ANNEXE3

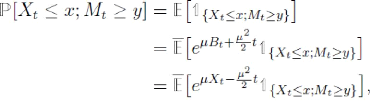

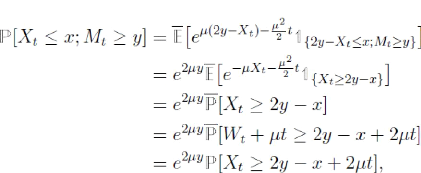

et d'âpres le principe de réflexion :

car W est un e -mouvement brownien. Ceci achève

la démonstration

Bibliographie

Vivien BRUNEL- Benoît ROGERT-version: September 23, 2009

Risque de crédit-Ecole Nationale des Ponts et Chausses

Couverture des risques dans les marchés financiers

Nicole El Karoui Ecole Polytechnique, CMAP, 91128 Palaiseau

Cedex

Aurelien ALFONSI, Thèse de doctorat ,L'ECOLE NATIONALE DES

PONTS ET CHAUSSÉES,

David KURTZ & Thomas B. PIGNARD,Modélisation du risque

de crédit, DEA de Statistique et Modèles

aléatoires en économie et finance Université

Paris 7 -- Université Paris 1

[1] Aven (T.). A theorem for determining the compensator of a

counting process. Scandinavian Journal of Statistics, 12(1), pp. 69-72

(1985).

[2] Bielecki (T. R.), Rutkowski (M.). Credit Risk : Modeling,

Valuation and Hedging. Springer (2002).

[3] Bomfim (A. N.). Credit Derivatives and Their Potential to

Synthesize Riskless Assets. The Journal of Fixed Income December 2002,

Vol. 12, No. 3, pp. 6-16 (2002).

[4] Crosbie (P. J.). Modeling Default Risk. KMV Corporation, San

Francisco,

www.kmv.com (1997).

[5] Dellacherie (C.) Meyer (P.A.). Probabilités et

potentiels, chapitres I `a IV, Hermann, Paris (1975).

[6] Duffie (D.), Filipovi_c (D.) & Schachermayer (W.).

Affine Processes and Applications in Finance. Annals of Applied

Probability, Vol.13, No 3, August 2003 (2003).

[7] Duffie (D.). A Short Course on Credit Risk Modeling with

Affine Processes. Working Paper. Stanford University and Scuola Normale

Superior (2002). Disponible sur http ://fibonacci.dm.unipi.it/ finance/duffie

notes.pdf.

[8] Duffie (D.), Lando (D.). The Term Structure of Credit

Spreads with Incomplete Accounting Information. Econometrica 69, pp.

633-664 (2001).

[9] Duffie (D.), Pan (J.), Singleton (K.). Transform Analysis

and Asset Pricing for Affine Jump Diffusions. Econometrica, Vol. 68,

pp. 1343-1376 (2000).

[10] Duffie (D.), Singleton (K. J.). Modeling Term Structure of

Defaultable Bonds. The Review of Financial Studies Special 1999 Vol.

12, No. 4, pp. 687-720 (1999).

[11] Duffie (D.), Singleton (K. J.). Credit Risk .

Princeton University Press (2003).

[12] _Emery (M.). Classical Probability Theory : An Outline of

Stochastic Integrals and Diffusions. Quantum Probability Communications, QP-PQ,

Vol. XI,World Scientific (1999). Disponible sur http ://

www-irma.u-strasbg.fr

[13] El Karoui (N.) & Mazliak (L.). Backward Stochastic

Differential Equations. Pitman Research Notes in Mathematic Series

(1997).

[14] Geske (R.). The valuation of compound options. J.

Finan. Econom. 7, pp. 63-81 (1979).

[15] Hull (J. C.), Nelken (I.), White (A.). Merton's Model,

Credit Risk, and Volatility Skews. Working Paper. University of Toronto

(2003).

[16] ISDA 2003 Credit Derivatives

Definitions.

www.isda.org.

[17] Krylov (N. V.). Introduction to the theory of diffusion

processes. American Mathematical Society, Providence.

[18] Laurent (J.-P.). I will survive. Risk, June

2003. www.risk.net (2003).

[19] Leland (H. E.). Corporate debt value, bond covenants, and

optimal capitalstructure. J.Finance 49, pp. 1213-1252.

[20] Longstaff (F. A.), Schwartz (E. S.). A simple approach to

valuing risky fixed and floating rate debt. J. Finance 50, pp. 789-819

(1995).

[21] Merton (R. C.). On the pricing of corporate debt :The risk

structure of interest rates. J.Finance 29, pp. 449-470 (1974).

[22] Pan (G.). Equity to credit pricing. Risk, November

2001. www.risk.net (2001).

[23] Protter (P.). Stochastic Integration and Differentiel

Equations. Springer (1990).

[24] Pye (G.). Gauging the Default Premium. Financial

Analyst's Journal, January-February, pp.49-50 (1974).

[25] Credit Derivatives Survey. Risk, February

2003. www.risk.net (2003).

[26] Roncalli (T.). La gestion des risques financiers.

Cours du DESS de Gestion des risques et des actifs de l'universit'e d'

Evry.

gro.creditlyonnais.fr.

[27] Rudin (W.). Real and Complex Analysis.

McGraw-Hill, New York, third edition(1987).

[28] Schonb

·ucher (P.), Rogge (E.). Modeling Dynamic

Portfolio Credit Risk.Working Paper. ETH Z·urich (2002). Disponible sur

www.schonbucher.de.

[29] Schonb

·ucher (P.), Schubert (D.). Copula-Dependent

Default Risk in Intensity Models. Working Paper. University of Bonn (2000).

Disponible sur

www.schonbucher.de.

[30] Vasicek (O.). Credit Valuation. Working Paper. KMV

Corporation. www.kmv.com

(1984). Merton R. (1974). On the pricing of corporate debt : The risk structure

of interest

rates, Journal of Finance, Vol. 29, pp. 449-470.

Black F., Cox J. C. (1976), Valuing corporate securities : Some

e_ects of bond indenture provisions, Journal

of Finance, Vol. 31, pp. 351-367..

Laure Coutin, Laboratoire de Probabilités-Statistiques,

Université Paul Sabatier Toulouse,

Jean-Claude Gabillon, Groupe de Finance, ESC Toulouse,

Laurent Germain, Groupe de Finance, ESC Toulouse,

Monique Pontier, Laboratoire de Probabilités-Statistiques,

Université Paul Sabatier Toulouse,

Clémentine Prieur, Laboratoire de

Probabilités-Statistiques, Université Paul Sabatier Toulouse,

Anne Vanhems, Groupe de Finance, ESC Toulouse

Correspondant du projet: Laurent Germain, ESC Toulouse.

|