5.1.2 Efficiency

5.1.2.1 Sound controlled operating expenses ratio

Operating expenses ratio appears as on major indicator to

assess whether MFIs are cost effective and expresses all the operating expenses

as a percentage of the period average gross loan portfolio (Rosenberg, 2009).

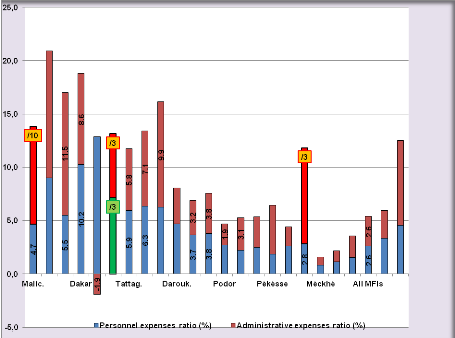

The figure 9 shows up the evolution of operating expenses ratio of the MFIs

over the last three years.

Figure 9: Operating

Expenses Ratios 2009-2011

/X: The real value is X times de value on the

figure

Source: Our survey (may-august

2012)

The figure brings out that in more than 85% of the cases,

operating expenses ratios are below 20%. However, the MEC MFR of Malicounda

recorded the highest operating expenses ratio of more than 95% in 2009 but

significant improvements are made in 2010 and 2011.

In opposite, the MEC of Dakar recorded the highest operating

expenses ratio in 2011 of about 40% after sound improvement in 2010. The

negative administrative expenses ratio in 2010 (-1.9%) is due to the recovery

in depreciation expenses.

The CREC of Meckhé recorded the lowest operating

expenses ratio subsequent to its high average loan size.

If for Lafoucarde et al. (2005) operating and

financial expenses are high in African regions, the specific case of this study

might be due to the fact that MFIs hire fewer and underpaid staff, use a very

simple accounting system, sometimes without any Management Information System

with low administrative expenses. For example, the use of paid internship

positions at the MEC of Tattaguine, and the opening of periodic services points

along with additional remunerated interns increased the operational expenses in

2011. The same trend is observed at the MEC FAM of Dakar where they permanently

hire internship positions in addition to old staff.

The analysis of the breakdown of operation expenses ratio

reveals that the most important part of operating expenses is pertained to

administrative costs.

However, opposite situation is observed at the MEC of Dakar

where personnel expenses are higher than administrative expenses over time.

This might be explained by higher staff salaries in urban areas compared with

MFIs operating in rural areas.

5.1.1.2 Portfolio Yield

The portfolio yield conveys how much an MFI earns in cash

interest payment from its credit provision in a given period. It is perceived

as a foremost indicator of an MFI's ability to create revenue in order to

defray its financial and operating expenses (von Stauffenberg et al.,

2003).

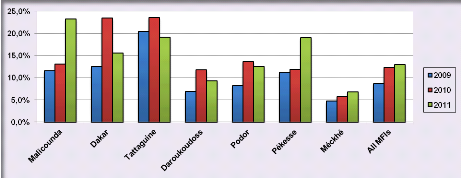

The figure 10 shows the evolution of the portfolio yield

during the last three years

Figure 10: Portfolio yields

2009-2011

Source: Our survey (may-august

2012)

The analysis reveals that the MEC MFR of Malicounda recorded

an increase in its portfolio yield during the last three years from about 11%

to 23%.

Kindred growth trends are observed with the MEC MFR of

Pékésse (11-19%) and the CREC of Méckhé (5-7%).

Notwithstanding that the CREC of Meckhé recorded an

increase in portfolio yield, the latter remains the lowest of the group due to

its low interest rate policy combined with the absence of additional fees

linked to the loan granting process. In contrast, the highest portfolio yields

recorded by the MEC of Tattaguine, Dakar and Pékesse (particularly in

2011) are due to the high rate and other additional fees and commissions on the

loan.

For the other MFIs, no real trend can be concluded even though

they recorded also important yield of their portfolios.

The differences reported in portfolio yields could be due to

additional fees, the differences in interest rates each MFI applies, even

though they have nearly loan products. For instance, the MFI of

Méckhé does not apply a fee for loan processing and charge a low

interest rate for investment loans (12) versus 1% for the MEC of Pékesse

with an interest rate of about 15% charged on investment loans. That

variability in loan product is due to the fact that each loan product is

tailored for each MFI in line with the expectations of their members,

expectation clearly stated during annual general meetings.

As the portfolio yield can be used as a proxy of effective

interest rate, it appears that the MFIs of Malicounda, Tattaguine, Dakar and

Pékésse apply the highest effective interest rates, which are

however below the usury rate in the UMOA region (27%). On the other hand, an

excessive social vision could lead to the application of very low interest

rates threatening the viability of the institution (Ben Soltane, 2012).

|