ANNEXES

ANNEXES 3 : résultats des estimations et test

de validation

|

Date: 07/24/05 Time: 13:14

|

|

Sample(adjusted): 1972 2003

|

|

Included observations: 32 after adjusting endpoints

|

|

Trend assumption: No deterministic trend

|

|

Series: DBP IPF PRH

|

|

Lags interval (in first differences): 1 to 1

|

|

|

|

|

|

|

Unrestricted Cointegration Rank Test

|

|

Hypothesized

|

|

Trace

|

5 Percent

|

1 Percent

|

|

No. of CE(s)

|

Eigenvalue

|

Statistic

|

Critical Value

|

Critical Value

|

|

None

|

0.260778

|

11.14384

|

24.31

|

29.75

|

|

At most 1

|

0.044681

|

1.474834

|

12.53

|

16.31

|

|

At most 2

|

0.000379

|

0.012115

|

3.84

|

6.51

|

|

*(**) denotes rejection of the hypothesis at the 5%(1%)

level

|

|

Trace test indicates no cointegration at both 5% and 1%

levels

|

|

|

|

|

|

|

Method: Least Squares

|

|

Date: 07/21/05 Time: 11:46

|

|

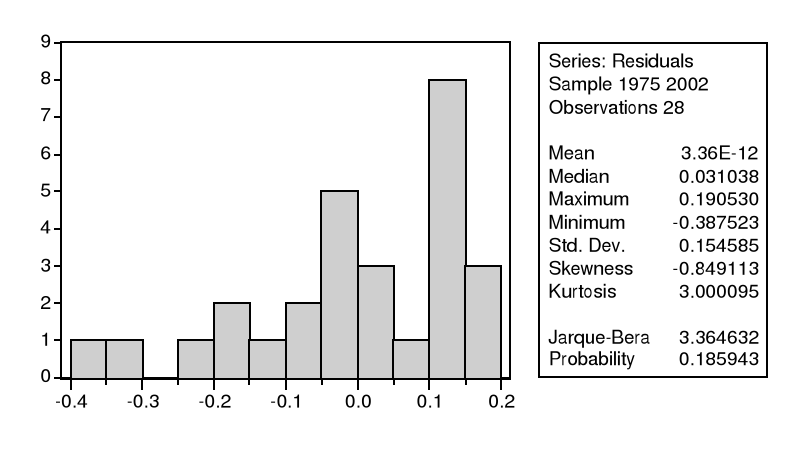

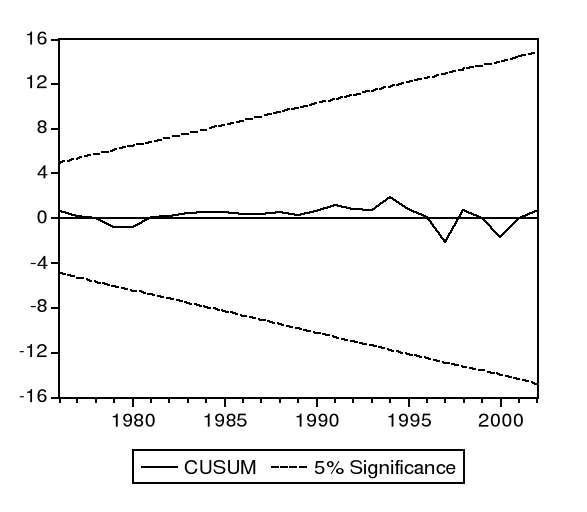

Sample(adjusted): 1975 2002

|

|

Included observations: 28 after adjusting endpoints

|

|

Convergence achieved after 15 iterations

|

|

Newey-West HAC Standard Errors & Covariance (lag

truncation=3)

