5.1.4.2 Operational self sufficiency: struggling to

survive

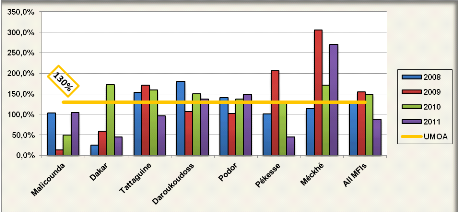

Operational self sufficiency appears as on key element of an

MFI performance. Measuring the extent to which a MFI can cover its ordinary

cost through operating income, it helps to evince whether a given MFI can

sustain without any subsidy. The figure 13 reveals the operational self

sufficiency of the seven MFIs over the past four year.

Figure 13: Operational Self

Sufficiency 2008-2011

Source: Our survey (may-august

2012)

The surveyed MFIs show up different features of OSS over time.

While some have reached the OSS and continue keeping the trend, others continue

striving to reach the OSS.

For example, the figure 13 underscores that for the last four

years OSS of the MEC MFR of Malicounda fluctuated tremendously between 103% and

104% whereas the MEC FAM of Dakar recorded only once a ratio higher than 100%

(in 2010). In the industry and specifically in UMOA region, a minimum

threshold of 130% is required to become really operationally self sufficient.

As consequence, the two MFIs cannot really survive without any donation or

subsidy. However since 2009, the operational self sufficiency ratio of

Malicounda is increasing showing some improvement.

The MEC SAPP of Tattaguine and MFR of Pékésse

recorded in 2011 a very low operational self sufficiency ratio (96% and 44%

respectively) due mainly their aforementioned administrative and personal

expenses.

The CREC of Méckhé sustained its OSS over 130%

during the last three years implying its ability to operate without any kind of

donation.

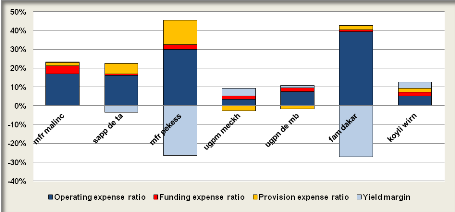

The case of the MEC FAM is mainly due to its operating areas,

urban and peri-urban. It is the only one MFI of the network operating with

headquarters in Dakar, the capital city of the Senegal. Therefore personnel

expenses might be higher than the other operating in rural areas as shown

through the figure 14.

Figure 14: Breakdown of

portfolio yield 2011

Source: Our survey (may-august

2012)

The figure 14 shows indeed that the MEC of Dakar reported the

highest operating expenses ratio compared with its peers; entailing then a

negative yield margin.

Considering the network as a whole, after having recorded very

high operational self sufficiency ratios in 2009 and 2010 (figure 13), the

operational self sufficiency of the entire seven MFIs is about 88% in 2011,

showing that the network still need subsidy to operate properly. This ratio is

mainly affected by the high operating expenses but very low financial

performances of the MEC of Tattaguine and Pékesse which contributed of

about 27% and 30% severally to the expenses of the entire network in 2011.

5.2 Social performance Analysis

Since 2000, miscellaneous initiatives were developed around

the world to improve the social performance measurement and management which

are perceived as the real implementation of social goals of MFIs (Hashemi,

2007:3 quoted by Bédécarrats, Baur & Lapennu, 2011). The

social performance measurement helps at assessing an MFI's social performance

as it permits to identify the level of application the social mission of an MFI

(Dewez & Neisa, 2009). It also helps at improving reciprocal trust, client

participation and satisfaction. As consequence, MFIs record higher repayment

rates and low their transactions costs (Lapenu, 2007 quoted by

Bédécarrats, Baur & Lapenu, 2011).

The social performance analysis is mainly based on the

ECHOS(c) tool of Incofin and includes five main dimensions: social mission

management, outreach and access, quality of customers (members) service in

compliance with client protection principles, human resources management,

environment and corporate social responsibility. The main intention was not to

assess and grade the social performance of the MFIs, rather the tool helped us

to have a sound insights on the situation among FONGS FINRURAL Network

affiliated MFIs as far as social performance is concerned.

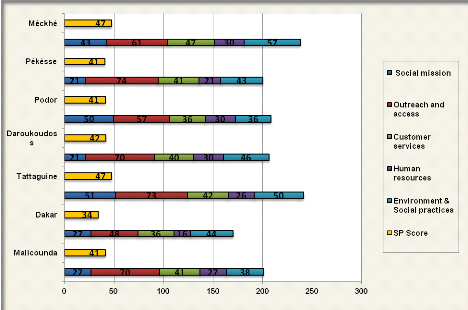

The figures 15 and 16 hereafter shows FONGS FINRURAL network

affiliated MFIs.

Figure 15: Social

Performances of the Seven MFIs

Source: Our survey (may-august

2012)

All the seven MFIs recorded social performance scores under

55% (based on ECHOS(c) scale) meaning a low social performance situation.

The MEC SAPP of Tattaguine and the CREC of

Méckhé recorded the highest score (47% each one) whereas the MEC

FAM of Dakar recorded the lowest score (34%).

All the seven MFIs present good scores in outreach an access

(65% in average). This is due mainly to their access conditions which are

competitive (affordable shares for membership, low cost for adhesion) and the

targeted area. Some MFIs are sole in their operational areas (Malicounda)

whilst others have opened additional periodic branches (SAP and FAM). This

finding corroborates Angora, Bédécarrats & Lapenu (2009) for

who sub Sahara MFIs tend to perform better in people targeting.

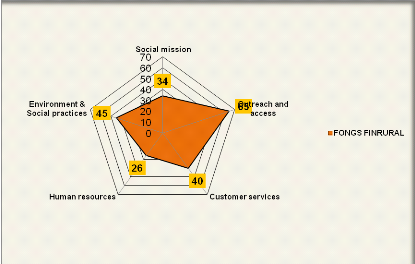

Figure 16: Social

performance of FONGS FINRURAL

Source: Our survey (may-august

2012)

In the opposite, low scores are observed in social mission and

human resources management (34% and 26% respectively). MFIs are perceived as

financial levers of mother associations and their missions are supposed to be

ingrained in the social mission of development associations. However the social

missions of the seven MFIs are not clearly stated with key indicators people

could track. The lack of training and information regarding social management

is one of the causes of the situation. Moreover, the staffs of these

self-managed MFIs are most often hired within local human resources, are

unqualified even if they hold strong records in the field of microfinance.

Their position is mainly perceived as volunteer services. Nevertheless, the

staff rotation is really low as the staff members are also members of the MFIs.

In addition, the overall score in customer services dimension

is low (26) despite of the adapted products delivery. This might be due to the

non provision of diversified products such as Business development services,

insurance, remittances etc... The provision of BDS is mainly assumed by the

mother associations which officers are involved in the devising of members or

households investment projects, their follow up and loans repayment monitoring

as well. But these services are only limited to members which belong to both

MFI and mother association. Moreover, the MFIs assets level might not be

sufficient to get involved in the provision of others products.

The CREC UGPM of Méckhé recorded the highest

score in services to customers (57%) because of their experience in solar

energy loans in partnership with KAYER.

For the last dimension, social practices and environment, the

MFIs are not trained enough to include environmental dimension in their credit

policies. Nevertheless, credit committees are aware that they should not grant

loan for activities that may damage the environment. Rather, MFIs are striving

to have access to some credit line to finance solar energy and biogas.

|