IV.3.b. Current Tendency: the "Fading Listing"

According to a study of the Banque de France made at the end

of December 2007, 38.5% of the companies composing the French index CAC

4050 was owned by nonresidents investors. However, the trading

activity analysis of the same crop of companies highlights the predominant

share of 96.8%51 held by Euronext Paris, clearly demonstrating that

the very great majority of investors are used to buying and to selling their

shares on the company's main trading market.

Furthermore, a more detailed look at the evolution of volume

distribution in cases of efficient foreign cross-listings reinforces this

notion of investors' preference for the most liquid trading place.

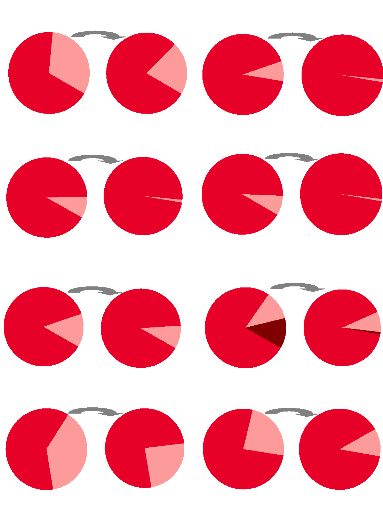

The following exhibits #38 illustrate this tendency applied

to bi-national companies, materialized by steadily diminishing volumes on the

secondary listing places during the years following the merger (see most

representative cases of ABB, AstraZeneca, InBev, SABMiller and Anglo

American).

By this way, after a certain period of time the most liquid

place overrides the other ones, leading to the marginalisation of the secondary

foreign cross-listings. Hence, an efficient foreign cross-listing in year T,

may become no longer efficient in year T+8 (e.g. see cases of Aventis, SAS,

AngloGold Ashanti and Altadis). In this research, this new notion will be

called the "Fading Listing". After a merger operation, the fading listing seems

to be verified whatever the company's origin country and the secondary stock

exchange. The average CAGR52 fading listing calculated thanks to the

examples presented in the exhibits #38 reaches -19.01%, suggesting that after a

merger operation the share in the total volumes held by the secondary listing

places losses on average -19.01% per year.

The case of the Anglo-South African SABMiller is probably the

most interesting case (see figures in exhibit #38). In 1999 the group SAB

(South African Breweries, and later renamed SABMiller after the purchase of the

U.S. based company Miller Brewing in 2002) initiated a listing on the L.S.E. At

this time, the share in volumes traded in London accounted for 32%, the rest

being traded in Johannesburg. Nine years later, the influence is reversed since

London henceforth accounts for 73% of the total volumes. During these years,

the overall greater liquidity of the British stock exchange had played the role

of catalyst by attracting

50 Are considered 36 companies belonging to the CAC

40, i.e. except those which have their head offices outside France like EADS,

ArcelorMittal, Dexia and STMicroelectronics

51

6-months average, source: ThomsonReuters Datastream

52 Compound Annual Growth Rate (CAGR), for more

details see Appendix 1

more and more investors. This example confirms the preference

of investors for the most liquid places.

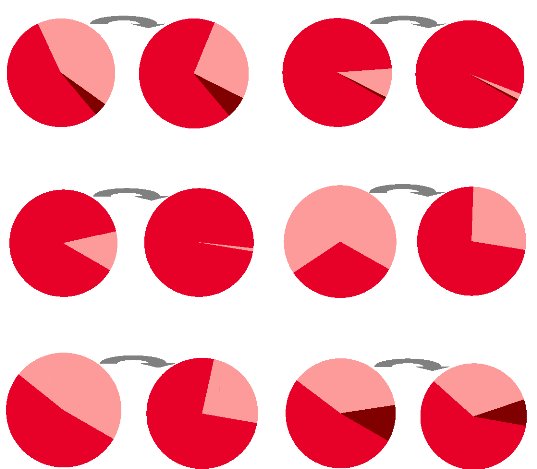

However, it is important to have a closer look at the foreign

cross-listings in the United States. Indeed the exhibit #37, clearly suggests

that a foreign cross-listing in the United States is generally not impacted by

the fading listing phenomenon. As we may notice, companies resulting from

merger operations with an American company naturally have a significant share

of their trading activity performed in New York; share which is even used to

gaining in weight over the years (GlaxoSmithKline 18% in 2008 vs. 12% in 2000),

Alcatel-Lucent (32% in 2008 vs. 24% in January 2007). But such levels may also

concern companies not resulting of a merger operation such as the German

companies SAP (24% in 2008 vs. 10% in 2000) and Infineon AG (17% in 2008 vs.

5.8% in 2004), the British Diageo (22% in 2008 vs. 8% in 2000). Therefore,

after a foreign cross-listing in the United States, we may state that the

American listing gains in importance in the company's total trading

activity.

