.

Unfortunately, the level of development of Africa is

questionable about its contribution to the success of globalization. Many

projects are initiated by international organizations to help the continent to

be competitive and play a significant role in the world economy.

The MBA in Banking and Finance is part of those projects, which

aim is to reduce the gap between developed and emerging countries.

The MBA in Banking and Finance is a post-graduate

bilingual program in banking and finance. It was established in

collaboration with the BCEAO, the BEAC, the Bank of France,

the French Development Agency, the European Union, the World

Bank, the French Ministry

of Foreign Affairs and the African Capacity Building

Foundation.

Africa like the rest of the world needs to be competitive and

must comply with international standards. Banking and Finance are areas where

techniques and methods grow at a very high speed. It was then important to

provide to Africans high skills in bank and risk management, value creation,

corporate finance, financial markets techniques and others.

Since financial markets and techniques are not yet well

developed in the continent, the most important risk banks are exposed to is

credit risk, that is the default of a borrower to meet his obligations. This

risk is worsen by the growing number of banks and the competition deriving

from, the need for financing to develop the countries, the

ineffectiveness of banking supervision among others.

For these reasons, we worked on the topic: «Problem

Loans Management Practices: Ecobank

Ghana Limited as a case study».

Essential data to engage the research were collected during our

three-month internship period

at the Bank. This work is part of the requirements for the Award

of the MBA in Banking and

Finance.

vii

MBA in Banking and Finance

EXECUTIVE SUMMARY

This study aimed to improve problem loans management practices at

Ecobank Ghana Limited

in order to reduce loan losses.

The reasons that justify the choice of this topic were as

follows:

- Most of world financial crises were due to large

amount of doubtful loans in banks'

portfolio especially in Japan and China among others.

- West Africa is exposed to the problem because of the

growing number of financial institutions (banks, stock exchanges,

microfinance institutions);

- The problem is not new for Ghana (crisis of 1970s) and its

current non-performing loans ratio is higher than 15%.

To achieve these objectives, the following issues were dealt

with:

1. Gathering of information about the guidelines of some

financial institutions (IMF, World Bank, BCEAO, and of Ghana) and setting

up of standards to provide the bank with maximum protection against

problem loans and better dealing with the issue.

2. Assessment of the credit risk management processes of the

Bank through a scanning of

the general credit policy and procedure manual and interviews

with the portfolio manager.

3. Sampling of some problem loans files, comparison between the

actual practices and our standards and interpretations of similarities and

dissimilarities.

The outcome of the study according to the points listed above

was:

1. Despite the lack of universally adopted common principles

the financial institutions have globally almost the same classification and

provisioning systems in dealing with problem loans management. They recommend a

four-tier classification as per the level of risk and,

to each class a provision is required.

However, the literature review showed that an effective

problem loans management demanded a sound credit risk management before,

during and after the loan was granted.

2. The Ecobank credit risk management assessment showed the

following steps:

- through a market analysis and targeting, the Bank

identified profitable and safe industries,

- a periodical follow up of the borrowers to have a dynamic

vision of the risk linked to them,

- a classification and provisioning of problem loans.

1 MBA in Banking and Finance

3. The comparison between our standards and the

Bank's actual classification system and remedial strategies showed that

ours were more severe than the Bank's one. The reasons were that:

- Due to historical client relationship the Bank tends to

be less severe with clients becoming bad.

- Asymmetric information between the Bank and us also justifies

different views in the assessment of the bad client situation.

Nevertheless, in order to improve the Bank's problem loans

management practices, namely incentives system, collateral risk, industry

risks, ownership of borrowing companies among

others.

2 MBA in Banking and Finance

RESUME DE L'ETUDE

La présente étude avait pour but d'améliorer

les pratiques de gestion des créances douteuses à

Ecobank Ghana afin de réduire les pertes dues à ces

prêts.

Les raisons de l'intérêt porté à ce

sujet étaient les suivantes :

- nombre de crises financières mondiales étaient

dues à l'importance des créances douteuses dans le portefeuille

des banques notamment au Japon et en Chine entre autres.

- L'Afrique de l'Ouest est exposée à ce

problème à cause de la concurrence au nombre croissant

d'institutions financières (banques, bourses de valeurs

mobilières, institutions de microfinance).

- Le Ghana n'est pas étranger au problème

(crise des années 1970) et le taux actuel des créances

douteuses du système bancaire ghanéen est supérieur

à 15%.

Pour atteindre cet objectif, nous avons :

1. à partir des recommandations de certaines

institutions financières (FMI, Banque

Mondiale, BCEAO, Banque du Ghana), élaboré des

principes qui selon nous sont à même

de fournir une protection maximale contre les

créances douteuses et en assurer une meilleure gestion.

2. Evaluer les processus de gestion du risque de

crédit au sein de la banque à travers l'examen du manuel

de politique de crédit et de procédures et d'interviews

avec le gestionnaire du portefeuille de la banque.

3. Echantillonné certains dossiers de clients douteux de

la banque et comparé le traitement

de ces dossiers aux standards que nous avions établis en

faisant ressortir les similitudes et les dissemblances.

Ce travail nous a permis d'aboutir aux résultats

suivants en fonction des points cités plus haut :

1. Malgré l'absence de principes communs

adoptés universellement, les institutions financières ont

des systèmes de classification et de provisionnement

globalement similaires en ce qui concerne les créances douteuses. Ils

recommandent la classification des créances douteuses en quatre

groupes en fonction du niveau de risque et, à chaque classe

correspond un niveau de provisions à constituer.

Par ailleurs, il est ressorti de la revue de littérature

qu'une politique de gestion efficace des créances douteuses passait

inévitablement par un bon système de gestion du risque

de

crédit avant, pendant et après l'octroi du

prêt.

3 MBA in Banking and Finance

2. L'évaluation des processus de gestion du risque de

crédit à Ecobank Ghana a fait ressortir

les phases suivantes :

- à travers une analyse des marchés et un

ciblage, la banque identifie des secteurs porteurs et peu

risqués,

- un suivi périodique de la situation des emprunteurs afin

d'avoir une vision dynamique

du risque couru,

- un système de classification et de provisionnement des

créances devenues douteuses

ou litigieuses.

3. Il est ressorti de la confrontation entre nos

recommandations et le traitement réel des dossiers par la banque

que notre classification et les stratégies de recouvrement

proposées apparaissaient plus sévères que celles de la

banque. Les raisons de ces différences étaient :

- La relation de clientèle entretenue par la banque avec

certains de ces clients la freine dans son élan de

sévérité extrême avec ces clients.

- Une différence d'appréciation de la

situation du client douteux compte tenu d'une asymétrie

d'information entre la banque et nous.

Des recommandations ont été néanmoins

faites en vue de l'amélioration des pratiques actuelles de la

banque en matière de gestion de ses créances douteuses, notamment

en ce qui concerne le système de motivation, les risques liés aux

garanties fournies, l'exposition à un

secteur d'activité donné, la nature des entreprises

emprunteuses.

4 MBA in Banking and Finance

CHAPTER ONE: GENERAL INTRODUCTION

I. Background of the study

Since the information between banks (as lenders) and borrowers is

asymmetric1, lending is a

risky activity. Banks need to monitor their borrowers to

ensure the credit extended will be reimbursed in accordance with the

pre-agreed terms and conditions.

