Collateralized Synthetic Obligations (CSO) are securities

issued by a Special Purpose Vehicle (SPV) and backed by a portfolio of credit

protection-selling positions taken through several (usually over 100) CDS. The

liabilities of the SPV get sliced into several CSO tranches that get hit

sequentially in case one or more reference entities within the underlying CDS

portfolio default. As a result, the fair premium of any tranche, usually

expressed as a spread over 3-month LIBOR/EURIBOR rate, eventually depends on

the joint-loss distribution of the underlying CDS portfolio.

CSO tranches can be defined by their attachment and detachment

points:

· The attachment point l of the tranche is expressed as

a percentage of the investment notional. It is the portfolio loss lower

threshold above which the tranche's principal gets hit if one or several

reference entities default within the portfolio.

· The detachment point u > l of the tranche is

expressed as a percentage of the investment notional. It is the portfolio loss

upper threshold above which the tranche's principal gets wiped out after one or

several events of default.

CSO tranches are labelled upon their seniority in the capital

structure:

· The equity tranche has the lowest attachment point

of the structure - 0% - and usually a detachment point below 3%. Hence it is

the riskiest tranche of the structure.

· The super senior tranche has the highest attachment point

of the structure - usually around 22% - and a detachment point of 100%.

· Mezzanine tranches have an attachment point above the

equity's detachment point and a detachment point below the senior's attachment

point.

· Senior tranches have an attachment point above the

mezzanine's detachment point and a detachment point below the supersenior's

attachment point.

Unlike cash Collateralized Debt Obligations (CDO), CSOs are

not backed by a portfolio of physical bonds or loans but by a portfolio of CDS

contracts. This latter feature allows much more flexibility in structuring

tailor-made securities than cash-based CDOs:

· Physical bonds or loans only exist in limited quantity,

whereas CDS contracts

can be created as long as two counterparties agree to

trade with each other;

· Whenever a cash-CDO is structured, all tranches must

be sold to the investors, i.e. the deal must be fully syndicated, unless the

CDO-arranging bank wants to keep some risk in it books, whereas CSO tranches

can be structured independently because their payoffs can be replicated through

model-based offsetting CDS positions.

· Transaction follow-up duties are heavier for cash-CDOs

than for CSOs: for instance, loans can be subject to contingent early

repayments.

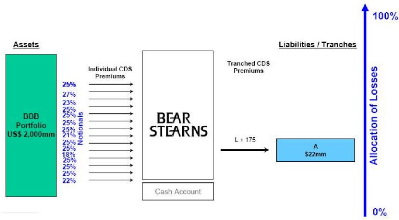

Figure 1.2: Structuring of a single-tranch CSO

CSO tranches on credit indices

As mentioned earlier, the price of a CSO tranche, which is

defined by its attachment and detachment points within the capital structure,

is a function of the joint-loss distribution of an underlying reference CDS

portfolio. This joint-loss distribution function can be modeled in terms of two

sets of parametres:

· single-name CDS spreads can be seen as proxies for

valuing the default risk of each reference entity;

· cross-asset default risk dependency parametres, i.e.

«correlation», that aim at describing the joint default-behaviour of

a portfolio of reference entities.

The rationale for setting up a liquid market for tranches

with standardized characteristics (attachment and detachment points) and

referencing standard CDS portfolios (typically ITRAXX IG or

CDX.NA.IG for 3,5,7 and 10 year-maturities)

was to make correlation tradable, thereby allowing flexible correlation hedging

for structured credit products.

Given that this market for standardized CSO tranches on

credit indices aims at pricing correlation only and not default risk on any

single name, tranches are quoted in terms of credit spread (measrued in basis

points) on a Delta-Exchange basis: in other words, tranches and offsetting CDS

positions are traded at the same time so that the resulting exposure of the

investor is only to correlation and not to single-name first-order spread risk.

Unlike other tranches which are quoted as a full running spread, the equity

tranche (0%-3%), which is the riskiest slice of the capital structure, is

quoted on a running basis assuming the protection seller on this tranche

receives a 5% upfront premium.

Bespoke Collateralized Synthetic Obligations

Bespoke CSOs are tailor-made versions of CSO tranches on

credit indices: the underlying CDS portfolio can be customized, as well as the

characteristics of the tranche. This range of products offers more flexibility

than standard tranches, for it allows the investor to choose his own credit

risk profile by playing with the shape of the joint-loss distribution function

(bespoke CDS portfolio) and choosing the attachment/detachment points that suit

his aversion to risk.

In addition to tailoring the initial underlying CDS portfolio

to the investor's needs, investment banks usually propose managed versions of

bespoke CSOs that allow the underlying CDS portfolio to be revised later on in

the transaction's life: the arranging bank appoints an external credit risk

manager whose role is to manage actively the underlying CDS portfolio by making

substitutions and weight adjustments among referenced single names.

Options on credit indices and tranches

As the liquidity of credit indices keeps improving, bid-offer

spreads decrease and investment banks start proposing swaptions on major credit

indices (ITRAXX XOVER, ITRAXX IG, CDX NA IG,...) on standard maturities (roll

dates, i.e. 20-Mar, 20- Jun, 20-Sep, 20-Dec) and tenors (3Y,5Y,7Y).