4. EMPIRICAL RESULTS

Fig.1

![]()

Fig.1

|

Portf Mean

|

Portf Risk

|

VaR

|

CVaR

|

|

M-V

|

0.0024

|

0.0171

|

0.0242

|

0.0372

|

|

MCVaR

|

0.00208

|

0.02274

|

0.0285

|

0.043

|

|

BL Cov

|

0.0032

|

0.0214

|

0.0000

|

0.0000

|

|

BL CAPM

|

0.0034

|

0.0221

|

|

|

In this empirical section we consider the weekly return data

on the JSE-ALSI from early February 2003 till late September 2010. The market

capitalization weights on the efficient portfolio are dominant of 24.9% on the

USD/ZAR exchange rate following by Chemical Index and there is no weight

allocated to Life insurance Index. The mean conditional variance is giving the

following figures through the risk budgets; the highest shares are in chemical,

technology and beverage by respectively 22.7%, 22.6% and 20.1%. The life

insurance stills the only stock which doesn't have any allocation.

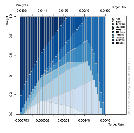

The fig.1 tells us that at a lowest risk with almost all the

weight will be allocated to USDZAR and some negative return on the USDZAR and

Technology Index. It's telling us also that at optimal point we have to

combine an important weight of the USDZAR with a target return of 0.000662 and

risk profile of 0.0111, following by Technology Index and almost a close weight

between the Bank Index and the Chemical. The highest level of risk will be

achieved with a target return of 0.0049 and Telecom will have the entire

maximum weight allocated.

The prior of the beverage index is very low to his posterior

while telecom has a high prior than the posterior. The highest weight is found

on the technology index where the prior and the posterior are almost closer to

0.8.

On fig.2 we have a highest portfolio mean on a Bayesian CAPM

which is the higher expected return and the lowest risk of the portfolio is

assigned to the Mean-Variance method. The highest expected value which can be

loosed and the highest expected value plus all negative losses is given by the

mean conditional value at risk method.

5. CONCLUSION

Traditional mean-variance portfolio optimization assumes that

it is extremely difficult to estimate expected returns precisely. In practice,

portfolios that ignore estimation error have very poor properties: the

portfolio weights have extreme values that fluctuate dramatically over time and

deliver very low Sharpe ratios over time. The Bayesian approach allows a

Bayesian investor to include a certain degree of belief in a portfolio

selection model. In this paper, we have shown how to allow

for the possibility of multiple priors about the estimated expected returns and

the underlying market return model. And, in addition to the standard

optimization of the mean-variance objective function over the choice of

weights, one also will provide the lowest value at risk and the conditional

value at risk. This study uses theoretically motivated prior and posterior

information about expected returns in portfolio selection. From an estimation

perspective, the focus on expected returns could be helpful since it is well

known that means are in general estimated with much less precision than

covariance. Nevertheless, using prior information to impose some structure on

the Black Litterman covariance matrix could potentially also be beneficial,

especially for a large number of stocks.

Reference

1. Polson, N. G., and Tew, B. V., 2000. Bayesian

portfolio selection: An empirical analysis of the S&P 500 index

1970-1996. Journal of Business & Economic Statistics,

18(2)

2. J.M MWAMBA, Slides of Bayesian asset pricing,

MCom Financial Economics, 2010

|