The issue of problem loan remains crucial for economies of the

world countries.

For instance, according to the Koizumi Cabinet2,

«One of the underlying causes of Japan's prolonged economic stagnation is

the non-performing or bad loan problem». Professor Park (2002), states in

a study3 that according to the Financial Agency Services, the total

sum of bad loans extinguished from the book for the entire banking

industry of Japan since 1992 amounted to nearly 69 trillion yen, but

the new bad loans cropped up faster than the ones retired. According

to the same study, 13 large city banks of the country had written

off 8 trillion yen of bad loans at the end of March 2002. However,

their combined bad loans outstanding actually increased by 8.7 trillion

yen over the previous year due to a faster accumulation of new bad

loans. These figures show that problem loans have become a serious concern and

finding a solution is becoming an emergency. The problem is not restricted to

only Japan; it concerns the whole world.

According to the McKinsey Quarterly, in 2002, European banks

were owed $900 billion of non-performing credits. The daily also noted

that dealing with bad loans has become so worrying for banks that

some of them have discerned the seeds for a new business. Some banks

and other companies are now specializing in debt recovery. If banks,

which are supposed to be debt specialists, start outsourcing the

recovery of their bad debt, depositors may be frightened and doubtful

about the safety of their deposits. In 2000, the weighted average cost

of bad debt as share of total profits in Europe was 48%.

West Africa is also facing the problem of bad loans. There are

three identifiable reasons that make the situation more critical than before:

(1) the growing number of lending institutions,

(2) the development of financial markets and stock exchanges and

(3) the weaknesses in the

Banking Supervision roles of Central Banks in the region.

1 For literature on asymmetric information refer to

Akerlof (1970), Spence (1973), Stiglitz and Weiss (1981), Mishkin

(2000).

2 «The Disposal of Non-Performing Loans and

Its Potential Influence», Study Project on the Potential Influence of

Balance- Sheet Adjustments, June 28, 2001.

3 «Bad loans and their impact on Japanese

economy», See-Hark Park (2002).

5 MBA in Banking and Finance

The number of banks in West Africa has grown steadily the recent

years. From 64 banks in

2000, the number of banks in the West African Economic

and Monetary Union was 66 in

2002 and 74 in July 20044. There is evidence that the

growing number of banks will lead them

to a competitive environment that will raise credit

extension. In a heightened competition, more money will be lent with a

moderate effect on banks credit policies. This occurrence will include the

creation of problem loans.

The growth of lending activities to non-bank financial

institutions, whose number is also significant (24 in 2004) will

heighten competition in the lending sector and then make the credit

conditions more flexible. Since the number of borrowers will increase due to

probable decrease of credit requirements, the likelihood for banks to lend to

bad borrowers will also increase. In that situation, prudent credit risk

management systems and ability to manage problem loans will become

critical successful factors.

Second, the deepening of the West African markets

through the creation of the stock exchanges in West Africa5

has given investors an alterative means for investment. Bank

shareholders will therefore now require higher returns on their

equity or shift their investments to the stock exchanges. This will

constitute a fresh pressure on banks to, among others, grow their loan books

for higher profitability, and hopefully increased shareholders' value.

Third, the weaknesses and inefficiencies of the Central

Banks reflect in the relatively poor quality of the performance of the

Banking Supervision function. In 2001, 15 of the 64 banks (being 23.4%) in West

African Monetary Union did not comply with the risk coverage ratio,

23 banks (being 36 %) exceeded the limits of loans to managers

and personnel of the bank and 29 banks were not complying with the ratio

limiting the transactions with related groups

or organizations6.

Apart from the above-mentioned factors, which are common to most

West African countries, there are note-worthy characteristics that are peculiar

to the Ghanaian banking environment.

A survey by the IMF showed that Ghanaian banks were

uncompetitive7. The institution

highlighted that banks in Ghana were making «super

profits» largely from treasury bills with little need to compete for

lending business in private sector so far that a decline in interest rates

yields involved a decline in banks profitability. Statistics from the

Bank of Ghana

4 Central Bank of West African States

(www.bceao.int).

5 Ghana Stock Exchange (in Ghana), Nigeria Stock

Exchange (in Nigeria), BRVM for the 8 WAEMU countries with an agency in each

capital.

6 Rapport Annuel, Commission Bancaire, 2002.

7 «Why Ghanaian banks behave

uncompetitively?», The Ghanaian Times August 22nd and

24th, 2005.

6 MBA in Banking and Finance

confirm that the banking industry advances represented

28.6% and 32.5% of total assets respectively in December 2002 and December

2003 (being a rise of 35%). The rise in lending

in 2003 was partially due to the decline in the T-bill yields

and a fall in lending rates (lending rates declined from 34% in January

2003 to 32.5% in December 2003). If these trends continue banks will

reduce their dependency on T-bills and increase lending, and most likely record

increases in their bad loan portfolio, since, future non-performing loans is

positively correlated with credit growth (Jiménez and Saurina, 2005).

The issue of problem loans is not new for Ghanaian banks. The

Bank of Ghana shows that the percentage of non-performing loans to total loans

amounted 12.8% and 11.9% in 1999 and

2000 respectively. After this marginal fall, non-performing loans

ratio increased to 19.6% in

2001 and further to 22.7 by December 2002. In December 2003, it

dropped to 17.9%. The

«up-and-down» movement described by these figures is

indicative that Ghanaian banks were yet to get a firm grasp of the bad loan

menace.

Compared to the average of the Ghanaian banking industry, the

non-performing loans ratio of Ecobank Ghana is relatively low. From 3.4%

in 2002, the ratio rose to 4.2% in 2003 and dropped again to 3.9% in

2004.

II. Purpose of the study

The purpose of this study is to improve problem loans

management practices at Ecobank

Ghana Ltd. Critical related objectives are as follows:

- understand the Credit Risk Management Processes in the Bank

- assess the existing Problem Loans Management Systems of

the Bank and compare these systems to best practices

- make recommendations to improve the Problem Loans Management

Systems of the Bank.

III. Research problem

The problem to be solved can be summarized in the following

question:

How can the losses due to problem loans be reduced at

Ecobank Ghana Limited?

Related questions to ask include:

1. What are the Credit Risk Management processes of the Bank?

2. What measures are taken to prevent the creation of problem

loans?

7 MBA in Banking and Finance

3.What are the existing Problem Loans Management Systems?

IV. Research methodology

In order to take a broader and complementary view of the research

problem the triangulation

methodology (Hussey and Hussey, 1997), a mix of both

phenomenological and positivistic paradigms was adopted. Denzin

(1970) defines triangulation as «the combination of

methodologies in the study of the same phenomenon». He argues

that the use of different methods by a number of researchers studying

the same phenomenon should, if their conclusions are the same, lead to

greater validity and reliability than a single methodological approach. The

use of this methodology was also motivated by the mixed nature of

the research questions requiring qualitative and quantitative data.

