II.3. Empirical Interpretation of the Results

II.3.a. Geographic Distribution

This study focuses on companies which are foreign

cross-listed on the main world financial places located in 15 countries: the

United States, Canada, Australia, Japan, The United Kingdom, France, Germany,

the Netherlands, Belgium, Switzerland, Northern Europe (Sweden, Finland and

Denmark), Italy and Spain.

This analysis records a total of 1,347 foreign cross-listing

cases. Among these 1,347 foreign cross-listings, 873 (64.8%) come from the main

MEDC28 countries, whereas the rest comes from Eastern Europe,

Russia, Turkey, China, India, Taiwan, South Korea, Pakistan, Indonesia,

Singapore, New Zealand, Israel, South America and Africa.

As we could anticipate, the most attractive places are the

American stock exchanges (Nyse, Nyse Alternext and Nasdaq), the L.S.E and to a

lesser extent the Swiss Stock Exchange, with respectively 518, 310 and 141

cross-listings of foreign companies. This supremacy is probably linked to the

strong degree of internationalisation of these stock exchanges (see following

exhibit #17), the predominant influence of three of the strongest currency in

the world (US Dollar, British Pound and Swiss Franc), but also the weight in

the world financial system of Wall Street, the City and the Swiss banking

industry.

#17: Weight of Foreign Companies on Each Main Stock

Exchange29

21.7%

19.6% 18.2% 17.6%

12.1% 11.5%

7.0%

4.1% 3.1% 2.0% 1.8% 1.1% 1.0%

24.4%

Source: World Federation of Exchanges

28 More Economically Developed Countries (Germany,

France, U.K, Switzerland, Italy, Spain, Netherlands, Belgium, Scandinavia,

Canada, the United States, Japan and Australia)

29 Excluding investment funds and Calculated in terms

of number of companies

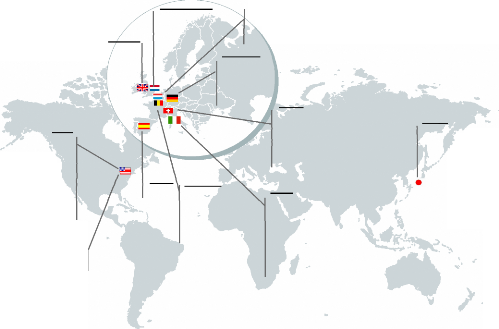

The exhibit #18 provides a global overview of the interest in

foreign cross-listin by local companies.

#18: Number of National Companies Cross-Listed Abroad

Total Cross-

Listings Abroad

Degree of

cross-listing 43

Total Cross-

Listings Abroad

Degree of

cross-listing 43

|

U.S

|

Canada

|

France

|

Japan

|

Australia

|

|

Worldwide

|

Spain

|

Italy

|

|

224

|

|

79

3.9%

Belgium

|

Swiss

|

873

4.7%

Scandinavia

|

|

10.3%

|

|

U.K

|

|

89

4.9%

|

66

|

55

|

17

|

11

4.4%

|

25

|

15

|

10

3.5%

|

|

38.7%

|

9.1%

|

|

9.9%

|

|

The Canada and the United States present both the greater

number of cross- listings abroad, with respectively 224 and 166 cases, that is

to say 25.7% and 19.0% of the total sample. However, after a more precise

analysis of the degree of cross-listings31, it appears that Canadian

companies are much more favorable for foreign cross-listings, since 10.3% of

companies listed on the TSX and TSX Venture have another listing abroad vs.

only 2.6% for American ones. In the past, Canadian companies have been

historically cross-listed in the United States, whereas the reverse is not

completely true: 77.7% of Canadian foreign cross- listings are performed in the

United States vs. only 20.5% for American companies in Canada. Worldwide, the

degree of cross-listing represents 4.7% of all national listings.