#37: Evolutions of the Share in Total Volumes of Foreign

Cross-Listings

in New York (Period 2000-2008)

|

British

Companies

|

French

Companies

|

German

Companies

|

Japanese

Companies

|

New York

Examples

|

|

|

|

|

|

+44%

|

+37%

|

+373%

|

|

32%

Alcatel-Lucent

|

24%

SAP

|

25%

Nidec

|

% max of volumes traded in New York

Company

|

|

Source: ThomsonReuters Datastream

AstraZeneca

As of after the merger, i.e. 01/2000 As of 11/2008

TeliaSonera

As of after the merger, i.e. 01/2003 As of 11/2008

Source: ThomsonReuters Datastream

66

#38: Shares of Volume Evolutions

ABB

Aventis

As of 01/2000 As of 11/2008

As of after the merger, i.e. 01/1999 As of 1/2004

Nyse Euronext

Euronext

Brussels

0.04%

Amsterdam

0.03%

Brussels

0.1%

As of before the merger w ith Nyse,

i.e. 5/2007

As of after the creation of Euronext,

i.e. 08/2001

As of after the merger, i.e. 05/2007 As of 11/2008

Amsterdam

-89%

Paris

99%

Paris

8%

9%

Paris

91% Amsterdam

Amsterdam

1%

New York

92%

Paris

-88%

New York

99% Paris

1%

Stockholm

Frankfurt

-88%

-34%

Paris

92%

Zurich

79%

Frankfurt

1%

Zurich

68%

Stockholm

32%

Stockholm

21%

Frankfurt

8% Paris

99%

Unibail-Rodamco

As of after the merger, i.e. 11/2007 As of 11/2008

EADS

As of after the merger, i.e. 01/2001 As of 11/2008

Amsterdam

-31%

Frankfurt

12%

Paris

87%

Paris

90%

Paris

76%

Spain

12%

Amsterdam

13%

Paris

91% Amsterdam

9%

Frankfurt -25%

Madrid -92%

Frankfurt

9% Spain

1%

London

62%

Stockholm

38%

Stockholm

-37%

London

76%

Stockholm

24%

Stockholm

76%

Helsinki

24%

Helsinki

-54%

Stockholm

89%

Helsinki

11%

Fortis

As of after the merger, i.e. 01/1992 As of 11/2008

Amsterdam

90%

Brussels

10%

Amsterdam

-13%

Amsterdam

78%

Brussels

22%

As of 01/2002 As of 11/2008

Copenhagen

26%

Stockholm

41%

Oslo

33%

Oslo -91%

Oslo

Stockholm 3%

68%

Copenhagen

29%

Anglo American AngloGold Ashanti

As of after the merger, i.e. 01/1 999 As of 11/2008

As of after the merger, i.e. 06/2004 As of 11/2008

Altadis

As of after the merger, i.e. 05/2000 As of 2/2008

SABMiller

As of after the IPO on L.S.E, i.e. 12/1999 As of 11/2008

Royal Dutch Shell

InBev

Paris

0.89%

Paris

0.59%

Nasdaq

4%

Johannesburg

-38%

Sydney -75%

Paris -34%

London

68%

Sydney

2%

London

54%

Johannesburg

42%

Johannesburg

26%

Johannesburg

91% Sydney

8%

Johannesburg

97%

Nasdaq

6%

Paris -94%

London

73%

London

32%

Madrid

88% Paris

12%

Madrid

99% Paris

0.7%

Johannesburg

68%

Johannesburg

-60%

Johannesburg

27%

As of after the merger, i.e. 04/2004 As of 11/2008

As of after the merger, i.e. 07/2005 As of 11/2008

Brazil

48%

Brazil -48%

Brazil

25%

London

38%

London -13%

London

33%

New York

8%

New York

11%

Belgium

75%

Belgium

52%

Amsterdam

51%

Amsterdam

59%

Source: ThomsonReuters Datastream

#39: Evolutions of the Share in Total Volumes of Foreign

Cross-Listings in

Financial Places Specialized in the Basic Resources and

Mining Sectors

(Period 2006-2008)

As Secondary Stock Share of Volume % of

Positive

Exchange Variation Variations *

|

|

|

|

|

|

|

|

|

TSX & TSX Venture L.S.E

|

|

|

+12.9%

+42.2%

|

|

|

|

38%

33%

|

|

ASX

|

|

|

+45.2%

|

|

|

|

57%

|

|

|

Source: ThomsonReuters Datastream

* Percentage of foreign cross-listing cases presenting an

increase of the weight of TSX, L.S.E or ASX in the total volumes

A first glance at the exhibit #39 would let suggest that

foreign cross-listings in specialized financial places are efficient thanks to

positive variations of the share in total volumes during the period 2006-2008.

The listing fading seems not to be verified for these cases of foreign

cross-listings, with shares in volume variation reaching +12.9% in Toronto,

+42.2% in London and +45.2% in Sydney.

However, this presumption has to be mitigated since the

tendency is not as clear as the one showed in the cases of foreign

cross-listings in the United States. Indeed, the findings are not totally

convincing, since the percentage of cases with positive variations is

relatively mixed for all three listing places, but above all a majority of

negative variations on the Toronto and the London stock exchanges. Only the

cases presenting negative shares of volumes variation suffer from the fading

listing phenomenon.

|