The methodology consisted of two steps:

- data collection

- data analysis and interpretation

1. Data collection

The data collection format depended on the kind of data to be

collected.

a. Interviews

To answer the first two questions of the research problem (credit

risk management processes and prevention measures) interviews were held with

the Bank's credit portfolio analyst. Information were also collected from the

Group Credit Policy and Procedure Manual, which

is the set of principles, procedures and controls that govern the

entire credit risk management process.

b. Questionnaires

The last question was answered through questionnaires. Problem

loans files were sampled and questionnaires containing closed questions were

used to focus on key actions for addressing problem loans. A longitudinal

study to follow the behavior of our variables throughout a period has

been made.

8 MBA in Banking and Finance

2. Data analysis and interpretation

Data collected from the interviews were analyzed separately and

compared to best practices.

Both similarities and discrepancies with relevant explanations

for the observed deviations as and when necessary were also analyzed and

interpreted. Dissimilarities were analyzed and explanations why the Bank's

practices were not complying with ours were provided.

V. Significance of the study

This study is significant because it deals with an issue banks

are facing and will continue to

confront in the future. According to the IMF, the

average level of non-performing loans (NPLs) in Ghana is around 25%

of the total loans. The institution also underlined that the

definition of a non-performing loan in Ghana and the associated provisioning

modalities were rather lax compared with other countries'. That means NPLs have

been underestimated. At

the same time, the Bank of Ghana in its last Financial Stability

Report (FSR May 2005) was estimating the NPL ratio at 15.7%.

This shows the challenge of «Problem Loans»

needs to be explored to set standards of definition because its

definition is «intrinsically elusive and subjective» (Fuchita,

2004). There is also need to find strategies to manage them well and to work

out.

The universal bank nature of Ecobank Ghana keeps the study of

great importance despite the bank's relative performance. The NPL ratio of the

bank is fluctuant (from 3.4% in 2002, to

4.2% in 2003 and 3.9% in 2004). For that reason, it is useful to

direct this study in order to reduce and keep the ratio as low as possible.

This study has also a particular importance for the whole

ECOBANK GROUP because it is a universal banking Group8

characterized by an upward trend of development and a growing demand for

money to develop the economies. The study will also provide a benchmark for

other affiliates of the Group.

VI. Limitations of the study

Although this study has been completed successfully, there

were practical difficulties. The

time available was short for an in-depth understanding of

the Ghanaian market, which is

8 Ecobank operates in 12 countries: Benin, Burkina

Faso, Cameroon, Côte d'Ivoire, Ghana, Guinea, Liberia, Mali, Niger,

Nigeria, Senegal and Togo.

9 MBA in Banking and Finance

relatively new to the writer. There were also difficulties to

find relevant materials related to the field of study were also encountered.

Although the issue of problem loans has important

accounting dimensions (provision and interest dealing), these were not

analyzed in depth because the focus of the study is fixed on

the lending practices in the Bank with the view to improving the

problem loan situation.

VII. Structure

The study is structured as follows:

The next chapter (chapter 2) summarizes the literature on the

problem loans issue. It gives an overview of the basic financial theories

related to the subject and standards used as best practices in dealing

with the issue.

Ecobank Ghana Credit Management Processes will be

presented in the following chapter (chapter 3) to give the reader the

general framework and techniques used to manage credit risks.

After that, the data collected will be analyzed and interpreted

(chapter 4). In that part, we will present the data collection and analysis

tools and show how the interpretations were done.

The data analysis and interpretation will be followed by

recommendations to improve the credit risk management and lower loan losses

(chapter 5).

The conclusion (chapter 6) will end the study with key deductions

and thoughts.

10 MBA in Banking and Finance

CHAPTER TWO: LITERATURE REVIEW

This chapter reviews the body of literature on the subject matter

of Problem Loans, and it is

sub-divided into five parts:

· Part one: It mentions some links between the reality of

problem loans and basic economic theories such as asymmetrical information,

adverse selection, moral hazard and early warning systems.

· Part two: This provides some country by country insights

by looking at bank crises faced

by Japanese, Chinese and Latin America banks and learn lessons

from them.

· Part three: This part shows the role played by

supervisors and external auditors in identifying problem loans.

· Part four: The focus is on identifying the defining

features of global acceptable practices

for managing problem loans.

· Part four: In this final part, the literature

review distills a core of recommendations as constituting the framework

of best practices.

I. Basic theoretical framework

1. Problem loans and asymmetrical

information

Although the problem of economics of information and the

special issue of asymmetric

information was debated by early economists such as

Adam Smith (1776), Simonde de Simondi (1814), John Stuart Mill (1848),

Alfred Marshall (1890) and Max Weber (1925), they did not mention

the term «asymmetrical information». The most famous paper on

the topic was «The market of lemons» of Akerlof (1970). In

this study, Akerlof notes that the owner of a «lemon» (used car)

knows more about its quality than any potential buyers. The example of used

cars therefore involves asymmetric information. According to Akerlof,

asymmetric information exists when one side of the market possesses information

lacked by

others players in that market. Other authors referred to

other markets in which asymmetric

11 MBA in Banking and Finance

information operates. Spence (1973) applied information

asymmetry to the labour market, stating that a job applicant knows more

about his skills than the employer. Another example relates to an insurance

company with a relatively inadequate knowledge about a potential

client's health. Stiglitz and Weiss (1981) are those who emphasized

on credit rationing as consequence of asymmetric information. For them there

is asymmetrical information between banks being the less-informed

principals and borrowers being the well-informed agents, referring to the

agency theory developed by Jensen and Meckling (1976). This model is quite

similar to the theoretical one of Jaffee and Russell (1976) in which

imperfect information about the investment to be made leads to credit

rationing in a loan market in which lenders are less informed than borrowers on

the likelihood of default and the riskiness of the investment. This last

example leads to the fear for the loan to become bad and the banker not to

recover

the principal and interest of the money lent. The

Minsky theory of investment finance and financial instability model

illustrates that as well. Minsky (1982, 1985) assumes that bank

financing is needed in an investment project and the decision of

investment is made under uncertainty. Once the decision to invest is taken

and the project financed, the principal and the interest are supposed to be

repaid with the expected revenues of the investment. If then an external shock

occurs, the recovering of the bank financing becomes doubtful and the loan

becomes bad.

Asymmetric information between the bank (as lender) and the

investor (as borrower) about

the actual characteristics of the investment being

made, coupled with the instability of the market and global environment

lead to problem loans management. Therefore, an effect on both factors is

supposed to overcome problem loans. Assuming the hypothesis of the

efficiency of the market, the only significant factor worth

considering is information asymmetry. This leads us to adverse

selection and moral hazard, both consequences of the attempt to overcome

information asymmetry.

2. Problem loans, adverse selection and moral hazard

«The market of lemons» contains both good and bad

quality used cars and Akerlof shows that

the awareness of potential borrowers will lead them to

assume that the percentage of bad quality used cars is high. That will

depress the price of used cars in general and drive good quality used cars out

of the market. This phenomenon is defined by him as adverse selection.

