4.3.4 Sources of funding

The surveyed MFIs rely on three main sources of funding: the

deposits, the equity and the borrowings.

71% of MFIs rely on deposits as main source of funding which

contributed in 2011 for 38%, 42%, 53%, 48% and 50% of the financial structures

of MFIs of Malicounda, Dakar, Tattaguine, Pékesse and

Méckhé severally. This situation corroborates the legal status of

these MFIs to collect first savings then to redistribute them as credit. For

the 29% remaining, their main source of funding is borrowings with 50% and 59%

for MFIs of Podor and Daroukoudoss respectively.

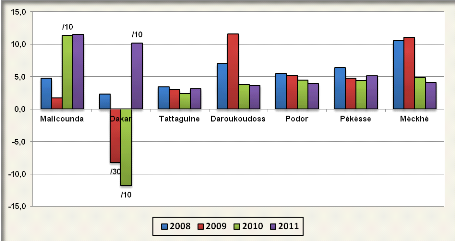

The figure 7 hereafter shows the borrowing capacity of the

MFIs.

Figure 7: Leverage

(Debt/Equity)

/X: The real value is X times de value on the

figure

Source: Our survey (may-august

2012)

The analysis of the figure 7 reveals that at the MFI of Dakar

(MEC FAM) the leverage ratio varied tremendously from high negative ratios in

2009 and 2010 to a highly positive figure in 2011. The negative figures in 2009

and 2010 are mainly due to the loss in equity during those periods. The equity

itself has been influenced by the negative figure of retained earnings over

years. The highly positive ratio in 2011 entails that the MFIs is borrowing

more than it should and might jeopardize its depositors albeit the decrease in

savings mobilization. Indeed, for Périlleux (2010), the higher the

external financing, the more borrowers prevail, thus threatening savings and

credit unions' viability. Therefore, the MFI should adopt new policies aiming

at boosting its equity capital in the perspective of lowering the leverage

ratio.

In contrast, most of the other MFIs showed a cushioning

situation in 2010 and 2011. This implies that they can still have access to

long term borrowed funds except at the MEC of Malicounda which recorded

impressive leverage (113%) in 2010 mainly due to loss in equity while at the

same time their liabilities increased, peculiarly the long term borrowed funds.

|