Chapter 1

Structured credit products: a

business review

1.1 Introduction

Credit derivatives markets have been consistently among the

fastest growing areas of capital markets in recent years: 2006 year-end ISDA

survey shows outstanding notionnal of 34,000 USD Bio for all credit derivatives

contracts, up from 8,000 USD Bio in 2004. Such a growth was fueled by the

appetite of various types of investors for credit risk and relied upon the

ability of investment banks to repackage credit risk into synthetic structured

products.

Before going into the details of modeling and pricing such

credit derivatives, we shall describe the principles of the main products that

can then be used as building blocks for more sophisticated ones. They share the

same underlying risk, that is the credit risk of one or several reference

entities, whether it be a corporate company, a financial institution or even a

soveriegn entity:

· Single-name Credit Default Swaps (CDS) are to credit

derivatives markets what single-name equity stocks are to equity derivatives

markets;

· Collateralized Synthetic Obligations (CSO) aim at

tranching credit risk on an entire portfolio of reference entities, hence

creating correlation risk;

· Constant Proportion Dynamic Portoflio Obligations

(CPDO) and Constant Proportion Portfolio Insurance (CPPI) products allow

investors to take credit risk on diversified portfolios of single names while

avoiding first-order correlation risk;

· Vanilla options on credit indices started trading as

liquidity in underlying CDS contracts and standardized CSO tranches was

increasing.

1.2 Elementary building blocks

1.2.1 Credit Default Swaps

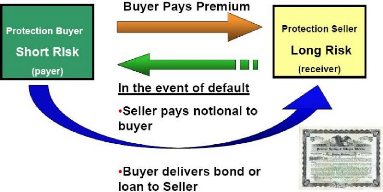

A Credit Default Swap (CDS) is a contract whereby counterpart

A (the «protection

seller») receives a periodic premium from

counterpart B (the «protection buyer») and

agrees to protect the

latter against the default of entity C (the «reference entity»).

In the event of default, counterpart A would pay counterpart

B the notional amount of a reference obligation (which could be a bond or a

loan) issued by entity C and receive the reference obligation.

Figure 1.1: Cash flows of a Credit Default Swap with physical

delivery

CDS are quoted in terms of spread (measured in basis points)

over an Inter Bank Offered Rate (EURIBOR or LIBOR depending on the currency).

Assuming a constant recovery rate R for the underlying obligation, we can

easily express this spread as a function of the survival cumulative

distribution function S0(.) of the reference entity defined as follows under

the risk neutral probability measure Q. Let r be the continuous random variable

modelling the instant of default:

?t ? R+,S0(t) = Q(r = t)

By construction, for a given notional amount N, a fixed

recovery rate R, a contract maturity of Tn and risk-free bond prices

B(0, Ti), i ? {1, .., n}, the market spread at inception of a given CDS is

determined such that the present value of the premium leg (the «fixed

leg») equals that of the default leg (the «variable» leg):

Xn B(0, Ti) · EQ [N(1 -

R)1{Ti-1=ô=Ti} ~

i=1

Xn B(0,Ti) · N(1 - R) · [S0(Ti-1) -

S0(Ti)]

i=1

[ Xn ]

= EQ B(0, Ti)sN1{ô=Ti}

i=1

Xn B(0, Ti) · sN · (Ti - Ti-1) ·

S0(Ti)

i=1

As a result, the CDS spread s is given by the following formula,

where D0(Ti) := B(0, Ti)S0(Ti) denotes the risky bond price:

|