CHAPTER FIVE: PERFORMANCES ANALYSES

5.1 Financial Analysis

This chapter which strives to deepen our cognition about how

well the surveyed MFIs are financially performing will be carried out

throughout four crux financial analysis dimensions: portfolio quality,

efficiency, profitability and sustainability. For each dimension, one or two

meaningful devices will merit our attention as it is not possible to go through

the entire financial indicators existing in the microfinance industry.

5.1.1 Portfolio Management

5.1.1.1 A growing loan portfolio

The entire MFIs recorded a global average annual growth rate

of 17% in the last four years. However a deepened analysis of the portfolio

points out that merely 86% of the MFIs are really growing with an average

annual growth rate fluctuating between 39% and 679%.

Surprisingly the growth rate is more noticeable at the MEC MFR

of Malicounda albeit appearing as the youngest, chiefly because boosted by the

investment funds of the FAIR in 2010 and 2011. Besides, corresponding trend is

observed at the MEC FAM of Dakar which presents likely 17% of average annual

growth rate. The two MFIs growth might explain their higher leverage ratios

aforementioned.

In opposite, the CREC of Méckhé portfolio has

constantly winced over the past four years (annual average of -47%) entailing

the total portfolio score of the seven MFIs. This might be explained mainly by

the decrease in the number of borrowers induced by the new credit policy which

stress out a better clients' screening, a reduction of agricultural loans, a

focus on lending to associations rather than individuals, a repayment of

borrowed funds; and meanwhile by the decrease in credit line and the

momentaneous cease of the FAIR in 2010. Nonetheless, the MFI still maintains

the crux outstanding loan portfolio thus contributing of 26% to the total

outstanding loan portfolio in 2011.

The MFIs of Pékésse, Daroukoudoss, Koyli

Winrdé and Tattaguine show up a relatively stable score with some kind

of rational growth which can be easily controlled comparing to other MFIs.

Despite this growth trend, only three MFIs (43%) held 69% of

the outstanding loan portfolio in 2011: the CREC of Méckhé (26%),

the MEC of Podor (23%) and the MEC of Tattaguine (20%).

5.1.1.2 A fluctuating portfolio at risk

One of the crux indicators appraising how well a MFI is

managed or performing remains its portfolio quality, commonly assessed through

the portfolio at risk (PAR). It integrates the entire outstanding loans

holding at least one arrears as well as the rescheduled loans. In the UMOA

region, and in accordance with the regulation and the BCEAO instructions on

periodic reports, the portfolio at risk usually appraised is the PAR after 180

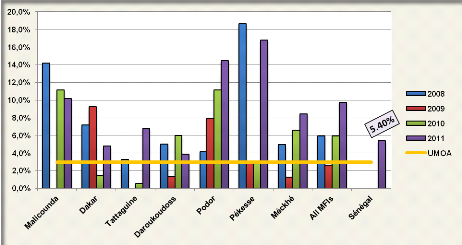

days (PAR>180 days). The figure 8 presents the PAR 180 days for the surveyed

MFIs.

Figure 8: Portfolio At Risk

over 180 days 2008-2011

Source: Our survey (may-august 2012)

The figure 8 reveals important PAR variability between MFIs

and over years.

Considering the entire MFIs, it appears that the PAR increased

from 5.9% to 9.7% in four years. This ratio is higher than the UMOA requirement

(3%) and the national average threshold of 5.4% (MEF/DRSSFD, 2010), and

different from the findings of Lafoucarde, Isern, Mwangi & Brown (2005) of

4% for portfolio at risk>30 days for African MFIs.

Nevertheless, some MFIs present improvement over years in

spite of the improvable score. For example, the MEC MFR of Malicounda performed

from 14% to about 10% in four years.

In contrast, high PAR fluctuations are observed in other MFIs

showing beforehand a lack of a strong credit policy management. The reasons may

be that of the agricultural volatility. In 2011, the PAR of the MEC of Podor

blew up to 14% due to the slump in vegetable sales. In other MFIs such as

Pékesse and Méckhé, members also face a slump of their

fattened cattle and epizootic diseases and livestock robberies. This explains

why the PAR of the MEC of Pékesse has varied inconstantly between 3 and

18% in the last four years.

Yet in other MFIs, there is an increase of the portfolio at

risk over time showing in addition to all aforementioned arguments, a flexible

loan recovery policy which underscores the dialogue and forbids harsh recovery

practices. This is the case of the MEC Koyli Winrdé, the CREC of

Méckhé and the MEC SAPP of Tattaguine which PAR increased in four

years from 4% to 15%; 4.9% to 8.5% and 3.3% to 6.8% severally.

The findings also divulge that the PAR figures recorded may

have been affected by the repayment schedules applied in most of the MFIs and

by the bookkeeping and financial statements data. Indeed, some overdue loans of

more than one year are still kept in books in some MFIs.

It appears important for MFIs to implement a better loan

monitoring system which will systematically track their PAR especially for long

term loans with annual instalments or bullet repayment. That's why the

provision should respect the standards set up by the regulation. An analysis of

the risk coverage ratio pinpoints that most of MFIs do usually not make the

required provision to cover their PAR even though some provisioning are made.

These practices are opposite to the common understanding of systematic loan

losses provision to preserve client deposits especially in deposits- based

MFIs.

|