In the Stiglitz and Weiss model, prices can act as a

screening device to distinguish bad

borrowers from good ones in the same market. According to them

raising the interest rate can

12 MBA in Banking and Finance

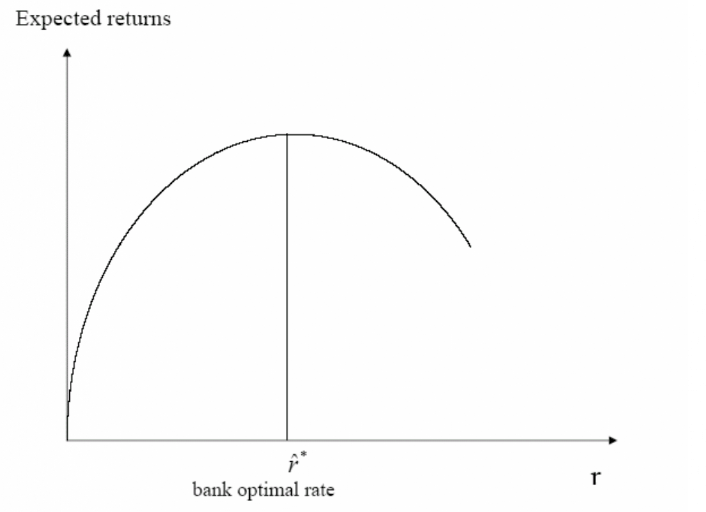

help select good borrowers but only up to a certain limit of

interest rate r* (figure 1). Above that interest rate, the adverse selection

operates and the market starts attracting bad borrowers with high risk. Another

effect of using interest rate as screening device is that at high interest

rates, borrowers are more likely to change their behavior and invest in high

risk projects (with high expected returns). That change in the behavior is

known as moral hazard.

Figure 1: Bank optimal rate

Source: Credit Rationing in

Markets with Imperfect Information,

Stiglitz and Weiss (1981)

Williamson (1986) developed a model of credit rationing

where borrowers are subject to a moral hazard problem. In his model some

borrowers receive loans and others do not.

In the same vein, according to Claus and Grimes

(2003) adverse selection increases the likelihood that loans will be

made to bad credit risks, while moral hazard lowers the probability

that a loan will be repaid. Their model of credit rationing to avoid problem

loans

is slightly different from Williamson's one. They identify two

forms of credit rationing. The first is to give some applicants a smaller loan

than they applied for at a given interest rate. The second is not to give other

applicant a loan at all even if they offered to pay a higher interest rate.

Edelberg (2004) studied tested adverse selection and moral hazard in

consumer loan

markets. She found evidence of adverse selection, with borrowers

self-selecting into contracts

13 MBA in Banking and Finance

with varying interest rates and collateral requirements.

She also found evidence of moral hazard such that collateral was used to

induce a borrower's effort to repay their debts. Her conclusion was that loans

terms had a feedback effect on behavior.

The efforts to solve the problem of asymmetric information

lead authors to adverse selection and moral hazard, both factors that higher

the probability to face a problem loan. Interest rate appears to be inefficient

in selecting good borrowers from bad ones as well as all other loan terms such

as collaterals. Is the optimal contract between a lender and a

borrower a debt contract in which the lender only monitors in the

event of default as concluded by Williamson? We do not think so

because the lender's concern is to prevent from problem loans and not

to support it.

3. Problem loans and early warning systems

In order to prevent borrowers bankruptcy, banks developed

insolvency-forecasting models.

Altman (1968) was the first to design an

insolvency-forecasting model based on multiple linear discriminant

analysis. He studied five financial ratios of 66 American companies and built

a Z-score function to forecast the defeasance of a company. He

studied 22 ratios (liquidity, solvency, gear ...) taken from the most

frequently used by American banks to assess the creditworthiness of

companies.

His model was as follows:

Z = 0.012 X1 + 0.014 X2 + 0.033 X3 + 0.006 X4 + 0.999 X5

where X1 = Working capital / Total of assets

X2 = Reserves / Total of liabilities

X3 = EBIT9 / Total of assets

X4 = Market value of shares / Total of debts

X5 = Turnover / Total of assets

The forecasting model was reliable at 80 % for only one and

sometimes two years. Above that timeline the model became reliable only at

40%.

Another study on a sample of 111 companies by Altman, Haldeman

and Narayanan (1977)

led to the Zeta model. The Altman model was improved later by

Conan and Holder (1979)

and by the Banque de France (1983), which build models specific

to industry sectors.

Such models are highly reliable since they are built from

companies operating in the same activity sector and have similarities of

financial structure.

9 Earning Before Interest and Taxes

14 MBA in Banking and Finance

Other methods were used to forecast insolvencies such as logistic

regression (Boisselier and

Dufour); a neuronal approach was also developed (Beauville and

Zollinger, 1995).

Most of these models were assuming that a scanning of

a company's financial statements three to five years before could

predict its failure. Other authors criticized these models arguing that

other non-financial information were relevant in credit rating models (Grunert,

Norden and Weber, 2002) and that banks were reluctant to let them

drive by a mechanist model (Treacy and Carey, 1998).

Despite all the critical notes, early warning systems are

still growing since the Basel 2

Committee encouraged banks to build Internal Ratings-Based (IRB)

systems. Those systems

are based upon the banks' own estimations of credit

risk. The risk components include measurements of the probability of

default (PD), loss given default (LGD) and exposure at default (EAD). It is

important to underline that those rating systems now integrate both

quantitative and qualitative information and even if they cannot eliminate

problem loans, they remain a key and relevant tool of decision-making.

All these models were applied on banks lending activities to

provide a solution to the issue of problem loans. Unfortunately, banks

still face problem loans. Information asymmetry will always exist since a

borrower's financial soundness can be affected by an external shock that may

occur (Minsky, 1982 & 1985). Interest rate has appeared to be an

ineffective screening device as insolvency forecasting models and IRB systems

only provide a probability of failure

but cannot ensure whether the failure will occur. Williamson's

conclusion that the optimal contract between a lender and a borrower is a debt

contract and the lender only monitors in

the event of default can also not avoid problem loans and loan

losses.

II. Lessons from world banks crises

The issue of problem loans has arisen as one of the

most important sources of the «lost-

decade» in Japan (Fukuda and Koibuchi, 2005). Whereas

more than 60% of total assets of banks are loans to customers, the

safety of those loans becomes very critical and relevant for

the banking system stability. Many authors commented on

the issue of problem loans by considering the measures taken by the

Japanese government to overcome the problem. They also look at the experiences

of other countries.

In his paper on the Japanese banking crisis, Ueda (1998) affirmed

that the definition of bad

loans has changed over time and has been a source of

confusion. Initially, banks were

15 MBA in Banking and Finance

reporting only Non-accrual Loans. Later, they added Past Due

Loans and then Restructured Loans to the list. He underlined inefficient or lax

bank management as a cause of bad loans problems but emphasized the role of the

real estate industry. He found that in 1990s banks with a high exposure to real

estate industry suffered more from bad loans problems.

Nishimura et al (2001), in their critical paper on the Koizumi

Cabinet policies regarding the disposal of Japanese financial institutions' bad

loans, raised the following issues:

- Risk management skills: in their view the existence of bad

loans is not a problem in itself as bad loans are inevitable when banks

provide firms with credit. The financial institutions must practice

adequate risk management.

- Dynamism: the risk management policies must be adjusted to

match the industry structure changes. To evaluate the financial risks they

assume through lending, financial institutions must also have accurate

information on real estate prices when these are used as collateral. According

to the IMF (1999), the slow speed of restructuring in Japan is in part due to

the extensive ownership links among banks, other financial intermediaries, and

corporations.

