II.1 Exchange rate and fundamentals

a) Flexi-price Monetary model

The model concentrates on the current account and assumes

prices are flexible and output is exogenous, determine by the supply side of

the economy. It's relies on the PPP condition and a stable demand for money

function. The logarithm of the demand for money may be assumed to depend on the

log of real income, Y, the price level, P, and the level of the interest rate,

r

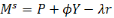

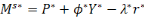

(Domestic equilibrium) (2.3) (Domestic equilibrium) (2.3)

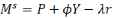

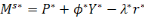

(Foreign equilibrium) (2.4) (Foreign equilibrium) (2.4)

Where ? is a coefficient parameter of real income and ë the

coefficient of the interest rate. In this model the domestic r is exogenous

because of the assumption of perfect capital mobility and a zero expected

change in the exchange rate. The equilibrium in traded exchange market ensues

when prices in a common currency are equalised; by using the PPP condition:

(2.5) (2.5)

b) Dornbusch overshooting model

In 1976, Dornbusch model begin with a description of the main

behavioural assumption. The uncovered interest parity relationship expresses

the conditions for equilibrium. Foreign exchange speculators investing abroad

expect a return of   +u%, where +u%, where   the foreign interest rate and u is is the expected appreciation of

foreign currency (depreciation in domestic currency). the foreign interest rate and u is is the expected appreciation of

foreign currency (depreciation in domestic currency).   (2.6) (2.6)

the expectation about the exchange rate are assumed to be

regressive; if the actual rate lies below the long run equilibrium rate, s,

therefore the expectation of actual rate to rise towards the long-run(Keith,

p293);    (2.7) (2.7)

The rational expectation in this formula allows having a

correct expectation:

(Equation in the money market) (Equation in the money market)

(Good market) (Good market)

Where the first term represents the impact of real exchange

rate on net trade volumes, the second (-är) is the invest schedule, the

third term ( Y) the consumption function and expenditure effects on imports and the

final term ( Y) the consumption function and expenditure effects on imports and the

final term ( ') exogenous demand factors such as government expenditure. ') exogenous demand factors such as government expenditure.

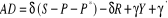

c) Frankel real interest differential model

In 1979 Jeffrey Frankel provides a model for analysing the

impact of change in the interest rate on the exchange rate and he refers to

this as «the real interest differential model». This model assumes

uncovered arbitrage but modifies the Dornbusch expectation equation for the

exchange rate by adding a term reflecting relative expected secular

inflation the expectation equation is(Keith p295): the expectation equation is(Keith p295):

And an uncovered interest parity yield is:

The term  is the expected rate of depreciation which depends upon the deviation

of the exchange rate from its equilibrium value. If is the expected rate of depreciation which depends upon the deviation

of the exchange rate from its equilibrium value. If , the expected rate of depreciation is given by the expected inflation

differential. , the expected rate of depreciation is given by the expected inflation

differential.

d) Noise Traders model

It have been noted that the risk neutrality and rational

expectation assumptions are not consistent with the empirical results on

forward rate unbiased and speculation in the spot market through the uncovered

interest parity condition. The irrational traders probably do influence spot

rates but such behaviour, based on results from chartists expectation, are

likely to have only a short run impact on freely floating spot rates and

chartists behaviour is unlikely to be destabilising, independently of other

trader's behaviour. They may drive a value of the asset away from its

fundamental value, and creates an opportunity for arbitrage for the rational

investor.

|