According to the results, it emerges that companies from the

Euro Zone32 are the most eager to perform foreign cross-listings

(Euro Zone average at 8.2%), even if result are relatively disparate (from 3.5%

up to 38.7%). The other countries reach a maximum of 4.9% (one notable

exception, Canada which is at the same level as France and Spain, i.e. circa

10%). Moreover, the Euro Zone companies appear more likely to perform a second

listing inside the Euro Zone (77.2% of cases),

30 Number of cross-listings performed by national

companies / Number of national companies listed

31 # of cross-listings abroad performed by national companies /

Total # of national companies listed on the national stock exchange

32 The Netherlands, France, Spain, Belgium, Germany

and Italy

whereas at the European Union scale the figure decreases to

64.2%. This result is not surprising since we may point up the beginning of a

unified European market materialized by a unique currency, a common top

authority (the European Commission) and the total abolition of borders.

#19: Distribution of French Cross-listed Companies

Peugeot Saint Gobain

Frankfurt

Eurotunnel

EADS Lagardère Sanofi

Saint Gobain Total

Tokyo

Alcatel-Lucent

Nyse

BNP Paribas

*****

Societe Generale *

***

Swiss

Alcatel-Lucent GDF Suez

Axa Sanofi

BNP Paribas Scor

Danone Saint Gobain

France Telecom Total

LVMH Vivendi

Spain

Brussels

~ ~~ ~ ~ ~

Milan

EADS

Alcatel-Lucent

Axa

CGG Veritas

France

Telecom

Sanofi (ADR)

STMicroelectronics

Total

Thomson

Veolia

(ADR)

Alcatel-Lucent

GDF Suez Peugeot

Saint Gobain

Total Vranken-Pommery

Nasdaq

* Dassault Systemes

** Ilog

*** Wavecom

Alcatel-Lucent LVMH

AXA PPR

BNP Paribas Renault

Carrefour Sanofi

Crédit Agricole Societe Generale Danone

STMicroelectronics

France Telecom Vivendi

GDF suez Total

L'Oréal

Amsterdam

Alcatel-Lucent Saint Gobain

Air France-KLM STMicroelectronics EADS

Unibail-Rodamco

Gemalto

Luxembourg GDF Suez

London

Sources: Companies

* The delisting of Dassault Systemes from the Nasdaq in 2008

is in progress

** In 2008,the American IBM launched a takeover on

Ilog

*** In December 2008, the Canadian Sierra Wireless launched

a takeover on Wavecom

**** Societe Generale has announced its delisting from Tokyo

for the end of 2008 ***** BNP Paribas has announced its delisting from Tokyo

during the year 2009

II.3.b. Sector

A closer look at the exhibits #15 and #16 highlights the

correlation between the foreign cross-listings and the dynamism of cross-border

mergers/acquisitions at the European scale (e.g. connections between

France/Italia, France/Netherlands, U.K./Netherlands and

Germany/Switzerland).

As noticed in part I.3.c Financial Motivations, the findings

also verify the attractiveness of specialized financial places for some

sectors. The case of the Toronto Stock Exchange (TSX) is particularly eloquent

(see exhibit #20); among all the foreign cross-listings on the TSX, 87% are

performed by companies operating in the Mining or Oil & Gas sectors. The

analysis of the typical Canadian company listed on the TSX shows that more

Mining and Oil & Gas companies are listed on the TSX than on any other

financial place in the world (Mining and Oil & Gas represent 402 of the 612

Canadian companies listed on the TSX). This result is the consequence of the

major influences of these sectors within the Canadian economy.

#20: Weight of Companies Operating in

he Mining and Oit

& Gas sectors in the TSX

|

Canadian

Companies

on the TSX

|

Foreign

Cross-Listings

on the TSX

|

Mining

|

267

|

87

|

Oil & Gas

|

135

|

12

|

Sum

|

402

|

99

|

% of all Canadian companies on the TSX

|

66%

|

|

|

% of cross-listed companies on the TSX

|

|

87%

|

|

|

This tendency may also be verified with the

technology-IT-biotech companies foreign cross-listed on the Nasdaq, with 77% of

Australian cross-listed companies operating in the Pharmaceutical or

Biotechnology sector.