The role of Asset Management Companies (AMCs) in dealing with

problem loans has been commented on by other authors.

Klingebiel (1999) thinks banks should be better placed to

resolve Non-Performing Loans

(NPLs) than centralized AMCs as they have the loan files and some

institutional knowledge

of the borrower. She adds that leaving the NPLs in

the banks' balance sheets may also provide better incentives for banks

to maximize the recovery value of bad debt and avoid future losses by

improving loan approval and monitoring procedures.

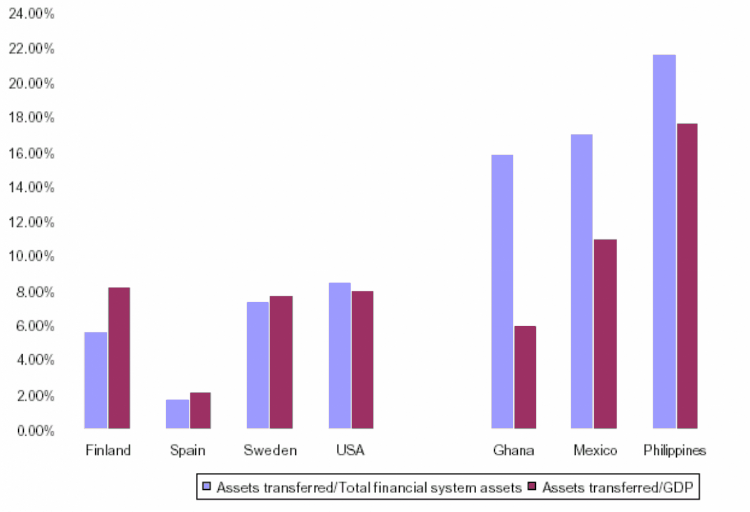

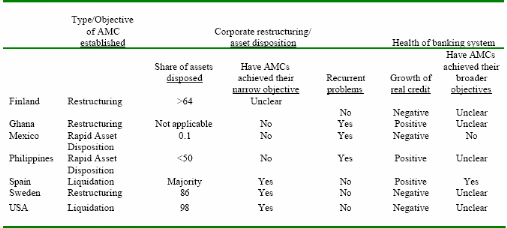

Her cross country experience showed that the countries that

transferred high percentages of their total assets to AMCs, namely Ghana,

Mexico and Philippines (figure 2) are the ones that faced recurrent problems

and did not achieve their narrow objectives. Even the achievement

of their broader objectives was unclear (cases of Ghana

and Philippines) and sometimes a

failure (case of Mexico).

16 MBA in Banking and Finance

Figure 2: Assets transferred to AMCs

Source: Kinglebiel (1999)

Table 1: Evaluating the Country Cases

Source: Kinglebiel (1999)

17 MBA in Banking and Finance

The role and independence of AMCs has also been pointed out in

China. Bartel and Huang (2002) disagreed with China's dealing with State Owned

Banks' (SOB) bad loans problem. For them the establishment of AMCs to

deal with China's bad loans problem was a good foundation upon which a

strong reform of the banking system can be built. Nevertheless, they pointed

out the lack of independent bank governance, and also underlined that creating

AMCs could lead to a moral hazard problem of encouraging banks to new low

quality loans. In their view, identification of bad loans is not trivial

in any banking system. The necessary information to distinguish a

good loan from a bad one is imbedded at the branch level, oftentimes

with the responsible loan officer.

The identification problem is magnified in China because

the standard international loan classification system was adopted only

recently.

Berger and DeYoung (1997) studied problem loans and cost

efficiency in commercial banks. They tested four hypotheses regarding the

relationships among loan quality, cost efficiency, and bank capital. Their data

suggested that: a. problem loans precede reductions in measured cost

efficiency; b. that measured cost efficiency preceded reductions in problem

loans; and c. reductions in capital of undercapitalized banks precede

increases in problem loans. They concluded that cost efficiency might be an

important indicator of future problem.

Cavallo and Majnoni (2001) studied a sample of 1176 large

commercial banks, 372 of which were from non-G10 countries, over the period

1988-1999. They found «robust evidence» that

the relationship between loan loss provisioning and banks'

pre-provision income was positive

for G10 banks and negative for non-G10 banks. They

concluded that non-G10 countries provisioned too little in good times and

were forced to increase provisions in bad times. This view is seconded by

Jiménez and Saurina (2005), who suggest banks to provision in

good times for the additional risk added to the portfolio due to credit growth.

Actually, they found evidence of a positive relation between rapid credit

growth and future non-performing loans

of banks. According to them banks could use the reserves

cumulated in boom periods to cover loan losses in bad times.

Laeven and Majnoni (2002) noted that many banks tended to delay

provisioning for bad loans until too late, when cyclical downturns had already

set in. According to them bankers created

too little provision in good times and then were forced

to increase them in economic downturns. They also found a considerable

difference in patterns followed by banks around

the world.

18 MBA in Banking and Finance

Dahiya, Puri and Saunders (2003) analyzed the effects of loan

sales on both the borrower and

the lender. They found that 42% of the firms whose loans were

sold filed for bankruptcy

within 3 years of the announcement of a loan sale by their bank

lender. On the other hand, the sale of a loan by a bank carries no significant

information and had no impact on its stocks

value; although loan sales appear to be made by generally weaker

banks.

III. Role of Supervisors and External auditors in

identifying problem loans

In summer 1993, Banco Español de Crédito (Banesto),

the Spain fourth-largest bank in terms

of deposits issued stocks for the global amount of 93 billion

peseta ($645.3 million). These stocks were worth almost nothing six months

later. In December, the Bank of Spain seized control of Banesto and fired its

management, trying to head off the run on deposits.

Two thrift institutions were charged by analysts for

having misled the investors of those stocks:

· Spain's central bank approved the rights issue

without a thorough inspection of the bank's accounts. Bank of Spain also did

not disclosed that Banesto had purchased 30 percent of

its own stocks despite the bank regulation that forbids banks to

own more than 5 percent

of their own shares.

· Price Waterhouse, the bank's external

auditor, only looked at the large loans without doing even a sampling of

the smaller loans and disregarding that different types of loans have different

rates of non-performance. The positive results of that audit were often

cited

by Banesto in presentations it made before the rights issue.

This example, among others, shows how important can be the role

of supervisors and external auditors in the stability of banking and financial

system.

This section is divided into two parts:

The first one demonstrates that, if well applied, any banking

supervision embodies the key elements to prevent from and identify problem

loans.

The Bank for International Settlements (BIS) through

the Basel Committee on Banking Supervision (BCBS) has performed 25

«core principles»10 that should be the bases of

an effective banking supervision. Bank regulations vary from one country to

another as do the

domestic circumstances. The core principles are seen to

be the minimum standards any

10 The exhaustive list of the 25 core principles is

available in appendix 2.

19 MBA in Banking and Finance

supervisory authority should comply with. For that reason

focus will be put on the core principles to show the contribution of

supervisors in identifying problem loans.

The second part of this section shows the capability

of a well conducted external audit mission to identify problem loans. In

the core principles, reference is also made to external auditors as key role

players in the financial stability of the banking system and the problem loans

issue.

