II.8.1 Payment cards systems

Payment cards are cards with payment of financial information

embedded in an electronic chip and which can be used for payment.

Three kinds of cars are currently used: (Turban et al., 2008,

p551)

? Credit card ? Debit

? Charge card

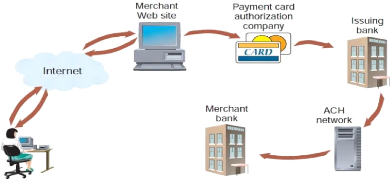

Card processing overview

Card payment processing consists on authorization of the

transaction and the settlement of the money.

Authorization is the phase during which verification is done to

check the validity of the card and the availability of the fund to be paid for

the transaction.

Settlement is the phase which consists on the transfer of money

from the buyer's card bank account to the seller's account.

Payment processing is a service offered by payment processing

service Provider (PSP).

Figure 8: Processing of a card transaction

Source: Gary

Schneider, 2011, p.501

Page | 30

The most threat for payment card is «the

fraud»; and tools have been developed to combat it (Turban et

al., 2008, pp 553-554).

> Address verification system (AVS): seller compare the

shipping address entered on the e-commerce portal with the address contained in

file at the cardholder's bank.

> Manual review: staffs review manually suspicious

transactions orders to detect fraudulent transaction. This method can be used

on business with small amount of transactions.

> Fraud screens and automated decision models: Intelligent

systems which use automated rules to determine if the transaction can be

accepted rejected or suspended.

> Card verification number (CVN): this number is printed on

the back of the credit card; the verification will ensure that the buyer has

the card into his hands. This verification will not be useful in case of stolen

number.

> Card association payer authentication services. This

service is provided by card issuer and offers the possibility for the card

holder to register with the system to ensure the protection of the card.

Merchant web portal will interact with this service to validate the

authenticity of the card. Mastercard offers «Mastercard securecode»

and Visa the «verified by visa» to authenticate and certify their

cards.

> Negative file. Customer and information about the

connection such as IP address name, shipping or billing address, contact

numbers, etc are stored in a file. When the transaction takes place on the web

portal it is matched against the information contained in the file and flag in

case of problem.

II.8.2 Electronic cash

Electronic cash (e-cash or digital cash) is «a general

term that describes any value storage and exchange system created by a private

(non-governmental) entity that doesn't use paper documents or coins and that

can serve as a substitute for government issued physical currency» (G.

Schneider, 2011, p502).

Security issue of e-cash

As for the credit card payment, privacy and security

of the transaction is the most important issue for e-cash

implementation in the e-commerce business.

Fraud is a big concern for e-cash; therefore

security system must be in place to prevent double spending which can happen

while the electronic cash is submitted twice for the same cash amount to two

different merchants.

To prevent this situation, cryptographic algorithms are

creating tamperproof electronic cash that can trace back the transaction to its

origin.

Page | 31

The e-cash has a significant disadvantage because it doesn't

provide an audit trail and can be used as money-laundering (conversion of

illegal owned money to cash) system.

E-cash needs to be supported by a strong regulation to

define standards with the supported secured system and banking in order to be

widely accepted as an alternative to credit/debit card.

|