Another example: among the 41 Israeli cross-listed companies

on the Nasdaq, 40 are operating in the Pharmaceutical, Biotech or IT sectors.

In comparison, there are only 3 Israeli foreign cross-listings on the Nyse and

4 on the L.S.E.

Moreover, we may notice that a major player within a sector

has an influence on the foreign cross-listings of its peers by attracting them

in its primary listing place. The rationale for such operation is the

following: when a financial place and its local investors are familiar with a

sector thanks to the presence of a local important player, it may be natural

for competitors to approach these same investors and therefore to raise

capital.

For instance, the analysis of British companies foreign

cross-listed on Euronext Paris shows that these companies own an important

subsidiary operating in the French market or have a French important

competitor. Among the 11 British companies cross-listed on Euronext Paris

4 HSBC owns the former French bank CCF since 2005

4 Kesa owns Darty, the second largest business unit of the group

(after Comet)

4 Kingfisher owns Castorama, the second largest French retailer

of home improvement tools and supply

4 Diageo is the main competitor of Pernod-Ricard, the world's

second largest player in the beverage sector

4 BP is one of the main competitors of the French major Total

4 Hammerson and Segro are competitors of world biggest real

estate company, the French-Dutch Unibail-Rodamco

As regards the 42 foreign companies cross-listed in Italy

4 AXA, Allianz, Aegon, Fortis, ING are competitors of the

3rd European insurer, Generali

4 Total is one of the main European competitors of the major

Eni

4 BNP Paribas and Credit Agricole are foreign cross-listed in

Italy since their important acquisition of Italian banks, respectively BNL

and

Ca riparma/FruilAdria

4 LVMH and PPR made important Italian acquisitions such as

Fendi, Gucci, Bottega Veneta

II.3.c. Size and Growth

As anticipated in part 111.1. Decreasing Advantages and

Increasing Concerns ?, a focus on companies' size shows that foreign

cross-listings are in the very great majority performed by large companies,

with 76.4% of the sample presenting a market capitalisation greater than US$1bn

(as of October 2008). The main reason behind this tendency is the cost related

to a foreign listing which is a financial border between small and large

companies.

According to the results, foreign cross-listed companies present

on average sales of US$31.2bn and a market capitalisation of US$26.8bn.

#21: Average Sales and Market Capitalisation of

Companies

Composing the Sample

Total Sales

(mUS$)

|

|

Market Cap.

(mUS$)

|

|

|

|

|

Average 31238 26793

Median 9640 8274

Source: ThomsonReuters Datastream

#22: Breakdown of the Sample by Market Capitalisation

5.3%

9.9%

8.5%

6.6%

3.9%

9.1%

13.5%

14.4%

28.8%

76.4%

More than $100bn

Between $75bn - $100bn

Between $50bn -

$75bn

Between $20bn - $50bn

Between $10bn - $20bn

Between $1bn -

$10bn

Between $500m - $1 bn

Between $100m - $500m

below $100m

Source: ThomsonReuters Datastream

#23: Average Sales and Market Capitalisations by Stock

Exchange (in mUS$)

Sales Mkt Cap Sales Mkt Cap Sales Mkt Cap

28522 27819 6516 3263 194 420

Milan

|

Swiss

|

Frankfurt

|

Paris

|

|

Sales Mkt Cap Sales Mkt Cap Sales Mkt Cap Sales Mkt Cap

63801 54269 57650 45209 44832 52508 42048

39410

Sales Mkt Cap Sales Mkt Cap Sales Mkt Cap

25928 18203 22425 19514 16992 22125

Sales Mkt Cap Sales Mkt Cap

58493 63088 3618 4157

Source:

