CHAPTER FOUR

DATA PRESENTATION AND ANALYSIS

4.0 INTRODUCTION

The main focus of this chapter is the presentation and

analysis of the data collected from the secondary sources. This chapter

embodies presenting and analysing the data collected qualitatively and

quantitatively following the objectives of the research stated in Chapter one.

Our analysis will be organised in two main parts: Analysis of the data

collected and Policies suggestion to financial body to reduce their risks and

increase their profitability level.

4.1 QUALITATIVE ANALYSIS

This refers to the use of tables and graphs to show how

variables have evolved over the years. This will be done for the period

2002-2005.

4.1.1 ASSESSING THE IMPACT OF RISK MANAGEMENT ON CREDIT

RISKS

The qualitative analysis made in this part of the study will

be a study which analyses the evolution of non performing loans as an indicator

to credit risks in the overall Cameroon Banking system.

The following table represents the evolution of non performing

loans and provision for bad loans as an indictor to credit risks.

Table 4.1 Cameroon: Banking system Indicators

(units indicators)

|

Years

|

2002

|

2003

|

2004

|

2005

|

|

Non performing loans

|

15.7

|

13.9

|

13.1

|

12.6

|

|

Provisions ( % of bad loans)

|

81.1

|

81.2

|

85.3

|

85.4

|

Source: Banking commission of Central Africa and

staff calculations.

The table above represents the key indicators of the banking

sector in Cameroon given as aggregates. More so it shows the evolution of non

performing loans over the years 2002-2005. The amount of non performing loans

are represented here as a percentage of the sum total of loans given out by the

banking sector. Going by the diagram, we can see that over the years the amount

of non performing loans (credit risk) is reducing .In 2002, the credit risk was

15.7 and in 2005 it was 12.6 indicating a reduction of credit risks of 3.1%.

This decrease can be explained by the action of the management team in their

effort to risk reduction.

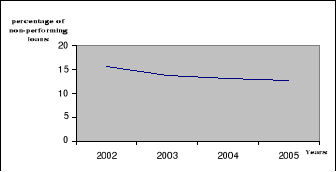

A- Trend Analysis

In this section, we are going to represent graphically the

data in the table 4.1 above in relation to the amount of non performing loans

which is presented as a percentage.

The following expression can therefore be derived:

Credit risks = (Amount of bad debt/ Amount of total

credit granted) X 100

This rate should be as low as possible since it the goal is to

minimise risks in order to make investments more profitable. The following

illustrates diagrammatically the evolution of credit risks.

FIGURE 4.1: Evolution of credit risk from 2002 to 2005

Source: Banking Commission of Central Africa and Staff

Calculations (COBAC), 2005.

The slope of this curve is negative showing that over the

years the amount of non performing loans is reducing. This therefore means that

the risk management has an impact on the credit risk, by reducing the size of

the non performing loans. This can be achieved for instance through an

effective credit policy.

4.1.2 ASSESSING THE IMPACT OF RISK MANAGEMENT ON LIQUIDITY

RISKS

a) Table Analysis

Our analysis in this part of our study will be based on the

table below, which represents the evolution of maturity transformation defining

the liquidity level of Cameroonian banks over the long run.

Table 4.2: Cameroon Banking system indicators

(unit indicators)

|

Years

|

2002

|

2003

|

2004

|

2005

|

|

maturity transformation

|

3

|

3

|

5

|

4

|

Source: Banking Commission of central Africa and Staff

Calculations, 2005

The maturity transformation is the ratio of the overall

solvency of the banking sector. By this ratio a company can determine how

liquid it is and how far it is coping with its long term obligations based on

its assets.

The following expression represents the ratio of maturity

transformation.

Maturity transformation = Long Term Assets / Long Term

Liabilities

The trick of this ratio is that organisations and of course

financial institutions must keep this ratio greater than one. This indicates

that if this ratio is higher it is a sign of solvency of the organisation,

since it can meet its long term obligations.

Going by the table above, we can say that the solvency ratio

in 2002 was 3 and that it has increased to 5 in 2004 and 4 in 2005, which means

that over the years the organisations are getting more solvent by increasing

their liquidity level.

Here the liquidity risk is lesser since it is expressed when

the solvency ratio tends to 0 or to a negative value. We ca therefore affirm

that the risks management of Banks in Cameroon is aware of the negative impact

of liquidity shortages and keep a high liquidity ratio in order to avoid

illiquidity. In brief the higher the liquidity ratio, the lesser the liquidity

risks.

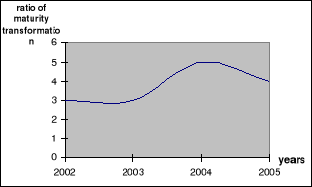

b) Trend Analysis

The figure below is represented on the data given in table4.2

above, which represents the evolution of maturity transformation for the entire

banking sector in Cameroon for the Period 2002-2005.

Figure 4.2 The evolution of Maturity Transformation, 2002-2005

Source: Banking Commission of Central Africa and Staff

calculations, 2005.

The curve drawn above represents the evolution of the

liquidity ratio of the Cameroon Banking sector over the years 2002-2005. In

2002 and 2003 the curve is constant meaning that the liquidity level remains

unchanged. But due to the action of risks managers in their tasks to maintain

adequate liquidity level, the ratio will increase in 2004 to 5 and decrease to

4 in 2005 while remaining higher than in 2002 and 2003. Given that the curve is

positive, the liquidity risks are diminished since adequate liquidity is kept n

Banks and Bankers can meet sudden upsurge withdrawals of creditors while not

affecting the overall profit of the financial institutions.

|