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

D(LOG(IPF))

|

0.107282

|

0.050923

|

2.106730

|

0.0494

|

|

D(LOG(PRH))

|

0.002161

|

0.077636

|

0.027840

|

0.9781

|

|

TCRE

|

-2.075139

|

0.539634

|

-3.845454

|

0.0012

|

|

C

|

0.181314

|

0.042870

|

4.229432

|

0.0005

|

|

INFL

|

-2.348638

|

0.598107

|

-3.926787

|

0.0010

|

|

D(LOG(PRH(-1)))

|

0.208895

|

0.049707

|

4.202540

|

0.0005

|

|

D(LOG(IPF(-1)))

|

-0.060772

|

0.032468

|

-1.871765

|

0.0776

|

|

AR(1)

|

-1.046933

|

0.136297

|

-7.681241

|

0.0000

|

|

AR(2)

|

-0.993087

|

0.235064

|

-4.224747

|

0.0005

|

|

AR(3)

|

-0.619111

|

0.265611

|

-2.330890

|

0.0316

|

|

R-squared

|

0.602178

|

Mean dependent var

|

0.010650

|

|

Adjusted R-squared

|

0.403268

|

S.D. dependent var

|

0.245088

|

|

S.E. of regression

|

0.189327

|

Akaike info criterion

|

-0.218228

|

|

Sum squared resid

|

0.645205

|

Schwarz criterion

|

0.257559

|

|

Log likelihood

|

13.05520

|

F-statistic

|

3.027379

|

|

Durbin-Watson stat

|

2.039324

|

Prob(F-statistic)

|

0.021746

|

|

Inverted AR Roots

|

-.13 -.88i

|

-.13+.88i

|

-.79

|

|

White Heteroskedasticity Test:

|

|

F-statistic

|

0.549261

|

Probability

|

0.849503

|

|

Obs*R-squared

|

8.547569

|

Probability

|

0.741011

|

|

|

|

|

|

|

Test Equation:

|

|

Dependent Variable: RESID^2

|

|

Method: Least Squares

|

|

Date: 07/26/05 Time: 10:50

|

|

Sample: 1975 2002

|

|

Included observations: 28

|

|

Newey-West HAC Standard Errors & Covariance (lag

truncation=3)

|

|

Date: 07/24/05 Time: 13:39

|

|

Sample(adjusted): 1972 2003

|

|

Included observations: 32 after adjusting endpoints

|

|

Trend assumption: No deterministic trend

|

|

Series: FB CRI INSTA IPF PRH

|

|

Lags interval (in first differences): 1 to 1

|

|

|

|

|

|

|

Unrestricted Cointegration Rank Test

|

|

Hypothesized

|

|

Trace

|

5 Percent

|

1 Percent

|

|

No. of CE(s)

|

Eigenvalue

|

Statistic

|

Critical Value

|

Critical Value

|

|

None

|

0.422889

|

42.61377

|

59.46

|

66.52

|

|

At most 1

|

0.303502

|

25.02272

|

39.89

|

45.58

|

|

At most 2

|

0.285725

|

13.44863

|

24.31

|

29.75

|

|

At most 3

|

0.080271

|

2.681056

|

12.53

|

16.31

|

|

At most 4

|

0.000107

|

0.003421

|

3.84

|

6.51

|

|

*(**) denotes rejection of the hypothesis at the 5%(1%)

level

|

|

Trace test indicates no cointegration at both 5% and 1%

levels

|

|

|

|

|

|

|

Dependent Variable: D(LOG(FB))

