6. Appendix

VaR.5% : -0.02851397 CVaR.5% : -0.04303770

Title:

MV Efficient Portfolio

Portfolio Weights:

Alsi Bank Beverage Chemical Equity.Inv Life.Insur

Telecom

0.0000 0.0854 0.1421 0.2242 0.0747 0.0000

0.0958

Technol USDZAR Risk.free

0.1244 0.2489 0.0044

Covariance Risk Budgets:

Alsi Bank Beverage Chemical Equity.Inv Life.Insur

Telecom

0.0000 0.1034 0.2012 0.2256 0.0814 0.0000

0.1432

Technol USDZAR Risk.free

0.2270 0.0185 -0.0003

Target Return and Risks:

mean mu Cov Sigma CVaR VaR

0.0024 0.0024 0.0171 0.0171 0.0372 0.0242

![]()

Iterations = 1001:11000

Thinning interval = 1

Number of chains = 1

Sample size per chain = 10000

1. Empirical mean and standard deviation for each variable,

plus standard error of the mean:

Mean SD Naive SE Time-series

SE

(Intercept) -0.0001138 8.713e-04 8.713e-06

1.073e-05

Dataset$Bank 0.1434273 3.481e-02 3.481e-04

2.628e-04

Dataset$Beverage 0.2692399 3.065e-02 3.065e-04

2.718e-04

Dataset$Chemical 0.1113228 3.898e-02 3.898e-04

3.467e-04

Dataset$Equity.Inv 0.0349513 3.327e-02 3.327e-04

3.460e-04

Dataset$Life.Insur 0.1670380 3.429e-02 3.429e-04

3.237e-04

Dataset$Telecom 0.1217420 2.772e-02 2.772e-04

2.699e-04

Dataset$Technol 0.1121895 2.673e-02 2.673e-04

2.366e-04

Dataset$USDZAR -0.0245311 3.799e-02 3.799e-04

3.799e-04

sigma2 0.0003003 2.175e-05 2.175e-07

2.134e-07

2. Quantiles for each variable:

2.5% 25% 50% 75%

97.5%

(Intercept) -0.0018314 -0.0007030 -0.0001028 0.0004741

0.0015800

Dataset$Bank 0.0758993 0.1192552 0.1433875 0.1667630

0.2121726

Dataset$Beverage 0.2088588 0.2486275 0.2690060 0.2898102

0.3288659

Dataset$Chemical 0.0353141 0.0851677 0.1112476 0.1371965

0.1893481

Dataset$Equity.Inv -0.0310190 0.0126328 0.0350995 0.0573648

0.1001137

Dataset$Life.Insur 0.0991277 0.1438379 0.1670621 0.1899787

0.2345747

Dataset$Telecom 0.0672014 0.1030527 0.1216117 0.1406669

0.1759571

Dataset$Technol 0.0593993 0.0945787 0.1124306 0.1299468

0.1643140

Dataset$USDZAR -0.0993244 -0.0497875 -0.0244516 0.0011008

0.0491126

sigma2 0.0002603 0.0002851 0.0002993 0.0003141

0.0003461

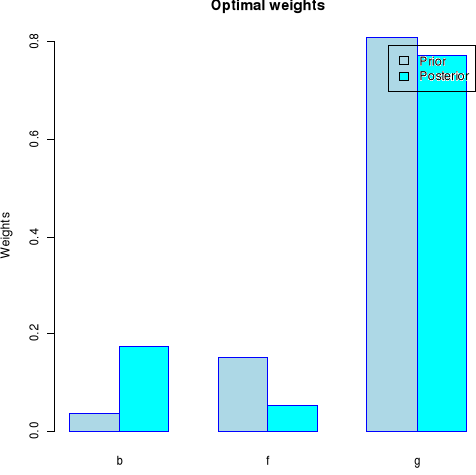

$priorPfolioWeights

a b c d e f

g

0.00000000 0.03770282 0.00000000 0.00000000 0.00000000 0.15294225

0.80935492

h

0.00000000

$postPfolioWeights

a b c d e f

g h

0.00000000 0.17475666 0.00000000 0.00000000 0.00000000 0.05346057

0.77178277

0.00000000

![]()

Title:

MV Tangency Portfolio

Estimator: .priorEstim

Solver: solveRquadprog

Optimize: minRisk

Constraints: LongOnly

Portfolio Weights:

a b c d e f g h

0.0417 0.2299 0.2235 0.0374 0.0000 0.1561 0.1818 0.1297

Covariance Risk Budgets:

a b c d e f g h

Target Return and Risks:

mean mu Cov Sigma CVaR VaR

0.0000 0.0030 0.0213 0.0000 0.0000

Description:

Tue Sep 28 15:35:54 2010 by user: General

$posteriorOptimPortfolio

Title:

MV Tangency Portfolio

Estimator: .posteriorEstim

Solver: solveRquadprog

Optimize: minRisk

Constraints: LongOnly

Portfolio Weights:

a b c d e f g h

0.0064 0.2508 0.2846 0.0000 0.0000 0.1357 0.1875 0.1350

Covariance Risk Budgets:

a b c d e f g h

Target Return and Risks:

mean mu Cov Sigma CVaR VaR

0.0000 0.0032 0.0214 0.0000 0.0000

Description:

Tue Sep 28 15:35:54 2010 by user: General

attr(,"class")

[1] "BLOptimPortfolios"

Iterations = 1001:11000

Thinning interval = 1

Number of chains = 1

Sample size per chain = 10000

1. Empirical mean and standard deviation for each variable,

plus standard error of the mean:

Mean SD Naive SE Time-series SE

(Intercept) 0.0009522 9.041e-04 9.041e-06 1.113e-05

Dataset$ebank 0.1398387 3.472e-02 3.472e-04 2.861e-04

Dataset$ebev 0.2688045 3.071e-02 3.071e-04 2.712e-04

Dataset$echem 0.1319496 3.712e-02 3.712e-04 3.282e-04

Dataset$eequit 0.0540071 3.231e-02 3.231e-04 3.318e-04

Dataset$elife 0.1775072 3.386e-02 3.386e-04 3.226e-04

Dataset$etelec 0.1266767 2.786e-02 2.786e-04 2.673e-04

Dataset$etech 0.1179304 2.654e-02 2.654e-04 2.457e-04

Dataset$eusazar -0.0094296 3.607e-02 3.607e-04 3.740e-04

sigma2 0.0003012 2.182e-05 2.182e-07 2.140e-07

2. Quantiles for each variable:

2.5% 25% 50% 75%

97.5%

(Intercept) -0.0008301 0.0003408 0.0009637 0.0015623

0.0027097

Dataset$ebank 0.0720157 0.1161651 0.1402517 0.1631226

0.2073024

Dataset$ebev 0.2085894 0.2482177 0.2686163 0.2893781

0.3291133

Dataset$echem 0.0599178 0.1070750 0.1317707 0.1565901

0.2057048

Dataset$eequit -0.0100727 0.0322763 0.0539325 0.0757838

0.1172233

Dataset$elife 0.1106212 0.1548548 0.1774808 0.2002120

0.2440648

Dataset$etelec 0.0719587 0.1081133 0.1265930 0.1455601

0.1808797

Dataset$etech 0.0657202 0.1002334 0.1182699 0.1358541

0.1696935

Dataset$eusazar -0.0808365 -0.0333380 -0.0095017 0.0147699

0.0617244

sigma2 0.0002611 0.0002860 0.0003002 0.0003151

0.0003471

|