ThomsonReuters Datastream

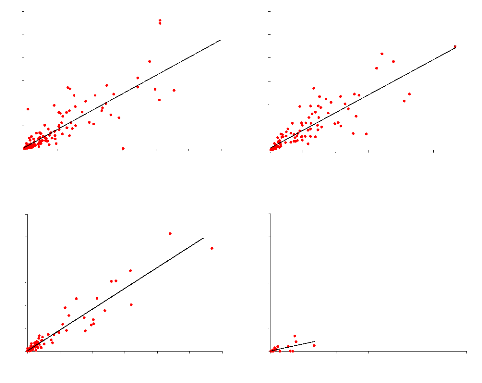

After a more detailed look at the data, it emerges major

differences of company profile between stock exchanges.

First of all, the analysis of the average size brings to

light that places like Paris, Frankfurt, Milan, Zurich or Tokyo mainly attract

very large multinationals (i.e. most of these companies belong to their

national reference index), whereas London and New York have a broader scope by

attracting more medium-sized companies as well as emerging countries companies.

This point is reinforced by the analysis of the dot distribution in the four

point clouds in exhibits #24.

Furthermore, it is worth to notice the major difference of

size and sales between the two main American stock exchanges, since foreign

cross-listed companies on the Nasdaq are on average far away smaller than those

on the Nyse. This may be explained by the different roles played by each stock

exchange: the Nyse is mainly targeted by multinational companies, well

established and operating in traditional activities, whereas the Nasdaq

welcomes more fast growing companies (see exhibit #25).

#24: Correlation between Net Incomes 2007 and Market

Capitalisations (mUS$)

Net Incomes 07 Net Incomes 07

R2 = 0.7612

Market Cap.

0 50000 100000 150000 200000 250000 300000

Nyse

Net Incomes 07

0 50000 100000 150000 200000 250000 300000

Europe*

Net Incomes 07

0 50000 100000 150000 200000 250000 300000

L.S.E

0 50000 100000 150000 200000 250000 300000

Nasdaq

30000

25000

30000

R2 = 0.7475

Market Cap.

25000

20000

15000

10000

5000

0

R2 = 0.9052

Market Cap.

30000

25000

20000

15000

10000

5000

0

30000

25000

20000

15000

10000

R2 = 0.464

Market Cap.

5000

0

20000

15000

10000

5000

0

Source: ThomsonReuters Datastream R2 is the

correlation in linear regression

Most striking, is the strong correlation between the net

incomes 2007 and market capitalisations for companies foreign cross-listed on

the L.S.E, on the Nyse and in Europe, with respectively R2 of 0.91,

0.76 and 0.75. A contrario, foreign crosslisted companies on the Nasdaq

generally offer a weak correlation with R2 dropping to 0.46. This

confirms the presence on the latter of smaller and fast-growing companies.

However, there is no proven correlation between the Price

Earnings Ratio (P/E) and the sales growth CAGR (Compound Annual Growth Rate)

for the period 2004- 2007 (see appendix 1).

* Europe includes main European markets for Foreign

cross-listing, i.e. France, Germany, Switzerland and Italy

#25: Sales Growth CAGR during the period 2004-2007

Euro Zone U.K Canada U.S

Origin Place

Foreign Listing Place

Japan Emerging

Countries

|

|

|

Average

|

|

|

Nyse

|

+9.3%

|

+6.3%

|

+24.4%

|

-

|

+10.5%

|

+30.8%

|

Nasdaq

|

+19.7%

|

+10.8%

|

+33.9%

|

|

-+1.9%

|

+14.6%

|

L.S.E

|

+10.9%

|

-

|

+38.7%

|

+7.1%

|

+7.1%

|

+17.7%

|

Euronext Paris

|

+4.6%

|

+9.1%

|

n.a

|

+8.3%

|

n.a

|

+33.0%

|

|

n.a: no enough data available Source: ThomsonReuters

Datastream

Note:

As regards Canadian foreign cross-listed companies, the

figures mostly concerns companies operating in the sector of Mining and Oil

& Gas; that explains the impressive double digit sales growth over the last

few years.

|