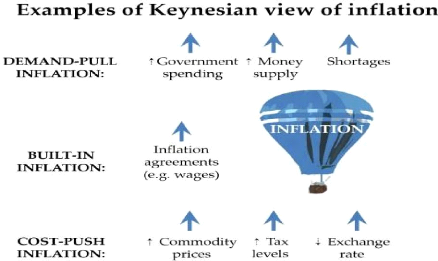

1.5.2 Keynesian inflation theory

The eminent economist John Maynard Keynes

theorized a lot about inflation. He postulated that the money supply

had an influence on inflation in a much more complex way than the strict

monetarists suggested. Instead Keynes proposed that inflation was caused in

number of different ways: By demand outstripping supply and pulling inflation

higher, by inflation being built into the system, by higher costs pushing

inflation higher. Below are examples of each of these types of causes of

inflation.

Source: Kahn R (1976) `Inflation-Keynesian View' Scottish

Journal of political Economy: London, UK Figure 1: Inflation Keynesian

View

It was also Keynes's view that inflation expectations were

important. They impact the wage settlements that workers seek and affect other

inflation agreements that are created. These can have a marked effect on future

inflation rates. Furthermore Keynes and his followers have argued that

governments face a trade-off between unemployment and inflation i.e. if you

want full employment you may need to tolerate higher inflation. Indeed, as

Keynes was writing during the Great Depression

(1929-1933), he not surprisingly gave great importance to

reducing unemployment. This thinking paved the way for post-war governments

that were less concerned about creating inflation than their predecessors, as

they saw it as a necessary trade-off to create full employment. It is

interesting that the Keynesian theory of inflation has gone out of fashion.

This is probably related to the rejection of Keynesian thinking in

general which started in the 1970s. However Keynesian ideas

have had something of a renaissance following the Great Recession of 2008 as

governments seek alternative solutions to the problems we now face.

1.6. Exchange rates

The exchange rate between two countries is the price which

residents of those countries trade with each other. Economists distinguish

between two exchange rates: Nominal exchange rate and Real exchange rate.

1.6. a. Nominal exchange rate (e)

This is the relative price of the currency of two countries.

In other words, the nominal exchange rate is the rate at which one currency

trades against another on the foreign exchange market. The nominal exchange

rate e is defined again as the number of units of the domestic currency that

can purchase a unit of a given foreign currency. A decrease in this variable is

termed nominal appreciation of the currency. (Under the fixed exchange rate

regime, a downward adjustment of the rate e is termed revaluation.) An increase

in this variable is termed nominal depreciation of the currency. (Under the

fixed exchange rate regime, an upward adjustment of the nominal rate e

is called devaluation). When people refer to the exchange rate between

two countries, they usually mean the nominal exchange rate. So the nominal

exchange rate can be expressed as:

1.6.b. Real exchange rate (å)

This is the relative price of the goods of two countries. It

tells us the rate at which we can trade the goods of one country for good of

another. The real exchange rate R is defined as the ratio of the price level

abroad and the domestic price level, where the foreign price level is converted

into domestic currency units via the current nominal exchange rate.

24

Where

25

å= Real exchange rate

P* = Price of foreign good

P= Price of domestic good

e= Nominal exchange rate

A decrease in å is termed appreciation of the real

exchange rate, an increase is termed depreciation. The real rate tells how many

times more or less goods and services can be purchased abroad (after conversion

into a foreign currency) than in the domestic market for a given amount. In

practice, changes of the real exchange rate rather than its absolute level are

important. In contrast to the nominal exchange rate, the real exchange rate is

always »floating», since even in the regime of a fixed nominal

exchange rate e, the real exchange rate å

can move via price level changes. Normally, it is the nominal exchange

rate adjusted for inflation. Unlike most other real variables, this adjustment

requires accounting for price levels in two currencies. Standard models of

international risk sharing with complete asset markets predict a positive

association between relative consumption growth and real exchange-rate

depreciation across countries. The striking lack of evidence for this link the

consumption/real-exchange-rate anomaly or `Backus-Smith

puzzle' has prompted research on risk-sharing indicators with

incomplete asset markets. That research generally implies that the association

holds in forecasts, rather than realizations. Independent evidence on the weak

link between forecasts for consumption and real interest rates suggests that

the presence of 'hand-to-mouth' consumers may help to resolve the anomaly.

Developed by James Duesenberry(1946), the relative income hypothesis states

that an individual's attitude to consumption and saving is dictated more by his

income in relation to others than by abstract standard of living; the

percentage of income consumed by an individual depends on his percentile

position within the income.

It is reasonable to say that Adam Smith (1776) has played an

important role in the development of welfare theory. The reasons are at least

two: In the first place, he created the invisible hand idea that is one of the

most fundamental equilibrating relations in economic theory, the equalization

of rates of returns as enforces by a tendency of factors to move from low to

high returns through the allocations of capital to individual industries by

self-interested investors. The self-interest will results in an optimal

allocation of capital for society. He writes: «every individual is

continually exerting himself to find out the most advantageous employment for

whatever capita he can command. It is his advantage, indeed, and not that of

society, which he has in view. But the study of his own advantage naturally, or

rather necessarily leads him to prefer that employment which is most

advantageous to society». Adam Smith does not stop there but notes that

what is true for investment is true in economic activity in general.

26

«Every individual necessarily labors to render the annual

revenues of the society as great as he can. He generally, indeed, neither

intends to promote the public interest, nor knows how much is promoting

it» He concludes: «It is not from the benevolence of the butcher, the

brewer or the baker, that we expect our dinner, but from the regards of their

own interest». The most famous line is probably the following: The

individual is led by an invisible hand to promote an end which was no part of

his own intention. The invisible hand is competition and this ides was present

already in the work of the brilliant and undervalued Irish economist

Richard Cantillon. He sees the invisible hand as embodied in

the central planner, guiding the economy to social optimum.

The second reason why Adam Smith played an important role in

the development of welfare theory is that, an attempt to explain the

«Water and Diamond Paradox», he came across an

important distinction in value theory. At the end of the fourth chapter of the

first book in Adam Smith's celebrated volume The Wealth of Nations

(1776), he brings up a valuation problem that is usually referred

to as the Value Paradox2. He writes.

27

CHAPTER 2: ANALYSIS OF THE STATUS AND TRENDS OF

DETERMINANTS

AFFECTING AGGREGATE CONSUMPTION EXPENDITUTE IN

RWANDA

2.0 INTRODUCTION

In this chapter, the researcher analyzed the trends of

consumption and its determinants. Using tables and graphs to describe the

variable, the researcher tested the first hypothesis of these variables and

found that gross consumption expenditure and its associates have the upward

evolution. From the post-Genocide period, the wellbeing of people in the

country increased gradually. Policies to enhance the standards of living of

people in different economic sectors have been put into action.

|