1. The role of banking supervision

Twelve (12) core principles11 make reference to

problem loans issue generally. They can be

gathered in three groups dealing with the three following

items:

¾ general advices to prevent the bank from problem loans

(CP11 to 15)

¾ checkpoints, criteria, ratios to respect (CP7 to 10)

¾ controls and coercion measures (CP16, 19 & 22)

a. General advices

From core principle 11 to 15, the following functions of

the banking supervision are highlighted:

- Control over banks organisation to ensure they have

effective information systems and risk management processes to monitor all

kinds of risk (country, transfer, market risks)

- supervisory authority must be sure appropriate reserves

and provisions are held against such risks where they may occur

- supervisors must ensure banks have strict

«know-your-customer» rules to avoid criminal activities (i.e.

money laundering)

- banks audit function is assessed to make certain the

internal control is sound and periodically reviewed to meet the changing in

the bank's activities

b. Checkpoints, criteria, ratios

Areas of interest of the supervisor in connection with problem

loans specifically are dealt with

in 4 core principles (CP7 to 10) and can be summarized as

follows:

- Evaluation and periodical review of policies, practices

and procedures of loans granting and their ongoing management

11 The 12 core principles are CP 7 to 16, 19 &

22.

20 MBA in Banking and Finance

- evaluation of policies and procedures of assessment of the

quality of assets and loans loss provisioning and reserves including asset

grading and classification

- limits are set by supervisor to avoid credit concentration

(i.e. large credits granted to single or related borrowers) and prevent banks

from great exposures

The items listed above are guidelines. Supervisors have the

responsibility to set quantifiable ratios and criteria to be followed by

banks.

c. Controls and coercion measures

In order to enforce its recommendations, supervisor has the right

to:

- Control banks both on-site and off-site to verify

the reliability of the information provided. This supervision can be

conducted either by supervisor's staff or by external auditors and also aims to

provide any additional information needed to better assess banks

- take remedial actions to address problems that occur

when banks fail to meet requirements

- revoke the banking license in case of extreme violation of

regulations

2. The contribution of external auditors

The 19th core principle stipulates that

«Banking supervisors must have a means of independent

validation of supervisory information either through on-site

examinations or use of external auditors». The reference made to

external auditors shows:

- the confidence of supervisors in external auditors

- the key role played by external auditors in the validation of

information provided by banks and/or collected by supervisors.

As for the supervisors, external auditors will have to

give an opinion on the bank's compliance with regulations generally and

specific ratios more precisely. This opinion shall cover all areas of banks

activity including the portfolio structure, its quality and the accuracy

of the classification and provisioning system for problem

loans.

21 MBA in Banking and Finance

IV. «Problem loans», «Bad

loans» and «Non-performing loans»: definitions and

recommended practices

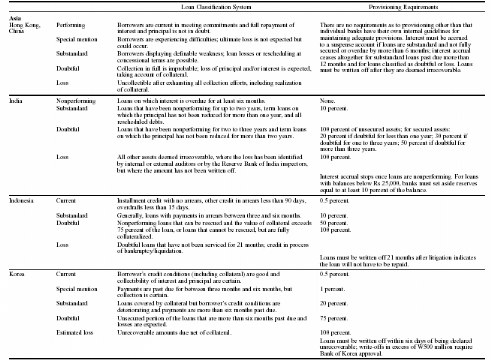

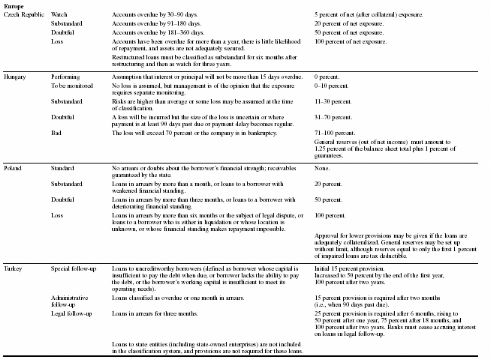

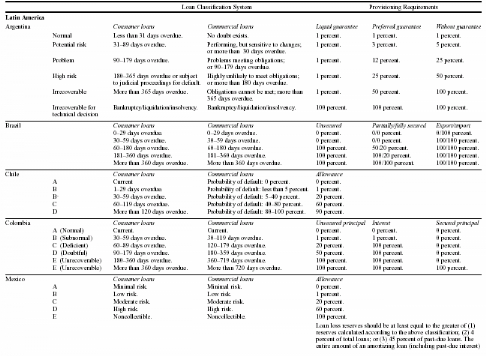

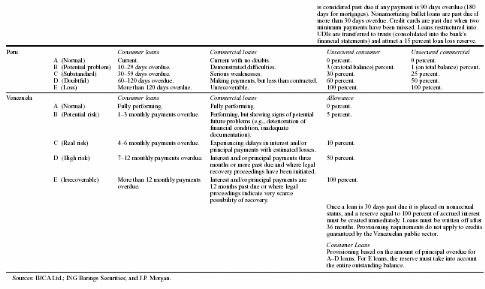

There is no harmonization of asset classification rules at an

international level. The definition

of problem loans or asset impairment varies across countries

(Lis, Pagés and Saurina, 2000). The differences among countries increase

when examining loan loss provisioning rules and practices (for illustration

see appendix 1: Loan loss provisioning in selected emerging markets).

«Problem loans» is used synonymously with «Non-Performing

Loans», «Problem Loans» or «Bad Loans».

Fuchita (2004) distinguished «Bad Loans» from «Bad

Loans Problems». While arguing that

the narrowest definition of «Bad Loans» might be

«a loan which fails to meet certain obligations to pay interest

and/or principal», he said it is bad loan problems we have to focus

on instead of bad loans per se. This meets our view since we are

working on «Problem Loans

Management Practices» and feel no need to emphasize on

«Problem Loans» definitions.

In this part we will present the practices recommended by

institutions like the World Bank,

the International Monetary Fund, the West African Monetary Union

and the Bank of Ghana for a successful dealing with problem loans.

The next section presents standard practices

recommended by the World Bank, the International Monetary Fund, the

West African Monetary Union and the Bank of Ghana for acceptable management of

problem loans.

1. World Bank

According to the World Bank12, the five basics that a

bank must have in order to successfully

deal with problem loans are:

1- A validated and properly functioning system of

credit quality control and asset classification

2- The needed reserves to write off all portions of the

identified losses

3- The removal of these assets from the line organization which

underwrote them and their transfer to a specially trained group of

collectors

4- The usage of a well-functioning legal system to help force

collection

5- The stoppage of making, or renewing, bad loans

12 Richard H. Daniel, «An Alternative

to Government Management Companies: The Mellon Approach»,

World Bank

Conference on Corporate Restructuring: International Best

Practices, March 22-24, 2004.

22 MBA in Banking and Finance

The recommended loan classification and provisions requirements

of the World Bank are as follows:

|

Classification

|

Loan Classification System

|

Provision

Requirement

|

|

Standard, or pass

|

When debt service capacity is considered beyond any doubt.

