B. Correlation between Consumer

Price Index and Real Gross Domestic Product

1. Summary of output from SPSS regression analysis

between CPI and GDP

|

Variables

|

Coefficients

|

t

|

P-Value

|

|

Constant

|

-4.678

|

-4.334

|

0.000

|

|

Gross Domestic Product

|

0.661

|

8.203

|

0.000

|

|

R = 0.888 Confidence intervals = 95%

F= 67.335 R Squared = 0.789 Model significance = 0.000

|

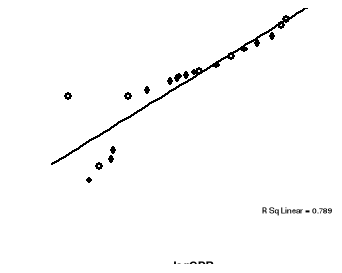

2. Graph2: Trends in CPI and GDP,

1990-2009

This shows that there is a correlation between GDP and CPI.

This is known as a weak positive correlation as the line goes up meaning that

if the GDP increases, CPI also increases which differs from the output of

regression analysis of the general model as well as the monetarist theory

whereby an increase in GDP should affect a decrease in CPI.

Consider the observed t-value of Real GDP (8.206) shows that

it lies in the critical region or region of rejection of null hypothesis.

Therefore we accept the alternative hypothesis says that Output has a

significant effect on inflation rate in Rwanda. Since an increase of one unit

in output (Real GDP) affect a decrease of 66.1% in Consumer price index

C. Correlation between Consumer Price

Index and Exchange rate

1. Summary of output from SPSS regression analysis

between CPI and ER

|

Variables

|

Coefficients

|

t

|

P-Value

|

|

Constant

|

-1.003

|

-2.229

|

0.039

|

|

Exchange rate

|

0.893

|

11.541

|

0.000

|

|

R = 0.939 Confidence intervals = 95% F=

133.205 R Squared = 0.881 Model significance = 0.000

|

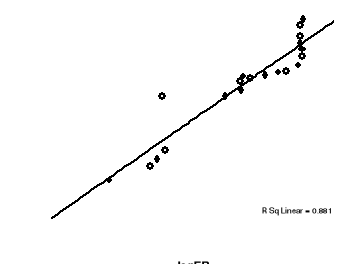

2. Graph3: Trends in CPI and Exchange

rate, 1990-2009

This scatter plot describes weak positive trend between

Exchange rate and CPI, The value of CPI increases slightly as the value of

exchange rate increases. P-value (0.000) is statistical significant, the

t-values of exchange rate (11.541) lies in the critical region. Therefore, we

reject the null hypothesis and confirm the alternative hypothesis says that

exchange rate has a positive effect on inflation rate in Rwanda. In addition

one unitary change in exchange rate affects an increase in consumer price index

by 32.55%

D. Correlation between Consumer Price

Index and Lending rate

1. Summary of output from SPSS regression analysis

between CPI and LR

|

Variables

|

Coefficients

|

t

|

P-Value

|

|

Constant

|

-4.763

|

-2.444

|

0.25

|

|

Lending rate

|

3.255

|

4.586

|

0.000

|

|

R = 0.734 Confidence intervals = 95% F=

21.034 R Squared = 0.539 Model significance = 0.000

|

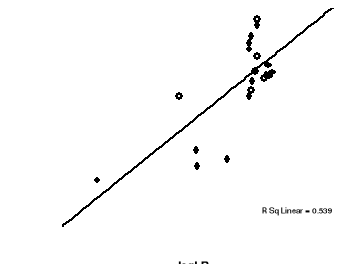

2. Graph 4: Trends in CPI and Lending

rate, 1990-2009

In this graph the plots are not on a completely straight line

but some are near each other and a line tends upward therefore there is a

positive correlation though but not strong. The value of CPI seems to be

related to the value of lending rate, but the relationship is not easily

determined.

Considering the result of the regression analysis, t-values of

lending rate (4.586) lies in the rejection area of null hypothesis and is also

statistical significance as shown by P-value (0.000). As conclusion we accept

the alternative hypothesis says that Lending rate has effect on inflation rate

in Rwanda. Since the change in one unit of lending rate affect an increase by

325.5% in consumer price index.

|