1.2.4 Structured Non-Correlation Products

Unlike CSO tranches, the value of which relies heavily on

correlation assumptions linking default probabilities on single names, a range

of «correlation-free» structured credit products has emerged since

2004. Constant Proportion Portfolio Insurance (CPPI) and Constant Proportion

Debt Obligation (CPDO) products reference CDS portfolios, but their joint-loss

distribution is not tranched among investors.

Constant Proportion Debt Obligation: «the more you lose,

the more you bet»

First introduced by ABN-Amro in S2 2006, a Constant

Proportion Debt Obligation is a security whose principal and coupons are rated

AAA by rating agencies such as S&P and Moody's and that pays to the

noteholder quarterly EURIBOR/LIBOR coupons plus a spread around 100-200 bps

depending on issuing market conditions. Such a return is achieved by selling

credit protection on credit indices or on a portfolio of single-name CDS in an

amount that is adjusted dynamically throughout the transaction's lifetime: this

dynamic «leverage» function can reach as much as 15 times the initial

notional.

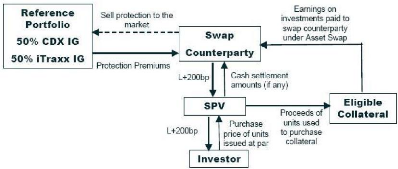

Figure 1.3: Structuring of a first-generation CPDO, referencing

credit indices

Let us define the following variables at time t in order to

summarize the few investment guidelines that rule the CPDO's behaviour:

· A = Notional of the security;

· NPV = Net Present Value of the security;

· MtM = Marked-to-Market value of all long positions on

credit indices and/or single-name CDS;

· Collat = Value of the assets collateralized in the

transaction to serve the EURIBOR/LIBOR component of the coupon;

· CA = Balance of the Cash Account of the structure; in

particular, can be affected by default losses;

· TRV = Target Redemption Value of the security;

· PVNotional = Present Value of the security's Notional as

discounted per the risk-free discount curve;

· PVCoupons = Present Value of the future coupons of the

security discounted as per the risk-free discount curve;

· PVFees = Present Value of the future running fees to be

paid by the noteholder and discounted as per the risk-free discount curve;

· TNE = Target Notional Exposure in credit indices or

single-name CDS;

· F = Shortfall Multiplier, assumed to be constant in this

example;

· lb = Lower Bound cash-out threshold, expressed as a

percentage of the security's notional;

· TL = Target Leverage function.

The aim of the structure is to increase the security's NPV in

order to hit the TRV (a «lock-in» event: in this case, the credit

portfolio is unwound and the proceeds of the transaction are high enough to

cover all future promised coupon, fee and principal payments until maturity by

construction of the TRV aggregate. At the same time, the structure must avoid

any «lock-out» event, which takes place when the security's NPV hits

a fixed percentage lb, usually around 10%, of the security's notional N.

As long as no lock-in nor lock-out event has occured, the

leveraging mechanism described hereafter expresses the Target Leverage function

TL(t) as a linearly increasing function of the structure's shortfall, defined

as the difference between the TRV and the NPV:

NPV (t) = MtM(t) + Collat(t) + CA(t)

TRV (t) = PV Notional(t) + PV Coupons(t) + PV Fees(t) TNE(t) = F

· (TRV (t) - NPV (t))

T NE(t)

T L(t) = A

|

(1.2)

|

|

In other words, the CPDO's leveraging mechanism enables the

structure to increase its credit exposure when the shortfall increases, i.e.

when the security's NPV incurs MtM or default losses: «the more you lose,

the more you bet». Conversely, MtM gains translate into a reduction in the

structure's credit exposure.

Constant Proportion Portfolio Insurance: placing greedy but

secured bets

Originally designed for equity underlyings, Constant

Proportion Portfolio Insurance (CPPI) products referencing credit-linked assets

have developped in the past three years. Unlike CPDOs, CPPIs are

principal-protected at maturity. In other words, the investor will always

receive the notional of the security at its maturity, whereas the CPDO

noteholder can end up with as little as lb% of his initial investment.

The CPPI is a security whose principal is protected at

maturity and whose coupons

can be rated by S&P and/or Moody's and/or

Fitch. Similarly to CPDOs, the rated

CPPI pays to the noteholder quarterly EURIBOR/LIBOR coupons

plus a spread around 50-100 bps depending on issuing market conditions. This

return is achieved by selling protection on a portfolio of single-name CDS in

an amount that is adjusted dynamically during the transaction's lifetime. This

dynamic «leverage» function can reach as much as 10-12 times the

initial notional.

Notations introduced earlier to describe the CPDO structure

remain valid hereafter. In addition, we define the following variables at time

t:

· BF = Bond Floor: value of a risk-free zero-coupon bond

maturing at the legal maturity of the security;

· R = Reserve;

· RM = Reserve Multiplier.

A CPPI lock-out event happens whenever the security's NPV hits

the Bond Floor BF. A lock-in event is the same as for CPDOs. The leveraging

mechanism is different however: the CPPI's target leverage function TL is an

increasing function of the Reserve R, defined as the difference between the

security's NPV and BF.

|

R(t) = NPV (t) - BF(t) TNE(t) = RM · R(t)

TNE(t)

TL(t) = A

|

(1.3)

|

The CPPI's leveraging mechanism enables the structure to

increase its credit exposure when the reserve increases, i.e. when either the

security's NPV increases due to MtM gains or its BF rises as a result of lower

interest rates. The more money you make, the more you can afford losing by

increasing your bets.

|