In general, loans and other assets fully secured (including

principal and interest) by cash or cash-substitutes (e-g banks

certificates of deposit or treasury bills and notes) are usually

classified as

standard, regardless of arrears or other adverse credit

factors.

|

General loss reserve, if disclosed

1 - 2%

|

|

Specially mentioned, or watch

|

Assets with potential weaknesses that may, if not checked

and

corrected weaken the asset as a whole or potentially

jeopardize a borrower's repayment capacity in the future. This, for

example, includes credit given through an inadequate loan agreement, a lack of

control over collateral, or without proper documentation. Loans

to borrowers operating under economic and market conditions

that negatively affect the borrower in the future should receive this

classification. This applies also to borrowers with an adverse trend

in their operations or an unbalanced position in the balance

sheet,

but which have not reached a point where

repayment is jeopardized.

|

Specific provision

5 - 10%

|

|

Substandard

|

This classification indicates well-defined credit weaknesses

that

jeopardize the debt service capacity, in particular when the

primary sources of repayment are inadequate and when the bank must

consider other sources of repayment such as collateral, the sale of a

fixed asset, refinancing, or fresh capital.

Substandard assets

typically take the form of term credits to borrowers

whose cash flow may be not sufficient to meet currently maturing

debts or loans, advances to borrowers that are significantly undercapitalized.

They may also include short-term loans and advances to borrowers for which

the inventory-to-cash cycle is insufficient to repay the debt at

maturity. NPAs13 that are at least 90 days overdue are

normally classified as substandard, as are renegotiated loans and

advances for which delinquent interest has been paid by the borrower

from his own funds prior to renegotiations and until sustained

performance under a realistic repayment program has been achieved.

|

Specific provision

10 - 30%

|

|

Doubtful

|

Such assets have the same weaknesses as the substandard

assets,

but their collection in full is questionable on the basis of

existing facts. The possibility of loss is present, but certain event that may

strengthen the asset defer its classification as loss until a more exact status

may be determined. NPAs that are at least 180 days past overdue are

also classified as doubtful unless they are sufficiently secured

|

Specific provision

50 - 75%

|

|

Loss

|

Certain assets are considered uncollectible and of such little

value

that the continued definition as bankable assets is

not warranted. This classification does not mean that an asset has

absolutely no recovery or salvage value, but rather that it is neither

practical nor desirable to defer the process of writing it off, even though

partial recovery may be possible in the future. NPAs that are at least one year

past overdue are also classified as losses, unless such assets are

very well secured.

|

Specific provision

100%

|

Loans classified as `pass' and `watch' are reviewed twice

per year and loans classified as

`substandard', `doubtful' and `loss' are reviewed at least each

quarter.

13 Non-Performing Assets.

23 MBA in Banking and Finance

2. International Monetary Fund (IMF)

For the IMF, the existence of both financial and non-financial

early warning systems plays an important role in problem loans management since

they may prevent the bank from losses if actions are taken in time to

develop a remedial strategy. In addition, loan documents must contain

clauses that allow the bank to examine the books of the borrower.

There are two essential work-out strategies recommended depending on the

assessment of the problem:

- If the problem area can be corrected, banks are

encouraged to restructure the loan by increasing collateral, revising

repayment and/or changing management.

- If the problem area cannot be corrected, banks must exit the

business by selling collateral and taking legal action.

The loan classification of the IMF is quite similar to

the World Bank's one but with the following classes:

- Sound

- Weak

- Substandard

- Doubtful

- Loss

3. West African Monetary Union

The WAMU Banking Commission defines `impaired loans14'

as all loans that are not repaid

under the pre-agreed terms and conditions. It

recommends that such loans must be clearly identified and isolated from

the bank's books for a specific treatment. All loans with either high or low

risks of non-recovery must be watched and an internal reporting system to the

Managing Director must be initiated. This will foster Senior Management

involvement and guidance in the close monitoring and management of the

stressed accounts to lessen the financial effects on the bank.

Loans classification system and provision requirements differ as

the case may be:

· Direct risks or signatory commitments taken on

the State and its fellows: optional provision.

14 The original french term is `créances en

souffrance'

24 MBA in Banking and Finance

· Risks guaranteed by the State: it is suggested,

but not demanded, to make provisions

up to the amount of the guaranteed debt (principal and

interest) over a maximum period of 5 years, if the risks covered are not

taken into account in the State budget.

· Private risks not guaranteed by the State: the

following table summarizes the loans

classification and provision requirements.

|

Classification

|

Loan Classification System

|

Provision Requirement

|

|

Unpaid debts

|

Debts overdue for a period not exceeding 6 months and that have

not been extended or renewed.

|

Optional

|

|

Immobilized debts

|

Debts overdue for a period not exceeding 6 months and

the repayment is unlikely due to reasons beyond the

borrower's control.

Debts restructured and that the repayment terms are

respected.

|

Optional

|

|

Doubtful or contentious debts

|

Debts overdue or not but presenting probable or certain

risks of part or full non-recovery.

Debts that have registered at least one unpaid of at least

6 months.

Debit accounts without any creditor movement for a period

over 3 months.

Debit accounts without any significant creditor movement for a

period over 6 months.

|

- Assets not secured: 100%

provisioning

- Assets secured by collateral: optional provision for the

first 2 years, 50% the

3rd year and 100% the 4th

year.

-

|

|

Uncollectible debts

|

Assets considered uncollectible after the bank has given up all

efforts either amicably or legally.

|

Uncollectible debts are accounted as losses for their full

amount.

|

|

Country risks

|

Off-balance sheet debts and undertakings on public and private

debtors

|

Provisioning is let at the

discretion of banks but interests must be fully

provisioned if due over 3

months.

|

4. Bank of Ghana

The Bank of Ghana guidelines concerning loans classifications are

as follows:

25 MBA in Banking and Finance

|

Category

|

Loan classification system

|

No. of days of

delinquency

|

Provision

|

|

Current

|

Advances in this category are those for which

the

borrower is up to date (i.e. current) with repayments

of both principal and interest. Indications that an overdraft is still current

would include regular activity on the account with no sign that a hardcore of

debt is building up.

|

0 - less than 30

|

1%

|

|

Other loans especially mentioned

("OLEM")

|

Advances in this category are currently protected

by

adequate security, both as to principal and interest,

but they are potentially weak and constitute an undue credit risk,

although not to the point of justifying the

classification of substandard. This category would include

unusual advances due to the nature of the

advance, customer or project, advances where there is a lack of

financial information or any other advance where there is more than a normal

degree of risk.

|

30 - less than 90

|

10%

|

|

Substandard

|

Substandard advances display well-defined credit

weaknesses that jeopardise the liquidation of the debt.

Substandard advances include loans to borrowers whose cash flow is not

sufficient to meet currently maturing debt, loans to borrowers which are

significantly undercapitalized, and loans to borrowers lacking sufficient

working capital to meet their operating needs. Substandard advances are

not protected by the current sound worth and paying capacity of the

customer.

Non-performing loans and receivables which are at least

90 days overdue but less than 180 days overdue are also

classified substandard. In this context advances become overdue when

the principal or interest is due and unpaid

for thirty days or more.

|

90 - less than 180

|

25%

|

|

Doubtful

|

Doubtful advances exhibit all the weaknesses inherent in

advances classified as substandard with the added

characteristics that the advances are not well-secured and the weaknesses

make collection or liquidation in full, on the basis of currently existing

facts, conditions and values, highly questionable and improbable. The

possibility of loss is extremely high, but because of certain

important and reasonably specific pending factors, which may work to the

advantage and strengthening of the advance, its classification as in

estimated loss is deferred until its more exact status may be determined.