|

|

Method: Least Squares

|

|

Date: 07/07/05 Time: 19:15

|

|

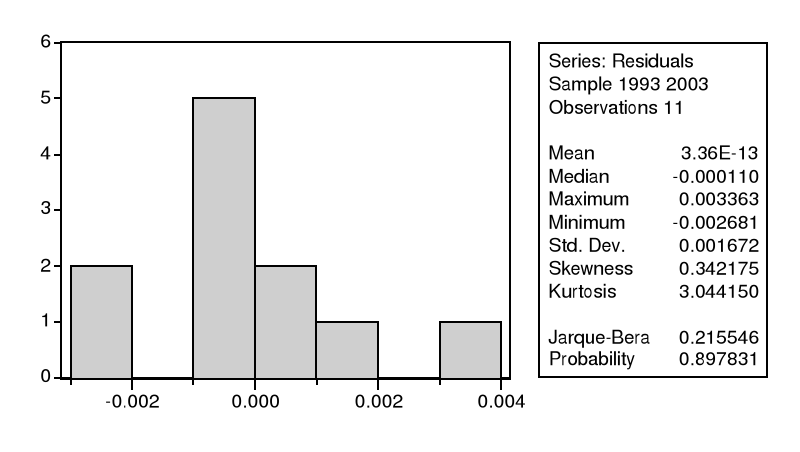

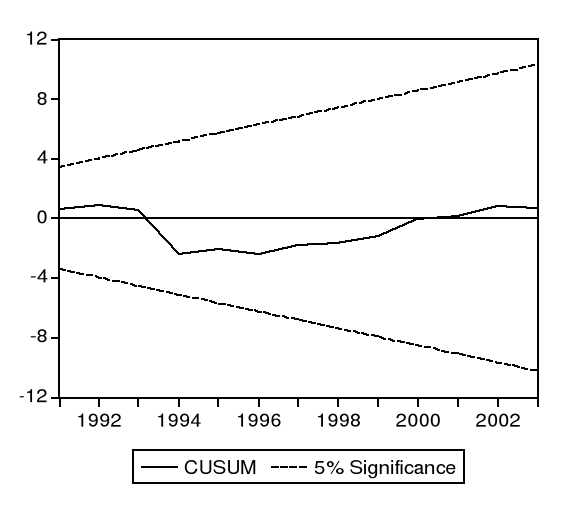

Sample(adjusted): 1993 2003

|

|

Included observations: 11 after adjusting endpoints

|

|

Convergence achieved after 12 iterations

|

|

Newey-West HAC Standard Errors & Covariance (lag

truncation=2)

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

LOG(INSTA)

|

-0.047331

|

0.008102

|

-5.841781

|

0.0281

|

|

D(LOG(IPF))

|

-0.062008

|

0.004956

|

-12.51219

|

0.0063

|

|

D(LOG(PRH))

|

-0.663499

|

0.089027

|

-7.452776

|

0.0175

|

|

D(LOG(CRI))

|

0.022462

|

0.002617

|

8.581704

|

0.0133

|

|

TDRE

|

0.514929

|

0.044019

|

11.69778

|

0.0072

|

|

C

|

-0.114341

|

0.005520

|

-20.71316

|

0.0023

|

|

AR(3)

|

-0.119872

|

0.034805

|

-3.444102

|

0.0749

|

|

AR(1)

|

-1.544709

|

0.073251

|

-21.08794

|

0.0022

|

|

AR(2)

|

-0.858790

|

0.103917

|

-8.264228

|

0.0143

|

|

R-squared

|

0.999630

|

Mean dependent var

|

-0.076426

|

|

Adjusted R-squared

|

0.998149

|

S.D. dependent var

|

0.086877

|

|

S.E. of regression

|

0.003738

|

Akaike info criterion

|

-8.409076

|

|

Sum squared resid

|

2.79E-05

|

Schwarz criterion

|

-8.083525

|

|

Log likelihood

|

55.24992

|

F-statistic

|

675.0753

|

|

Durbin-Watson stat

|

1.868593

|

Prob(F-statistic)

|

0.001480

|

|

Inverted AR Roots

|

-.21

|

-.67+.37i

|

-.67 -.37i

|

|

White Heteroskedasticity Test:

|

|

F-statistic

|

4.134383

|

Probability

|

0.365372

|

|

Obs*R-squared

|

10.71211

|

Probability

|

0.295959

|

|

|

|

|

|

|

Test Equation:

|

|

Dependent Variable: RESID^2

|

|

Method: Least Squares

|

|

Date: 07/26/05 Time: 10:53

|

|

Sample: 1993 2003

|

|

Included observations: 11

|

|

Newey-West HAC Standard Errors & Covariance (lag

truncation=2)

|

|