4.3.3 Delivering flexible financial services

4.3.3.1 Savings

Notwithstanding the widespread understanding that poor people

especially living in rural and remote areas do save in different ways (Mersland

& Eggen, 2007), there is nowadays increasing evidence that monetary savings

in banks or MFIs are growing tremendously.

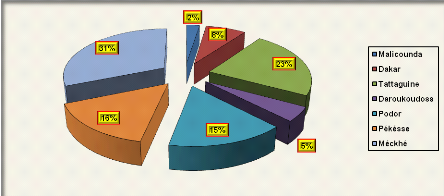

The figure 5 depicts the contribution of each MFI in savings

mobilization in 2011.

Figure 5: MFIs contribution

to the network saving mobilization in 2011

Source: Our survey (may-august

2012)

It appears from the figure 5 that in 2011, the CREC UGPM of

Méckhé and the MEC SAPP of Tattaguine contributed both for about

54% of the network savings meaning an uneven ability of savings mobilization

amongst the seven MFIs.

Besides, the savings growth rate recorded by the seven MFIs in

the last three years is about 14.5% with some variations between MFIs.

The increasing savings at the MEC SAPP (annual average growth

of 18%) is peculiarly vindicated by its targeting strategy based on periodic

service points and the mandatory savings' requirements before loans granting

(33% of the loan).

In contrast, despite the high annual average savings growth at

the MEC MFR of Malicounda of about 29%, its contribution to the entire MFIs is

about only 2% in 2011. This situation can be explained not only by the

malfunctioning of its mother-association, but also by the difficulties of the

MFI to meet its members' financial needs. For example fewer loans were granted

in 2008 and 2009.

If similar savings growth tendency is witnessed at the MEC

Koyli Winrdé of Podor (average growth of 31%), it is not the case of MEC

FAM of Dakar (6%) showing tremendous difficulties for collecting savings. On

the other hand, the MEC FAM of Dakar recorded very low amount in savings with

low contribution to the network (8%) owing to a prior situation of bad

financial governance especially in 2009 leading to a crisis of confidence

between staff, board members and the MFI members, despite of the creation of a

periodic service point.

The savings amount collected at the CREC Méckhé

entailing its noteworthy contribution to the network (31%) is chiefly boosted

by the mother association (Union des Groupements de Producteurs de

Meckhé) and the economic interest grouping KAYER (Kayor Energie Rural)

which have opened accounts in the MFI for financial transactions with their

members or clients respectively.

Overall, the savings collected can be gathered in three main

categories:

- The demand deposits. It is the most dominant savings product

(in average 53% of total deposits) over the last four years for all the seven

MFIs.

- Term deposit: it is interest bearing deposit in favour of

depositors. In most of the MFIs, the interest varies from 3 to 5% with maturity

of 3 to 7 months for short term deposits and more than 12 months for long terms

deposits.

- Compulsory savings: in all the MFIs surveyed, the compulsory

savings is one on the requirement to have access to credit. It replaces

tangible collateral and helps MFIs mitigate credit risk as the provision of

collateral assets in rural areas is very tricky. In general, the compulsory

savings vary between 10 and 25% except in the MEC SAPP where the compulsory

savings is about 33%.

Likewise, some periodic compulsory savings are collected from

the members in the MEC FAM of Dakar and MEC Koyli Winrdé (FONGS

FINRURAL, 2011).

|