Non-performing loans and receivables which are at least

180 days overdue but less than 360 days overdue are also

classified as doubtful

|

180 - less than 360

|

50%

|

|

Loss

|

Advances classified as a loss are considered uncollectable

and of such little value that their continuation

as recoverable advances is not warranted. This classification does not mean

that the advance has absolutely no recovery

value, but rather it is not practical or desirable to

defer

writing off this basically worthless advance even

though partial recovery may be effected in the future. Advances classified as

a loss include bankrupt companies and loans to insolvent firms with negative

working capital and cash flow. Banks should not retain advances on the

books while attempting long-term recoveries. Losses should be taken in the

period in which they surface as uncollectible. Non-performing loans and

receivables which are 360 days or more overdue are also classified as a

loss.

|

360 and above

|

100%

|

26 MBA in Banking and Finance

V. Soundness problem loans management criteria

Up to this point the literature review has focused on

some global perspectives and factors

relating to the internal workings of corporate systems

and how they impact on loans management. Despite the absence of

consensus on internationally agreed standards, significant strands of

thought run through the prescriptions of leading financial institutions. From

the preceding literature review, it appears a sound Problem loans Management

system is founded on three main pillars, namely:

- The credit risk management: it

constitutes the framework within which credit applications

are processed and as aforesaid it can sometimes

be chargeable for problem loans occurrences.

- Loans classification and

provisioning: it is particularly important because it

provides a mechanism to classify loans by degree of riskiness

and develop specific remedial management strategies.

- Remedial management: Key actions

to be made and strategies to be developed at each stage of the

remedial management process.

1. Credit Risk Management

These are some of the criteria a good Credit Risk

Management System must have as

recommended by the ICBC15:

1. Pre-lending controls:

¾ Detailed credit policy and management rules

¾ Internal Rating System to assess credit risk

¾ Centralized review of customers credit limits

2. On-lending controls:

¾ Authorization management

¾ Approval of credit business

3. Post-lending controls:

¾ Credit monitoring

¾ Field inspection

15 Industrial and Commercial Bank of China, Annual

Report 2003

27 MBA in Banking and Finance

2. Loans classification and provisioning

A good loans classification system looks like the following one,

regardless of the names given

to the different classes:

|

Classification

|

Loan Classification System

|

Provision

|

|

Class A

|

Debts fully secured by cash collateral even if overdue. Borrowers

are up-to-date in repayments.

Debts above suspicion overdue for less than 1 month.

|

1% - 2%

|

|

Class B

|

Debts overdue for a period between 1 month and 3 months.

|

10% - 15%

|

|

Class C

|

Debts overdue for a period between 3 months and 6 months.

|

25% - 30%

|

|

Class D

|

Debts overdue for a period between 6 months and 12 months.

|

50% - 75%

|

|

Class E

|

Debts overdue for a period above 1 year.

|

100%

|

In the above classification system does not emphasize on

the perception of future events

concerning the borrower's financial situation by the

analyst, as did many organizations in their recommendations. We

considered that appreciation of future events could vary from person to

person and can lead to different classifications of the same asset.

Intervals have been provided for provisions so that

the problem loans officer can make different levels of provision for

assets classified in the same category but with different probabilities

of failure.

3. Remedial management

We consider that remedial management strategies depend on

assets classification. At each

stage, a new strategy must be deployed.

28 MBA in Banking and Finance

|

Classification

|

Remedial management strategies

|

Officer in charge

|

|

Class A

|

Maintain and improve relationship.

Friendly remind the borrower (if debt is overdue).

|

Relationship Officer

|

|

Class B

|

Require more collateral to secure the loan

Require a short-term repayment schedule from the

borrower or restructure the loan if the borrower is not likely to repay within

3 months.

|

Relationship Officer

|

|

Class C

|

Require a short-term repayment schedule from the

borrower or restructure the loan if the borrower is not likely to repay within

6 months.

|

Remedial Manager

|

|

Class D

|

Exit the business by selling collateral and/or taking legal

action.

|

Remedial Manager

|

|

Class E

|

Exit the business by selling collateral and/or taking legal

action.

|

Remedial Manager

|

The proposed remedial strategy may appear as rigid but two main

reasons founded our choice:

1. Loan recovery is extremely time-consuming especially when

the borrower is unwilling

to repay. It may also draw staff members' attention away

from other tasks and more lucrative businesses.

2. The long follow-up process involving telephone

calls and transportation fees particularly when the borrower is not in

the same geographical area can make the loan recovery be very costly for the

bank. Attorney fees can also burden the bank especially

when it refers to a legal counsel in collecting the money.

29 MBA in Banking and Finance

CHAPTER THREE: CREDIT RISK MANAGEMENT PROCESSES

IN

ECOBANK GHANA LTD

Problem loans are at the end of the credit channel. Before a loan

becomes bad, it needs to be

granted. Moreover, as we referred to so far, the poor quality

of a loan is sometimes due to factors not attributable to the lending

bank such as adverse selection and moral hazard (Stiglitz and Weiss

(1981)) or any other external shock that may alter the borrower's ability to

repay the loan (Minsky, 1982 & 1985). Nevertheless, there are cases where

the way banks grant and monitor credits can be responsible for the bad loan

portfolio. In other terms, weak credit risk management systems can also

be sources of problem loans (Nishimura and al,

2001).

For this last reason, it was essential to overview the credit

risk management process of the Bank in order to capture the framework of

the bad loans management before scanning the problem loans files.

For competitive and confidential reasons, only

significant details related to the credit management processes are

revealed here. Yet, we put enough information to overview the process

and give an opinion on it.

This chapter is divided in two parts:

- the first part deals with the credit management process

- the second explains the problem loans management.

The information in this chapter is mostly based on the

Group Credit Policy and Procedure

Manual (GCPPM) and interviews with the portfolio manager.

I. Credit management process

Ecobank Ghana Limited credit management processes can be

summarized in three main

stages:

- credit initiation

- documentation and disbursement

- credit administration

30 MBA in Banking and Finance

1. Credit initiation

The credit initiation is a process that starts from a

market analysis and ends at the credit

application approval. The steps of the credit initiation are

listed below:

- Surveys and industry studies:

Relationship Officers scan the market and economic sectors

to identify key players and potential business for the Bank. In

the same vein, industries with high potential of growth that can be good

business for the Bank are also listed.

- Risk Asset Acceptance Criteria (RAAC):

for each industry, criteria are designed to guide

the relation with both industry and clients in order to limit

the level of exposure at credit risk. RAACs applied to industries include both

quantitative and qualitative information such as net sales, net profit, years

of experience in the business and the quality of corporate governance.

- Prospect lists: some prospects

(companies and individual customers) identified as the main role players are

short listed in accordance with the industry studies and the minimum

risk criteria. This prospect list is ranked in order of preference.

- Customer solicitation: at that

stage, although the primary source of target is the prospect list, the

initiation of a credit comes either at the bank request in the

frequent contact with existing customers or at the clients request if they

have a need for financing.

- Negotiation: the relationship

officer identifies the financing needs of the borrower and gathers

background information such as the latest financial statements, project